Viridian Therapeutics (NASDAQ:VRDN - Get Free Report) had its price target reduced by research analysts at Wells Fargo & Company from $27.00 to $26.00 in a report released on Thursday,Benzinga reports. The firm currently has an "equal weight" rating on the stock. Wells Fargo & Company's price target points to a potential upside of 53.94% from the company's previous close.

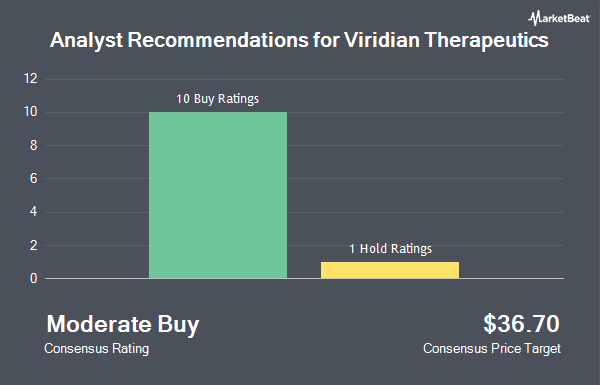

Other research analysts also recently issued reports about the stock. JMP Securities reduced their price target on shares of Viridian Therapeutics from $42.00 to $38.00 and set a "market outperform" rating on the stock in a research report on Wednesday, May 7th. Needham & Company LLC dropped their price objective on shares of Viridian Therapeutics from $36.00 to $34.00 and set a "buy" rating on the stock in a report on Wednesday, August 6th. Oppenheimer increased their price objective on shares of Viridian Therapeutics from $28.00 to $32.00 and gave the stock an "outperform" rating in a report on Thursday. Royal Bank Of Canada dropped their price objective on shares of Viridian Therapeutics from $46.00 to $45.00 and set an "outperform" rating on the stock in a report on Wednesday, May 7th. Finally, HC Wainwright reaffirmed a "buy" rating and issued a $34.00 price objective on shares of Viridian Therapeutics in a report on Wednesday, April 23rd. One investment analyst has rated the stock with a hold rating and eight have given a buy rating to the stock. According to data from MarketBeat, Viridian Therapeutics has an average rating of "Moderate Buy" and an average price target of $37.00.

Check Out Our Latest Analysis on Viridian Therapeutics

Viridian Therapeutics Stock Up 2.9%

Shares of VRDN stock traded up $0.48 on Thursday, hitting $16.89. The stock had a trading volume of 758,148 shares, compared to its average volume of 897,727. Viridian Therapeutics has a 52-week low of $9.90 and a 52-week high of $27.20. The company has a debt-to-equity ratio of 0.04, a quick ratio of 11.01 and a current ratio of 11.01. The firm has a market capitalization of $1.38 billion, a price-to-earnings ratio of -4.41 and a beta of 0.42. The stock's 50 day moving average is $15.95 and its 200-day moving average is $15.17.

Viridian Therapeutics (NASDAQ:VRDN - Get Free Report) last posted its quarterly earnings data on Wednesday, August 6th. The company reported ($1.00) EPS for the quarter, meeting analysts' consensus estimates of ($1.00). Viridian Therapeutics had a negative net margin of 112,806.88% and a negative return on equity of 78.95%. The firm had revenue of $0.08 million for the quarter, compared to the consensus estimate of $0.05 million. During the same period in the prior year, the firm posted ($0.81) EPS. The firm's revenue was up 4.2% compared to the same quarter last year. As a group, research analysts expect that Viridian Therapeutics will post -4.03 earnings per share for the current year.

Hedge Funds Weigh In On Viridian Therapeutics

Several large investors have recently bought and sold shares of VRDN. Vanguard Group Inc. grew its stake in shares of Viridian Therapeutics by 4.0% in the 4th quarter. Vanguard Group Inc. now owns 4,595,049 shares of the company's stock worth $88,087,000 after purchasing an additional 174,952 shares during the last quarter. Geode Capital Management LLC boosted its holdings in shares of Viridian Therapeutics by 11.1% during the fourth quarter. Geode Capital Management LLC now owns 1,658,980 shares of the company's stock worth $31,809,000 after purchasing an additional 165,669 shares during the period. ExodusPoint Capital Management LP acquired a new stake in shares of Viridian Therapeutics during the fourth quarter worth approximately $493,000. FMR LLC boosted its holdings in shares of Viridian Therapeutics by 6.2% during the fourth quarter. FMR LLC now owns 11,881,912 shares of the company's stock worth $227,776,000 after purchasing an additional 698,434 shares during the period. Finally, Invesco Ltd. boosted its holdings in shares of Viridian Therapeutics by 59.5% during the fourth quarter. Invesco Ltd. now owns 33,099 shares of the company's stock worth $635,000 after purchasing an additional 12,350 shares during the period.

Viridian Therapeutics Company Profile

(

Get Free Report)

Viridian Therapeutics, Inc, a biotechnology company, discover and develops treatments for serious and rare diseases. The company's product pipeline includes VRDN-001, a monoclonal antibody targeting insulin-like growth factor-1 receptor that is in Phase 3 clinical trial for the treatment of thyroid eye disease (TED); and VRDN-003, a next generation IGF-1R humanized monoclonal antibodies targeting IGF-1R and incorporating half-life extension technology for the treatment of TED.

Further Reading

Before you consider Viridian Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viridian Therapeutics wasn't on the list.

While Viridian Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.