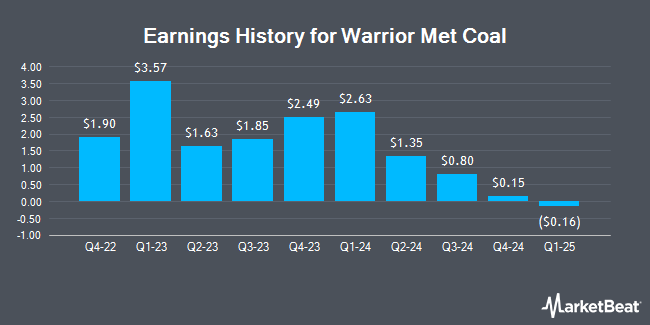

Warrior Met Coal (NYSE:HCC - Get Free Report) is expected to post its Q1 2025 quarterly earnings results after the market closes on Wednesday, April 30th. Analysts expect Warrior Met Coal to post earnings of $0.12 per share and revenue of $296.39 million for the quarter.

Warrior Met Coal (NYSE:HCC - Get Free Report) last posted its quarterly earnings data on Thursday, February 13th. The company reported $0.15 EPS for the quarter, missing the consensus estimate of $0.49 by ($0.34). Warrior Met Coal had a return on equity of 12.56% and a net margin of 16.43%. The business had revenue of $297.47 million for the quarter, compared to the consensus estimate of $331.70 million. On average, analysts expect Warrior Met Coal to post $5 EPS for the current fiscal year and $9 EPS for the next fiscal year.

Warrior Met Coal Stock Down 0.5 %

Shares of NYSE HCC traded down $0.23 during trading on Monday, reaching $48.87. The company had a trading volume of 278,939 shares, compared to its average volume of 935,022. The stock has a market cap of $2.57 billion, a PE ratio of 10.20 and a beta of 0.80. The business's 50-day moving average is $47.63 and its 200 day moving average is $55.68. Warrior Met Coal has a 12-month low of $38.00 and a 12-month high of $75.53. The company has a quick ratio of 3.99, a current ratio of 5.20 and a debt-to-equity ratio of 0.09.

Warrior Met Coal Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, May 12th. Investors of record on Monday, May 5th will be issued a $0.08 dividend. The ex-dividend date of this dividend is Monday, May 5th. This represents a $0.32 annualized dividend and a yield of 0.65%. Warrior Met Coal's payout ratio is 6.68%.

Wall Street Analyst Weigh In

A number of equities research analysts have issued reports on the company. Benchmark restated a "hold" rating on shares of Warrior Met Coal in a research note on Friday, February 14th. B. Riley lowered their price objective on shares of Warrior Met Coal from $86.00 to $76.00 and set a "buy" rating for the company in a research report on Friday, April 11th. Finally, Jefferies Financial Group dropped their price objective on shares of Warrior Met Coal from $75.00 to $65.00 and set a "buy" rating on the stock in a research note on Monday, January 6th.

View Our Latest Research Report on Warrior Met Coal

Warrior Met Coal Company Profile

(

Get Free Report)

Warrior Met Coal, Inc produces and exports non-thermal metallurgical coal for the steel industry. It operates two underground mines located in Alabama. The company sells its metallurgical coal to a customer base of blast furnace steel producers located primarily in Europe, South America, and Asia. It also sells natural gas, which is extracted as a byproduct from coal production.

Featured Articles

Before you consider Warrior Met Coal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warrior Met Coal wasn't on the list.

While Warrior Met Coal currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.