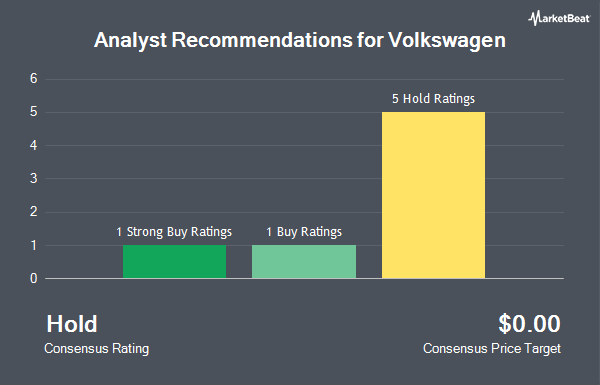

Shares of Volkswagen AG Unsponsored ADR (OTCMKTS:VWAGY - Get Free Report) have received an average recommendation of "Hold" from the seven research firms that are currently covering the firm, Marketbeat reports. Five equities research analysts have rated the stock with a hold recommendation, one has issued a buy recommendation and one has given a strong buy recommendation to the company.

VWAGY has been the topic of a number of recent research reports. Sanford C. Bernstein raised Volkswagen to a "hold" rating in a report on Thursday, May 1st. Citigroup reissued a "buy" rating on shares of Volkswagen in a research note on Thursday, April 3rd. Morgan Stanley upgraded shares of Volkswagen from an "underweight" rating to an "equal weight" rating in a research note on Friday, April 25th. Finally, UBS Group raised shares of Volkswagen from a "strong sell" rating to a "hold" rating in a report on Monday, March 17th.

Get Our Latest Analysis on Volkswagen

Volkswagen Stock Performance

OTCMKTS VWAGY traded up $0.01 during trading on Friday, reaching $10.75. The company's stock had a trading volume of 197,117 shares, compared to its average volume of 140,048. The business's fifty day moving average price is $10.93 and its 200-day moving average price is $10.53. Volkswagen has a twelve month low of $8.57 and a twelve month high of $12.59. The firm has a market cap of $53.89 billion, a price-to-earnings ratio of 5.40, a P/E/G ratio of 0.79 and a beta of 1.27.

Volkswagen (OTCMKTS:VWAGY - Get Free Report) last released its quarterly earnings results on Wednesday, April 30th. The company reported $0.38 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.42 by ($0.04). The company had revenue of $88.29 billion for the quarter, compared to analysts' expectations of $86.25 billion. Volkswagen had a return on equity of 4.73% and a net margin of 2.84%. As a group, sell-side analysts forecast that Volkswagen will post 2.53 EPS for the current fiscal year.

Volkswagen Cuts Dividend

The business also recently announced a dividend, which was paid on Thursday, June 5th. Shareholders of record on Wednesday, May 21st were given a dividend of $0.4419 per share. The ex-dividend date was Tuesday, May 20th. This represents a dividend yield of 3.79%. Volkswagen's payout ratio is currently 22.61%.

About Volkswagen

(

Get Free ReportVolkswagen AG manufactures and sells automobiles in Germany, other European countries, North America, South America, the Asia-Pacific, and internationally. The company operates through four segments: Passenger Cars and Light Commercial Vehicles, Commercial Vehicles, Power Engineering, and Financial Services.

Further Reading

Before you consider Volkswagen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Volkswagen wasn't on the list.

While Volkswagen currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.