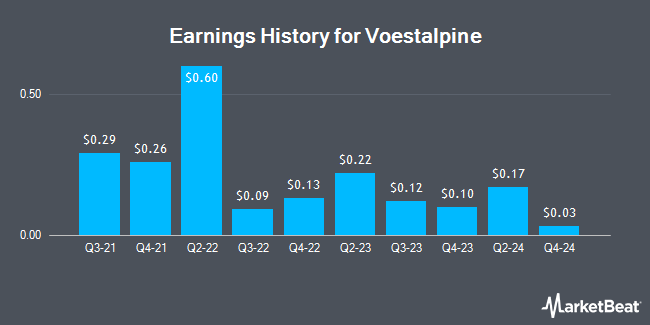

Voestalpine (OTCMKTS:VLPNY - Get Free Report) released its quarterly earnings data on Wednesday. The company reported $0.17 earnings per share for the quarter, Zacks reports. Voestalpine had a net margin of 1.02% and a return on equity of 2.18%. The company had revenue of $4.70 billion during the quarter.

Voestalpine Price Performance

OTCMKTS:VLPNY remained flat at $5.70 during midday trading on Friday. 21 shares of the company traded hands, compared to its average volume of 552. Voestalpine has a one year low of $3.34 and a one year high of $6.01. The company's fifty day simple moving average is $5.41 and its 200 day simple moving average is $4.93. The company has a debt-to-equity ratio of 0.26, a quick ratio of 0.55 and a current ratio of 1.44. The company has a market capitalization of $4.89 billion, a price-to-earnings ratio of 28.52 and a beta of 1.31.

Voestalpine Cuts Dividend

The firm also recently declared a dividend, which was paid on Wednesday, July 30th. Investors of record on Monday, July 14th were issued a $0.0724 dividend. This represents a yield of 130.0%. The ex-dividend date was Friday, July 11th. Voestalpine's dividend payout ratio is 35.00%.

Wall Street Analyst Weigh In

Separately, Citigroup reaffirmed a "neutral" rating on shares of Voestalpine in a research note on Wednesday, June 11th.

Check Out Our Latest Stock Analysis on VLPNY

About Voestalpine

(

Get Free Report)

Voestalpine AG processes, develops, manufactures, and sells steel products in Austria, European Union, and internationally. The company operates through five segments: Steel, High Performance Metals, Metal Engineering, Metal Forming, and Other. The Steel division produces hot and cold-rolled steel strips, as well as electrogalvanized, hot-dip galvanized, and organically coated steel strips; and heavy plates for the energy sector, as well as turbine casings for automotive, white goods/consumer goods, building/construction, energy, mechanical engineering, and others.

Featured Stories

Before you consider Voestalpine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Voestalpine wasn't on the list.

While Voestalpine currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.