Wall Street Zen cut shares of Foot Locker (NYSE:FL - Free Report) to a strong sell rating in a research note issued to investors on Saturday morning.

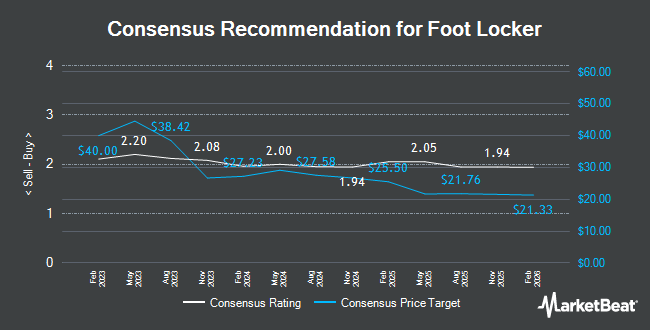

A number of other research firms have also recently issued reports on FL. Telsey Advisory Group reissued a "market perform" rating and set a $24.00 price objective on shares of Foot Locker in a research report on Wednesday, August 27th. Zacks Research upgraded shares of Foot Locker from a "strong sell" rating to a "hold" rating in a report on Monday, August 18th. Citigroup lifted their price objective on shares of Foot Locker from $20.00 to $24.00 and gave the company a "neutral" rating in a report on Friday, May 16th. Robert W. Baird raised their price target on shares of Foot Locker from $24.00 to $26.00 and gave the company a "neutral" rating in a research report on Thursday, August 28th. Finally, Gordon Haskett downgraded Foot Locker from a "moderate buy" rating to a "hold" rating in a research note on Thursday, May 15th. Two equities research analysts have rated the stock with a Buy rating, twelve have issued a Hold rating and two have assigned a Sell rating to the company. Based on data from MarketBeat, the company presently has an average rating of "Hold" and an average price target of $21.33.

Get Our Latest Analysis on Foot Locker

Foot Locker Trading Up 0.1%

NYSE:FL traded up $0.03 on Friday, reaching $24.15. 2,435,086 shares of the stock traded hands, compared to its average volume of 5,460,238. The company has a current ratio of 1.59, a quick ratio of 0.45 and a debt-to-equity ratio of 0.17. Foot Locker has a 1-year low of $11.00 and a 1-year high of $29.24. The company's 50 day moving average is $25.19 and its 200-day moving average is $20.19. The firm has a market capitalization of $2.31 billion, a price-to-earnings ratio of -5.99, a price-to-earnings-growth ratio of 2.18 and a beta of 1.79.

Foot Locker (NYSE:FL - Get Free Report) last posted its quarterly earnings data on Wednesday, August 27th. The athletic footwear retailer reported ($0.27) earnings per share for the quarter, missing the consensus estimate of $0.05 by ($0.32). Foot Locker had a positive return on equity of 2.92% and a negative net margin of 4.90%.The business had revenue of $1.86 billion during the quarter, compared to the consensus estimate of $1.87 billion. During the same period last year, the business posted ($0.05) earnings per share. The business's revenue was down 2.3% on a year-over-year basis. Equities research analysts anticipate that Foot Locker will post 1.23 EPS for the current fiscal year.

Insiders Place Their Bets

In related news, CAO Giovanna Cipriano sold 22,383 shares of Foot Locker stock in a transaction on Tuesday, July 1st. The shares were sold at an average price of $24.90, for a total value of $557,336.70. Following the transaction, the chief accounting officer owned 93,895 shares in the company, valued at $2,337,985.50. This trade represents a 19.25% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, President Franklin Bracken sold 14,922 shares of the business's stock in a transaction on Friday, August 29th. The shares were sold at an average price of $24.50, for a total transaction of $365,589.00. Following the transaction, the president directly owned 213,496 shares in the company, valued at approximately $5,230,652. The trade was a 6.53% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 0.89% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in FL. Norges Bank bought a new position in Foot Locker during the 2nd quarter worth about $37,975,000. Alliancebernstein L.P. boosted its position in Foot Locker by 1,249.5% during the second quarter. Alliancebernstein L.P. now owns 1,510,886 shares of the athletic footwear retailer's stock valued at $37,017,000 after purchasing an additional 1,398,924 shares in the last quarter. AQR Arbitrage LLC purchased a new position in Foot Locker in the second quarter valued at about $29,349,000. Man Group plc raised its holdings in Foot Locker by 890.3% in the second quarter. Man Group plc now owns 1,047,369 shares of the athletic footwear retailer's stock worth $25,661,000 after purchasing an additional 941,601 shares in the last quarter. Finally, P Schoenfeld Asset Management LP purchased a new stake in shares of Foot Locker during the second quarter valued at about $19,562,000.

About Foot Locker

(

Get Free Report)

Foot Locker, Inc, through its subsidiaries, operates as a footwear and apparel retailer in North America, Europe, Australia, New Zealand, Asia, and the Middle East. Its brand portfolio includes Foot Locker, a brand comprising sneakers and apparel; Kids Foot Locker, which offers athletic footwear, apparel, and accessories for children; and Champs Sports that operates as a mall-based specialty athletic footwear and apparel retailer.

See Also

Before you consider Foot Locker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Foot Locker wasn't on the list.

While Foot Locker currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.