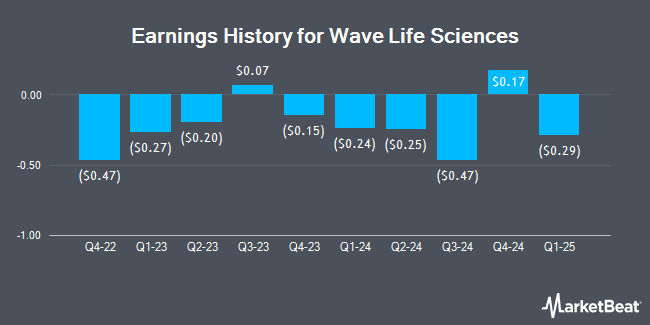

WAVE Life Sciences (NASDAQ:WVE - Get Free Report) released its quarterly earnings data on Wednesday. The company reported ($0.31) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.29) by ($0.02), Zacks reports. The business had revenue of $8.70 million during the quarter, compared to analysts' expectations of $11.52 million.

WAVE Life Sciences Price Performance

Shares of WVE traded up $0.06 during midday trading on Tuesday, reaching $8.81. The stock had a trading volume of 515,995 shares, compared to its average volume of 1,297,532. WAVE Life Sciences has a 52 week low of $5.04 and a 52 week high of $16.74. The firm's 50 day moving average price is $7.27 and its 200-day moving average price is $8.25. The company has a market capitalization of $1.40 billion, a P/E ratio of -9.79 and a beta of -0.95.

Analysts Set New Price Targets

Several analysts have weighed in on WVE shares. Citigroup assumed coverage on WAVE Life Sciences in a report on Wednesday, July 16th. They issued a "buy" rating and a $16.00 target price on the stock. Canaccord Genuity Group initiated coverage on WAVE Life Sciences in a report on Monday. They issued a "buy" rating and a $19.00 price objective on the stock. Oppenheimer initiated coverage on WAVE Life Sciences in a report on Monday, July 28th. They set an "outperform" rating and a $24.00 target price on the stock. Raymond James Financial initiated coverage on WAVE Life Sciences in a report on Wednesday, June 11th. They set an "outperform" rating and a $14.00 price objective on the stock. Finally, Wedbush restated an "outperform" rating and set a $18.00 price objective on shares of WAVE Life Sciences in a report on Monday, June 23rd. One analyst has rated the stock with a sell rating, one has assigned a hold rating and fourteen have assigned a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $20.27.

Read Our Latest Research Report on WVE

Insider Activity at WAVE Life Sciences

In other news, Director Gregory L. Verdine sold 30,000 shares of the business's stock in a transaction on Friday, June 13th. The stock was sold at an average price of $6.95, for a total value of $208,500.00. Following the sale, the director owned 282,517 shares of the company's stock, valued at approximately $1,963,493.15. The trade was a 9.60% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Corporate insiders own 23.98% of the company's stock.

Institutional Inflows and Outflows

A hedge fund recently raised its stake in WAVE Life Sciences stock. Goldman Sachs Group Inc. boosted its stake in shares of WAVE Life Sciences Ltd. (NASDAQ:WVE - Free Report) by 3.8% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 557,644 shares of the company's stock after purchasing an additional 20,624 shares during the quarter. Goldman Sachs Group Inc. owned 0.36% of WAVE Life Sciences worth $4,506,000 at the end of the most recent quarter. 89.73% of the stock is currently owned by institutional investors and hedge funds.

About WAVE Life Sciences

(

Get Free Report)

Wave Life Sciences Ltd., a clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform. The company's RNA medicines platform, PRISM, combines multiple modalities, chemistry innovation, and deep insights into human genetics to deliver scientific breakthroughs that treat both rare and prevalent disorders.

See Also

Before you consider WAVE Life Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WAVE Life Sciences wasn't on the list.

While WAVE Life Sciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.