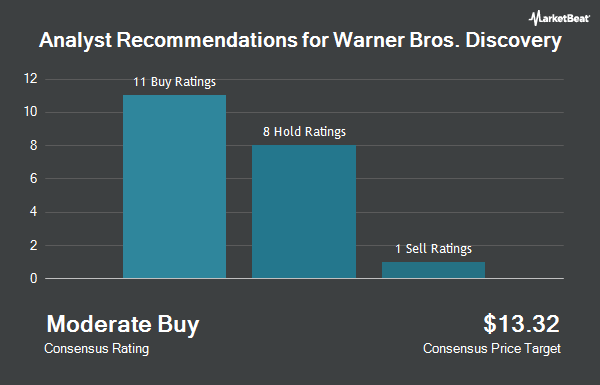

Warner Bros. Discovery, Inc. (NASDAQ:WBD - Get Free Report) has received an average rating of "Moderate Buy" from the twenty-one research firms that are currently covering the firm, MarketBeat.com reports. Ten investment analysts have rated the stock with a hold recommendation and eleven have assigned a buy recommendation to the company. The average 12-month price target among brokers that have issued ratings on the stock in the last year is $12.01.

A number of research firms have recently issued reports on WBD. Moffett Nathanson raised shares of Warner Bros. Discovery from a "neutral" rating to a "buy" rating and lifted their price objective for the stock from $9.00 to $13.00 in a report on Tuesday, January 21st. JPMorgan Chase & Co. lifted their price objective on shares of Warner Bros. Discovery from $9.00 to $10.00 and gave the stock a "neutral" rating in a report on Tuesday, January 14th. Raymond James dropped their price objective on shares of Warner Bros. Discovery from $14.00 to $13.00 and set an "outperform" rating for the company in a report on Friday, April 4th. Citigroup lifted their price objective on shares of Warner Bros. Discovery from $13.00 to $15.00 and gave the stock a "buy" rating in a report on Wednesday, March 5th. Finally, KeyCorp lowered their price target on shares of Warner Bros. Discovery from $14.00 to $13.00 and set an "overweight" rating for the company in a research note on Monday, April 14th.

Check Out Our Latest Stock Report on Warner Bros. Discovery

Warner Bros. Discovery Stock Performance

Warner Bros. Discovery stock traded up $0.07 during mid-day trading on Monday, reaching $8.77. The company's stock had a trading volume of 25,472,285 shares, compared to its average volume of 33,048,858. Warner Bros. Discovery has a 12-month low of $6.64 and a 12-month high of $12.70. The company has a market capitalization of $21.53 billion, a P/E ratio of -1.91, a PEG ratio of 8.64 and a beta of 1.43. The company has a debt-to-equity ratio of 1.03, a quick ratio of 0.80 and a current ratio of 0.80. The firm's fifty day moving average price is $9.72 and its two-hundred day moving average price is $9.79.

Warner Bros. Discovery (NASDAQ:WBD - Get Free Report) last released its quarterly earnings results on Thursday, February 27th. The company reported ($0.20) EPS for the quarter, missing analysts' consensus estimates of $0.10 by ($0.30). The firm had revenue of $10.03 billion for the quarter, compared to analysts' expectations of $10.16 billion. Warner Bros. Discovery had a negative net margin of 28.34% and a negative return on equity of 27.56%. Sell-side analysts predict that Warner Bros. Discovery will post -4.33 EPS for the current fiscal year.

Insider Buying and Selling

In related news, Director Piazza Samuel A. Jr. Di purchased 17,346 shares of the company's stock in a transaction dated Monday, March 3rd. The shares were purchased at an average cost of $11.41 per share, with a total value of $197,917.86. Following the transaction, the director now directly owns 159,932 shares in the company, valued at $1,824,824.12. This trade represents a 12.17 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. 1.80% of the stock is owned by insiders.

Institutional Inflows and Outflows

Large investors have recently added to or reduced their stakes in the stock. Colonial Trust Advisors raised its stake in Warner Bros. Discovery by 71.8% during the fourth quarter. Colonial Trust Advisors now owns 2,383 shares of the company's stock valued at $25,000 after buying an additional 996 shares during the last quarter. Stonebridge Financial Group LLC purchased a new position in Warner Bros. Discovery during the fourth quarter valued at $26,000. SRS Capital Advisors Inc. raised its stake in Warner Bros. Discovery by 313.4% during the fourth quarter. SRS Capital Advisors Inc. now owns 2,559 shares of the company's stock valued at $27,000 after buying an additional 1,940 shares during the last quarter. Graney & King LLC purchased a new position in Warner Bros. Discovery during the fourth quarter valued at $28,000. Finally, North Capital Inc. purchased a new position in Warner Bros. Discovery during the first quarter valued at $28,000. Hedge funds and other institutional investors own 59.95% of the company's stock.

About Warner Bros. Discovery

(

Get Free ReportWarner Bros. Discovery, Inc operates as a media and entertainment company worldwide. It operates through three segments: Studios, Network, and DTC. The Studios segment produces and releases feature films for initial exhibition in theaters; produces and licenses television programs to its networks and third parties and direct-to-consumer services; distributes films and television programs to various third parties and internal television; and offers streaming services and distribution through the home entertainment market, themed experience licensing, and interactive gaming.

Read More

Before you consider Warner Bros. Discovery, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warner Bros. Discovery wasn't on the list.

While Warner Bros. Discovery currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.