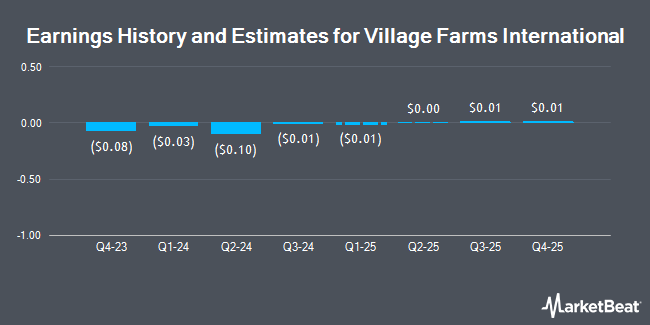

Village Farms International, Inc. (NASDAQ:VFF - Free Report) - Investment analysts at Alliance Global Partners lifted their Q3 2025 earnings per share estimates for Village Farms International in a research note issued on Monday, August 11th. Alliance Global Partners analyst A. Grey now expects that the company will earn $0.02 per share for the quarter, up from their prior estimate of $0.01. Alliance Global Partners has a "Buy" rating on the stock. The consensus estimate for Village Farms International's current full-year earnings is ($0.15) per share. Alliance Global Partners also issued estimates for Village Farms International's Q4 2025 earnings at $0.02 EPS and FY2026 earnings at $0.11 EPS.

Village Farms International (NASDAQ:VFF - Get Free Report) last posted its quarterly earnings data on Monday, August 11th. The company reported $0.10 earnings per share for the quarter, beating analysts' consensus estimates of ($0.02) by $0.12. Village Farms International had a negative return on equity of 2.24% and a net margin of 3.42%. The firm had revenue of $59.90 million for the quarter, compared to analysts' expectations of $48.86 million.

Other analysts also recently issued research reports about the company. Wall Street Zen upgraded Village Farms International from a "sell" rating to a "buy" rating in a research note on Sunday. Zelman & Associates reissued an "overweight" rating on shares of Village Farms International in a research note on Monday, June 9th.

Check Out Our Latest Report on Village Farms International

Village Farms International Stock Down 8.9%

Shares of VFF traded down $0.25 during midday trading on Wednesday, reaching $2.57. 2,882,128 shares of the stock were exchanged, compared to its average volume of 2,518,143. The company has a current ratio of 2.65, a quick ratio of 0.98 and a debt-to-equity ratio of 0.11. The company has a market capitalization of $289.48 million, a P/E ratio of 28.56 and a beta of 2.14. Village Farms International has a 52 week low of $0.45 and a 52 week high of $2.90. The company's 50 day moving average is $1.42 and its two-hundred day moving average is $0.99.

Insider Activity at Village Farms International

In other Village Farms International news, CFO Stephen C. Ruffini purchased 25,000 shares of Village Farms International stock in a transaction on Friday, May 30th. The shares were bought at an average price of $1.21 per share, with a total value of $30,250.00. Following the purchase, the chief financial officer directly owned 9,783,127 shares in the company, valued at $11,837,583.67. This trade represents a 0.26% increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. 12.60% of the stock is owned by company insiders.

Hedge Funds Weigh In On Village Farms International

Several large investors have recently modified their holdings of VFF. Lighthouse Financial LLC bought a new position in shares of Village Farms International during the 4th quarter worth about $36,000. Stephens Inc. AR increased its position in shares of Village Farms International by 50.6% during the second quarter. Stephens Inc. AR now owns 59,500 shares of the company's stock worth $65,000 after acquiring an additional 20,000 shares in the last quarter. Hilton Capital Management LLC acquired a new position in Village Farms International during the second quarter worth $94,000. Tudor Investment Corp ET AL acquired a new stake in Village Farms International in the fourth quarter valued at $146,000. Finally, Raymond James Financial Inc. acquired a new stake in Village Farms International in the fourth quarter valued at $146,000. Institutional investors own 12.15% of the company's stock.

Village Farms International Company Profile

(

Get Free Report)

Village Farms International, Inc, together with its subsidiaries, produces, markets, and sells greenhouse-grown tomatoes, bell peppers, and cucumbers in North America. It operates through four segments: Produce, Cannabis-Canada, Cannabis-U.S., and Energy. The company also produces and supplies cannabis products to other licensed providers and provincial governments in Canada and internationally; develops and sells cannabinoid-based health and wellness products, including ingestible, edibles, and topical applications; and produces power.

Recommended Stories

Before you consider Village Farms International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Village Farms International wasn't on the list.

While Village Farms International currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.