Viking Therapeutics (NASDAQ:VKTX - Get Free Report)'s stock had its "sell (d-)" rating restated by equities research analysts at Weiss Ratings in a note issued to investors on Wednesday,Weiss Ratings reports.

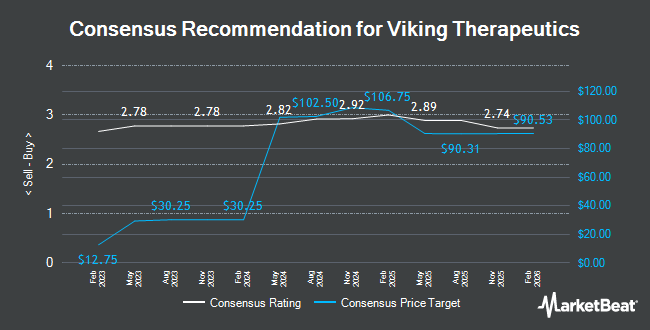

Several other analysts also recently weighed in on the company. Raymond James Financial cut their price target on Viking Therapeutics from $125.00 to $122.00 and set a "strong-buy" rating on the stock in a research note on Thursday, July 24th. Citigroup upped their price target on Viking Therapeutics from $31.00 to $38.00 and gave the stock a "neutral" rating in a research note on Thursday, July 24th. HC Wainwright restated a "buy" rating and issued a $102.00 price target on shares of Viking Therapeutics in a research note on Monday, September 29th. Finally, BTIG Research restated a "buy" rating and issued a $125.00 price target on shares of Viking Therapeutics in a research note on Monday, September 22nd. Two analysts have rated the stock with a Strong Buy rating, nine have assigned a Buy rating, two have issued a Hold rating and one has assigned a Sell rating to the company. According to MarketBeat.com, Viking Therapeutics has a consensus rating of "Moderate Buy" and an average target price of $86.42.

Read Our Latest Analysis on VKTX

Viking Therapeutics Stock Up 2.7%

Shares of VKTX stock traded up $0.84 during midday trading on Wednesday, reaching $32.37. 5,968,889 shares of the stock were exchanged, compared to its average volume of 5,362,967. The company's 50 day moving average is $29.25 and its two-hundred day moving average is $27.95. Viking Therapeutics has a 1 year low of $18.92 and a 1 year high of $81.73.

Viking Therapeutics (NASDAQ:VKTX - Get Free Report) last posted its quarterly earnings results on Wednesday, July 23rd. The biotechnology company reported ($0.58) earnings per share for the quarter, missing the consensus estimate of ($0.44) by ($0.14). The business's revenue was up NaN% compared to the same quarter last year. During the same period in the prior year, the firm posted ($0.20) earnings per share. As a group, analysts forecast that Viking Therapeutics will post -1.56 earnings per share for the current fiscal year.

Institutional Trading of Viking Therapeutics

Several large investors have recently modified their holdings of the company. Harbour Investments Inc. grew its holdings in shares of Viking Therapeutics by 2.2% in the second quarter. Harbour Investments Inc. now owns 14,961 shares of the biotechnology company's stock worth $396,000 after acquiring an additional 326 shares during the period. Allworth Financial LP lifted its position in Viking Therapeutics by 58.4% during the second quarter. Allworth Financial LP now owns 955 shares of the biotechnology company's stock valued at $25,000 after purchasing an additional 352 shares in the last quarter. Montag A & Associates Inc. lifted its position in Viking Therapeutics by 6.1% during the second quarter. Montag A & Associates Inc. now owns 6,220 shares of the biotechnology company's stock valued at $165,000 after purchasing an additional 358 shares in the last quarter. Lewis Asset Management LLC lifted its position in Viking Therapeutics by 0.9% during the second quarter. Lewis Asset Management LLC now owns 44,060 shares of the biotechnology company's stock valued at $1,168,000 after purchasing an additional 385 shares in the last quarter. Finally, HighMark Wealth Management LLC lifted its position in Viking Therapeutics by 9.4% during the first quarter. HighMark Wealth Management LLC now owns 4,660 shares of the biotechnology company's stock valued at $113,000 after purchasing an additional 400 shares in the last quarter. Institutional investors own 76.03% of the company's stock.

About Viking Therapeutics

(

Get Free Report)

Viking Therapeutics, Inc, a clinical-stage biopharmaceutical company, focuses on the development of novel therapies for metabolic and endocrine disorders. The company's lead drug candidate is VK2809, an orally available tissue and receptor-subtype selective agonist of the thyroid hormone receptor beta (TRß), which is in Phase IIb clinical trials to treat patients with biopsy-confirmed non-alcoholic steatohepatitis, as well as NAFLD.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Viking Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viking Therapeutics wasn't on the list.

While Viking Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.