Wall Street Zen upgraded shares of Erasca (NASDAQ:ERAS - Free Report) from a sell rating to a hold rating in a research report sent to investors on Sunday.

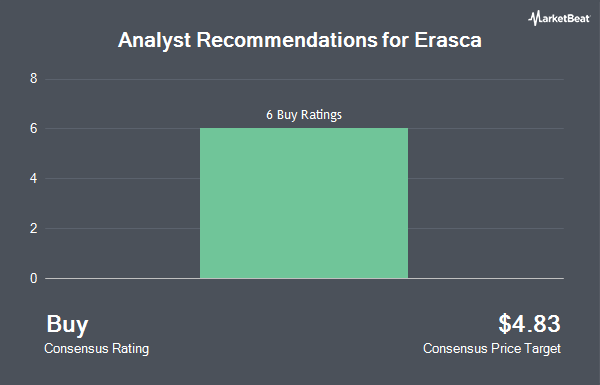

ERAS has been the subject of several other reports. Bank of America restated an "underperform" rating and set a $1.00 price objective (down from $4.00) on shares of Erasca in a research report on Wednesday, September 3rd. Morgan Stanley reaffirmed an "equal weight" rating and set a $2.00 target price (down from $4.00) on shares of Erasca in a report on Monday, August 18th. Five research analysts have rated the stock with a Buy rating, one has given a Hold rating and one has issued a Sell rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $3.71.

Get Our Latest Stock Report on Erasca

Erasca Stock Performance

NASDAQ:ERAS traded up $0.03 during mid-day trading on Friday, hitting $1.81. The stock had a trading volume of 709,859 shares, compared to its average volume of 1,336,476. Erasca has a twelve month low of $1.01 and a twelve month high of $3.31. The stock has a market cap of $512.02 million, a price-to-earnings ratio of -4.01 and a beta of 1.08. The company's 50 day simple moving average is $1.57 and its 200 day simple moving average is $1.44.

Erasca (NASDAQ:ERAS - Get Free Report) last issued its earnings results on Tuesday, August 12th. The company reported ($0.12) earnings per share (EPS) for the quarter, meeting the consensus estimate of ($0.12). As a group, equities analysts forecast that Erasca will post -0.73 earnings per share for the current year.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in ERAS. Ameriprise Financial Inc. raised its position in Erasca by 165.6% during the fourth quarter. Ameriprise Financial Inc. now owns 55,585 shares of the company's stock valued at $140,000 after purchasing an additional 34,657 shares in the last quarter. BNP Paribas Financial Markets acquired a new position in Erasca during the fourth quarter valued at approximately $61,000. Deutsche Bank AG raised its position in Erasca by 163.1% during the fourth quarter. Deutsche Bank AG now owns 135,770 shares of the company's stock valued at $341,000 after purchasing an additional 84,171 shares in the last quarter. Millennium Management LLC raised its position in Erasca by 73.3% during the fourth quarter. Millennium Management LLC now owns 4,177,900 shares of the company's stock valued at $10,487,000 after purchasing an additional 1,767,350 shares in the last quarter. Finally, Nuveen Asset Management LLC raised its position in Erasca by 14.9% during the fourth quarter. Nuveen Asset Management LLC now owns 555,704 shares of the company's stock valued at $1,395,000 after purchasing an additional 72,121 shares in the last quarter. 67.78% of the stock is currently owned by institutional investors and hedge funds.

Erasca Company Profile

(

Get Free Report)

Erasca, Inc, a clinical-stage precision oncology company, focuses on discovering, developing, and commercializing therapies for patients with RAS/MAPK pathway-driven cancers. The company's lead product is naporafenib which is in phase 1b trial for patients with RAS Q16X solid tumors and plans to initiate a pivotal Phase 3 trial for patients with NRASm melanoma.

Further Reading

Before you consider Erasca, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Erasca wasn't on the list.

While Erasca currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.