Mid-America Apartment Communities (NYSE:MAA - Get Free Report) was downgraded by equities research analysts at Wall Street Zen from a "hold" rating to a "sell" rating in a research note issued on Saturday.

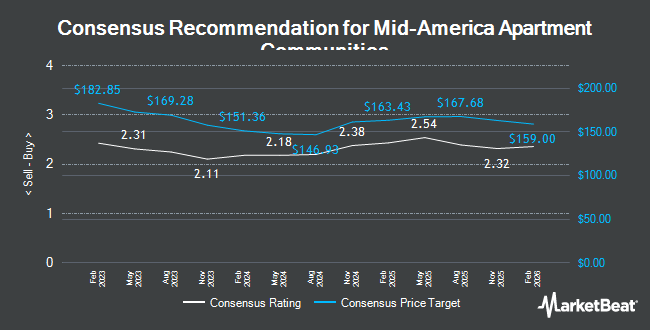

Several other research analysts have also recently issued reports on MAA. Scotiabank cut their target price on shares of Mid-America Apartment Communities from $194.00 to $180.00 and set a "sector outperform" rating on the stock in a report on Friday, June 13th. Truist Financial cut their price target on shares of Mid-America Apartment Communities from $174.00 to $171.00 and set a "buy" rating on the stock in a report on Wednesday, May 21st. Robert W. Baird lifted their price target on shares of Mid-America Apartment Communities from $161.00 to $162.00 and gave the company a "neutral" rating in a report on Thursday, May 1st. The Goldman Sachs Group cut shares of Mid-America Apartment Communities from a "buy" rating to a "neutral" rating and set a $165.00 price target on the stock. in a report on Friday, July 11th. Finally, Mizuho cut their price target on shares of Mid-America Apartment Communities from $166.00 to $161.00 and set a "neutral" rating on the stock in a report on Friday, May 23rd. Two investment analysts have rated the stock with a sell rating, eleven have given a hold rating and nine have given a buy rating to the stock. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $167.76.

View Our Latest Research Report on MAA

Mid-America Apartment Communities Price Performance

MAA traded up $0.05 on Friday, reaching $140.05. The company had a trading volume of 1,154,395 shares, compared to its average volume of 908,944. The business has a 50 day simple moving average of $150.30 and a 200 day simple moving average of $156.18. The company has a market cap of $16.39 billion, a price-to-earnings ratio of 28.82, a P/E/G ratio of 3.59 and a beta of 0.75. The company has a debt-to-equity ratio of 0.83, a quick ratio of 0.10 and a current ratio of 0.10. Mid-America Apartment Communities has a 52-week low of $138.67 and a 52-week high of $173.38.

Mid-America Apartment Communities (NYSE:MAA - Get Free Report) last announced its earnings results on Wednesday, July 30th. The real estate investment trust reported $2.15 earnings per share for the quarter, beating analysts' consensus estimates of $2.14 by $0.01. The business had revenue of $549.90 million for the quarter, compared to the consensus estimate of $552.19 million. Mid-America Apartment Communities had a net margin of 25.98% and a return on equity of 9.35%. Mid-America Apartment Communities's quarterly revenue was up .6% on a year-over-year basis. During the same period last year, the firm posted $2.22 earnings per share. As a group, sell-side analysts anticipate that Mid-America Apartment Communities will post 8.84 EPS for the current year.

Institutional Investors Weigh In On Mid-America Apartment Communities

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Capital World Investors increased its holdings in Mid-America Apartment Communities by 45.9% in the 4th quarter. Capital World Investors now owns 6,636,915 shares of the real estate investment trust's stock worth $1,025,868,000 after acquiring an additional 2,088,143 shares in the last quarter. APG Asset Management US Inc. increased its holdings in Mid-America Apartment Communities by 9.7% in the 1st quarter. APG Asset Management US Inc. now owns 3,069,507 shares of the real estate investment trust's stock worth $514,081,000 after acquiring an additional 271,507 shares in the last quarter. Northern Trust Corp increased its holdings in Mid-America Apartment Communities by 4.8% in the 1st quarter. Northern Trust Corp now owns 1,952,778 shares of the real estate investment trust's stock worth $327,247,000 after acquiring an additional 89,370 shares in the last quarter. Dimensional Fund Advisors LP increased its holdings in Mid-America Apartment Communities by 1.4% in the 4th quarter. Dimensional Fund Advisors LP now owns 1,725,605 shares of the real estate investment trust's stock worth $266,723,000 after acquiring an additional 24,407 shares in the last quarter. Finally, Deutsche Bank AG increased its holdings in Mid-America Apartment Communities by 38.3% in the 1st quarter. Deutsche Bank AG now owns 1,695,832 shares of the real estate investment trust's stock worth $284,188,000 after acquiring an additional 469,806 shares in the last quarter. 93.60% of the stock is owned by hedge funds and other institutional investors.

About Mid-America Apartment Communities

(

Get Free Report)

Mid-America Apartment Communities, Inc is a real estate investment trust, which engages in the operation, acquisition, and development of apartment communities. It operates through the Same Store and Non-Same Store segments. The Same Store Communities segment represents those apartment communities that have been owned and stabilized for at least 12 months as of the first day of the calendar year.

Recommended Stories

Before you consider Mid-America Apartment Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mid-America Apartment Communities wasn't on the list.

While Mid-America Apartment Communities currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.