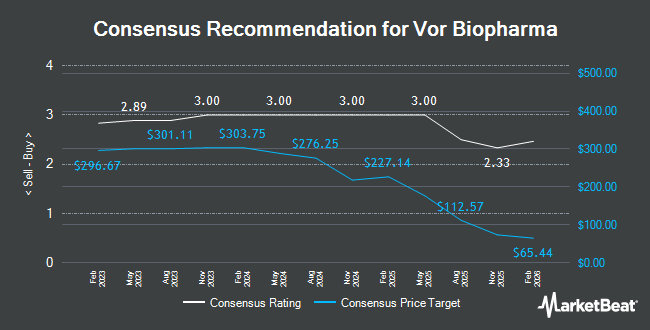

Vor Biopharma (NASDAQ:VOR - Get Free Report) was downgraded by stock analysts at Zacks Research from a "hold" rating to a "strong sell" rating in a research report issued on Monday,Zacks.com reports.

Other research analysts have also issued research reports about the stock. Stifel Nicolaus raised shares of Vor Biopharma from a "hold" rating to a "buy" rating and set a $55.00 price target for the company in a research report on Wednesday, September 24th. Wedbush reissued an "outperform" rating on shares of Vor Biopharma in a research report on Thursday, June 26th. Weiss Ratings reissued a "sell (d-)" rating on shares of Vor Biopharma in a research report on Wednesday, October 8th. HC Wainwright reaffirmed a "buy" rating and set a $60.00 price objective on shares of Vor Biopharma in a research note on Thursday, August 14th. Finally, Wall Street Zen cut shares of Vor Biopharma to a "strong sell" rating in a research note on Saturday, June 28th. Five equities research analysts have rated the stock with a Buy rating, four have issued a Hold rating and two have given a Sell rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $113.83.

Read Our Latest Stock Analysis on VOR

Vor Biopharma Price Performance

Shares of VOR opened at $30.81 on Monday. The company's 50-day moving average is $37.28. The firm has a market capitalization of $211.05 million, a price-to-earnings ratio of -0.11 and a beta of 2.07. Vor Biopharma has a 52 week low of $2.62 and a 52 week high of $65.80.

Vor Biopharma (NASDAQ:VOR - Get Free Report) last posted its quarterly earnings results on Tuesday, August 12th. The company reported ($43.60) earnings per share (EPS) for the quarter, missing the consensus estimate of ($11.40) by ($32.20).

Insider Activity at Vor Biopharma

In other Vor Biopharma news, major shareholder Reprogrammed Interchange Llc sold 48,884 shares of the firm's stock in a transaction that occurred on Thursday, October 9th. The shares were sold at an average price of $32.07, for a total value of $1,567,709.88. Following the transaction, the insider directly owned 1,374,775 shares of the company's stock, valued at approximately $44,089,034.25. This trade represents a 3.43% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders have sold 1,021,203 shares of company stock worth $21,890,146 over the last quarter. 0.45% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On Vor Biopharma

Hedge funds have recently bought and sold shares of the company. Money Concepts Capital Corp raised its holdings in Vor Biopharma by 106.1% in the first quarter. Money Concepts Capital Corp now owns 51,535 shares of the company's stock worth $37,000 after purchasing an additional 26,535 shares during the period. Goldman Sachs Group Inc. raised its holdings in Vor Biopharma by 218.2% in the first quarter. Goldman Sachs Group Inc. now owns 84,945 shares of the company's stock worth $61,000 after purchasing an additional 58,247 shares during the period. XTX Topco Ltd acquired a new stake in Vor Biopharma in the second quarter worth $66,000. OMERS ADMINISTRATION Corp acquired a new stake in Vor Biopharma in the first quarter worth $100,000. Finally, Jane Street Group LLC acquired a new stake in shares of Vor Biopharma during the first quarter worth $140,000. 97.29% of the stock is currently owned by institutional investors and hedge funds.

Vor Biopharma Company Profile

(

Get Free Report)

Vor Biopharma, Inc, a clinical-stage company, develops engineered hematopoietic stem cell (eHSC) therapies for cancer patients. It is developing VOR33, an eHSC product candidate that is in phase 1/2 to treat acute myeloid leukemia (AML) and other hematological malignancies. The company's VOR33 eHSCs lacks CD33, a protein that is expressed by AML blood cancer cells.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vor Biopharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vor Biopharma wasn't on the list.

While Vor Biopharma currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.