I-Mab (NASDAQ:IMAB - Get Free Report) was upgraded by research analysts at Wall Street Zen from a "hold" rating to a "buy" rating in a research report issued to clients and investors on Saturday.

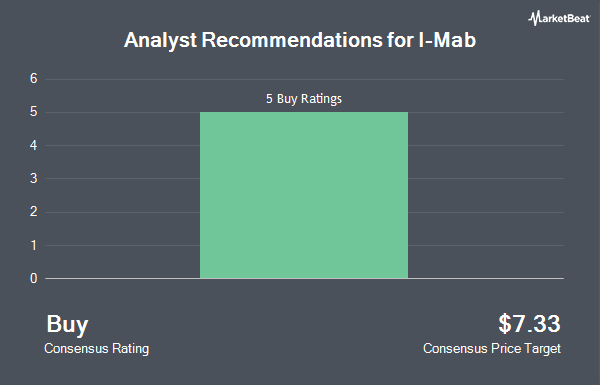

IMAB has been the subject of several other reports. Loop Capital set a $8.00 price target on I-Mab in a research report on Thursday, August 28th. Leerink Partners began coverage on I-Mab in a research report on Friday, October 3rd. They issued an "outperform" rating and a $9.00 price target for the company. New Street Research set a $7.00 price target on I-Mab in a research report on Wednesday, September 10th. Weiss Ratings reissued a "sell (d+)" rating on shares of I-Mab in a research report on Wednesday. Finally, Leerink Partnrs raised I-Mab to a "strong-buy" rating in a research report on Friday, October 3rd. One research analyst has rated the stock with a Strong Buy rating, five have given a Buy rating and one has issued a Sell rating to the stock. According to MarketBeat.com, I-Mab has an average rating of "Moderate Buy" and a consensus price target of $7.33.

Get Our Latest Report on I-Mab

I-Mab Stock Performance

IMAB opened at $4.77 on Friday. The stock's fifty day moving average is $4.16 and its two-hundred day moving average is $2.43. I-Mab has a 52 week low of $0.60 and a 52 week high of $5.90.

I-Mab (NASDAQ:IMAB - Get Free Report) last released its quarterly earnings data on Wednesday, August 20th. The company reported ($0.07) EPS for the quarter, topping the consensus estimate of ($0.10) by $0.03. On average, research analysts anticipate that I-Mab will post -0.56 EPS for the current year.

Institutional Trading of I-Mab

Several large investors have recently added to or reduced their stakes in IMAB. HBK Sorce Advisory LLC purchased a new stake in I-Mab during the 1st quarter valued at about $38,000. Ground Swell Capital LLC purchased a new stake in I-Mab during the 1st quarter valued at about $53,000. Millennium Management LLC grew its stake in I-Mab by 763.1% during the 4th quarter. Millennium Management LLC now owns 97,749 shares of the company's stock valued at $83,000 after purchasing an additional 86,424 shares during the last quarter. Geode Capital Management LLC grew its stake in I-Mab by 147.6% during the 2nd quarter. Geode Capital Management LLC now owns 54,562 shares of the company's stock valued at $132,000 after purchasing an additional 32,525 shares during the last quarter. Finally, Stonepine Capital Management LLC purchased a new stake in I-Mab during the 1st quarter valued at about $398,000. Hedge funds and other institutional investors own 38.38% of the company's stock.

About I-Mab

(

Get Free Report)

I-Mab, a clinical stage biopharmaceutical company, discovers, develops, and commercializes biologics in the fields of immuno-oncology and immuno-inflammation diseases primarily in the United States. It is developing Uliledlimab, a CD73 neutralizing antibody, which is in Phase 2 clinical trial for the treatment of solid tumors; Givastomig, a bi-specific antibody that is in Phase 1 clinical trial for the treatment of gastric and other cancers; and Ragistomig, a programmed cell death ligand-based tumor-dependent T cell engager, which is in Phase 1 clinical trial for the treatment of for solid tumors.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider I-Mab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and I-Mab wasn't on the list.

While I-Mab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.