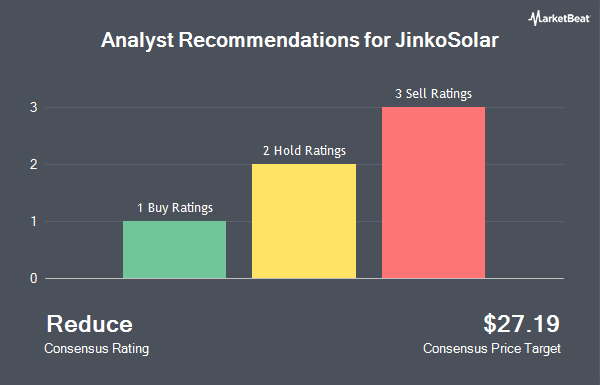

Wall Street Zen upgraded shares of JinkoSolar (NYSE:JKS - Free Report) from a sell rating to a hold rating in a research report report published on Sunday.

JinkoSolar Stock Performance

JKS stock traded down $0.63 during trading hours on Friday, reaching $23.68. The stock had a trading volume of 405,034 shares, compared to its average volume of 514,720. The stock has a market capitalization of $1.22 billion, a PE ratio of -4.72 and a beta of 0.13. The company has a debt-to-equity ratio of 1.11, a current ratio of 1.33 and a quick ratio of 1.07. The stock has a 50-day simple moving average of $23.26 and a 200 day simple moving average of $20.65. JinkoSolar has a fifty-two week low of $13.42 and a fifty-two week high of $37.36.

JinkoSolar Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Wednesday, July 16th. Shareholders of record on Wednesday, July 2nd were issued a dividend of $0.325 per share. The ex-dividend date of this dividend was Wednesday, July 2nd. This represents a $1.30 annualized dividend and a yield of 5.5%. JinkoSolar's dividend payout ratio (DPR) is currently -25.50%.

Institutional Trading of JinkoSolar

Hedge funds have recently modified their holdings of the stock. Charles Schwab Investment Management Inc. acquired a new stake in shares of JinkoSolar during the 1st quarter worth about $1,660,000. Hsbc Holdings PLC increased its holdings in JinkoSolar by 23.1% in the 1st quarter. Hsbc Holdings PLC now owns 126,175 shares of the semiconductor company's stock valued at $2,351,000 after buying an additional 23,652 shares during the period. Jump Financial LLC increased its holdings in JinkoSolar by 573.2% in the 1st quarter. Jump Financial LLC now owns 54,176 shares of the semiconductor company's stock valued at $1,010,000 after buying an additional 46,129 shares during the period. Northern Trust Corp grew its holdings in shares of JinkoSolar by 58.6% during the 4th quarter. Northern Trust Corp now owns 84,252 shares of the semiconductor company's stock valued at $2,098,000 after purchasing an additional 31,130 shares during the last quarter. Finally, Aberdeen Group plc grew its holdings in shares of JinkoSolar by 63.6% during the first quarter. Aberdeen Group plc now owns 78,065 shares of the semiconductor company's stock worth $1,455,000 after purchasing an additional 30,340 shares during the last quarter. Institutional investors and hedge funds own 35.82% of the company's stock.

JinkoSolar Company Profile

(

Get Free Report)

JinkoSolar Holding Co, Ltd., together with its subsidiaries, engages in the design, development, production, and marketing of photovoltaic products. The company offers solar modules, silicon wafers, solar cells, recovered silicon materials, and silicon ingots. It also provides solar system integration services; solar power generation and solar system EPC services; and energy storage system, as well as undertakes solar power projects.

Further Reading

Before you consider JinkoSolar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JinkoSolar wasn't on the list.

While JinkoSolar currently has a Strong Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.