Vita Coco (NASDAQ:COCO - Get Free Report) was downgraded by analysts at Zacks Research from a "hold" rating to a "strong sell" rating in a research report issued to clients and investors on Thursday,Zacks.com reports.

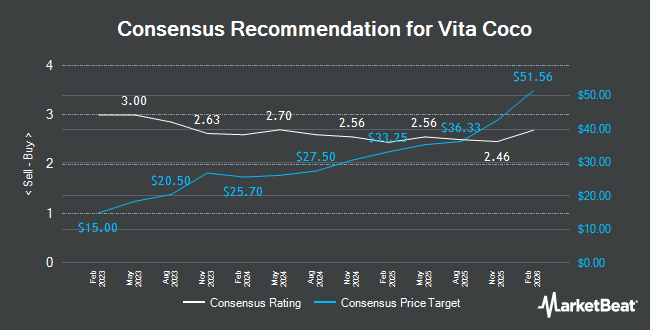

Several other research firms also recently issued reports on COCO. Piper Sandler upgraded shares of Vita Coco from a "neutral" rating to an "overweight" rating and set a $39.00 price objective on the stock in a report on Wednesday, August 20th. Needham & Company LLC initiated coverage on shares of Vita Coco in a report on Wednesday, September 24th. They set a "hold" rating on the stock. Weiss Ratings restated a "buy (b-)" rating on shares of Vita Coco in a report on Wednesday. The Goldman Sachs Group boosted their price objective on shares of Vita Coco from $41.00 to $47.00 and gave the stock a "buy" rating in a report on Thursday, October 2nd. Finally, Bank of America lifted their target price on shares of Vita Coco from $40.00 to $45.00 and gave the company a "neutral" rating in a research report on Wednesday. Six research analysts have rated the stock with a Buy rating, four have issued a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $40.63.

Read Our Latest Stock Report on COCO

Vita Coco Stock Performance

NASDAQ:COCO opened at $41.80 on Thursday. The firm's 50-day moving average is $37.68 and its 200-day moving average is $35.46. Vita Coco has a 52-week low of $25.79 and a 52-week high of $43.65. The company has a market cap of $2.38 billion, a price-to-earnings ratio of 39.07, a PEG ratio of 2.77 and a beta of 0.40.

Vita Coco (NASDAQ:COCO - Get Free Report) last posted its quarterly earnings data on Wednesday, July 30th. The company reported $0.38 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.36 by $0.02. Vita Coco had a net margin of 11.50% and a return on equity of 24.99%. The company had revenue of $168.76 million for the quarter, compared to the consensus estimate of $162.20 million. During the same quarter in the previous year, the firm posted $0.32 EPS. The business's revenue was up 17.1% compared to the same quarter last year. Vita Coco has set its FY 2025 guidance at EPS. Equities analysts predict that Vita Coco will post 1.07 EPS for the current year.

Insider Activity

In other Vita Coco news, CEO Martin Roper sold 1,835 shares of the business's stock in a transaction dated Tuesday, October 7th. The shares were sold at an average price of $42.74, for a total value of $78,427.90. Following the transaction, the chief executive officer directly owned 287,062 shares in the company, valued at $12,269,029.88. The trade was a 0.64% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, COO Jonathan Burth sold 3,173 shares of the business's stock in a transaction dated Monday, September 29th. The shares were sold at an average price of $42.50, for a total transaction of $134,852.50. Following the completion of the transaction, the chief operating officer owned 76,127 shares in the company, valued at approximately $3,235,397.50. This trade represents a 4.00% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 3,463,800 shares of company stock worth $141,214,319. 32.30% of the stock is owned by company insiders.

Hedge Funds Weigh In On Vita Coco

A number of institutional investors and hedge funds have recently added to or reduced their stakes in COCO. Voya Investment Management LLC boosted its position in Vita Coco by 3,376.9% in the first quarter. Voya Investment Management LLC now owns 586,969 shares of the company's stock valued at $17,991,000 after buying an additional 570,087 shares in the last quarter. Marshall Wace LLP acquired a new position in Vita Coco in the second quarter valued at about $9,627,000. Wellington Management Group LLP boosted its position in Vita Coco by 102.2% in the first quarter. Wellington Management Group LLP now owns 511,462 shares of the company's stock valued at $15,676,000 after buying an additional 258,521 shares in the last quarter. Victory Capital Management Inc. boosted its position in Vita Coco by 62.2% in the first quarter. Victory Capital Management Inc. now owns 645,225 shares of the company's stock valued at $19,776,000 after buying an additional 247,339 shares in the last quarter. Finally, Capricorn Fund Managers Ltd acquired a new position in Vita Coco in the second quarter valued at about $5,054,000. 88.49% of the stock is currently owned by institutional investors and hedge funds.

Vita Coco Company Profile

(

Get Free Report)

The Vita Coco Company, Inc develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific. The company offers coconut oil and coconut milk; juice; Runa, a plant-based energy drink; packaged water under the Ever & Ever brand name; and PWR LIFT, a protein-infused fitness drink.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vita Coco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vita Coco wasn't on the list.

While Vita Coco currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.