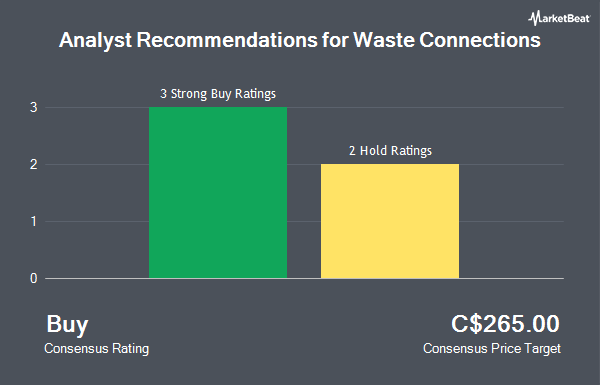

Waste Connections, Inc. (TSE:WCN - Get Free Report) has been given a consensus recommendation of "Buy" by the six analysts that are presently covering the firm, MarketBeat reports. Two investment analysts have rated the stock with a hold rating and four have given a strong buy rating to the company. The average 1 year target price among brokers that have covered the stock in the last year is C$265.00.

Several analysts recently issued reports on the stock. National Bank Financial upgraded shares of Waste Connections to a "strong-buy" rating in a research report on Monday, May 26th. William Blair upgraded shares of Waste Connections to a "strong-buy" rating in a research report on Thursday, April 3rd. Melius Research upgraded shares of Waste Connections to a "strong-buy" rating in a research report on Monday, June 9th. Finally, Seaport Res Ptn upgraded shares of Waste Connections to a "strong-buy" rating in a research report on Tuesday, May 6th.

Check Out Our Latest Stock Analysis on WCN

Insiders Place Their Bets

In other news, Senior Officer Robert Andres Nielsen sold 473 shares of the business's stock in a transaction on Friday, May 23rd. The shares were sold at an average price of C$269.79, for a total value of C$127,610.67. Company insiders own 0.21% of the company's stock.

Waste Connections Stock Performance

TSE WCN traded down C$1.39 during trading hours on Wednesday, hitting C$259.20. 178,251 shares of the company's stock traded hands, compared to its average volume of 293,994. The business's fifty day moving average price is C$268.36 and its two-hundred day moving average price is C$265.26. The company has a current ratio of 0.77, a quick ratio of 0.74 and a debt-to-equity ratio of 102.69. The firm has a market capitalization of C$47.12 billion, a P/E ratio of 50.10, a P/E/G ratio of 2.22 and a beta of 0.72. Waste Connections has a 52 week low of C$229.26 and a 52 week high of C$284.73.

About Waste Connections

(

Get Free ReportWaste Connections is the third- largest integrated provider of traditional solid waste and recycling services in the North America, operating 91 active landfills (12 are E&P waste landfills), 132 transfer stations, and 68 recycling operations. The firm serves residential, commercial, industrial, and energy end markets.

Further Reading

Before you consider Waste Connections, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Waste Connections wasn't on the list.

While Waste Connections currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.