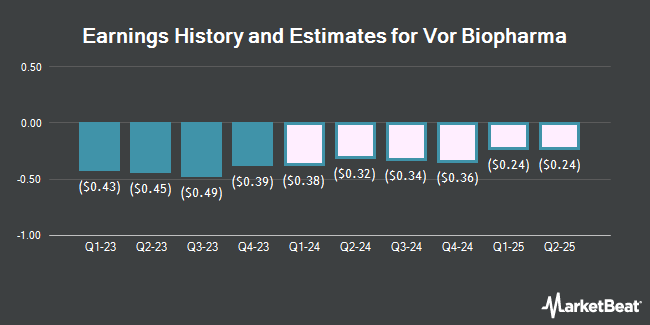

Vor Biopharma Inc. (NYSE:VOR - Free Report) - Equities researchers at Wedbush increased their Q3 2025 earnings per share estimates for shares of Vor Biopharma in a research note issued to investors on Wednesday, August 13th. Wedbush analyst D. Nierengarten now forecasts that the company will post earnings per share of ($0.03) for the quarter, up from their prior estimate of ($0.19). Wedbush currently has a "Outperform" rating on the stock. The consensus estimate for Vor Biopharma's current full-year earnings is ($1.42) per share. Wedbush also issued estimates for Vor Biopharma's Q4 2025 earnings at ($0.03) EPS, Q1 2026 earnings at ($0.03) EPS, Q2 2026 earnings at ($0.03) EPS, Q3 2026 earnings at ($0.03) EPS, Q4 2026 earnings at ($0.03) EPS and FY2026 earnings at ($0.14) EPS.

A number of other research analysts have also recently issued reports on VOR. HC Wainwright reiterated a "buy" rating and issued a $3.00 target price on shares of Vor Biopharma in a research report on Thursday, August 14th. JMP Securities reaffirmed a "market perform" rating and set a $6.00 price target on shares of Vor Biopharma in a report on Friday, May 9th. Jones Trading downgraded shares of Vor Biopharma from a "strong-buy" rating to a "hold" rating in a research note on Thursday, May 8th. Baird R W lowered shares of Vor Biopharma from a "strong-buy" rating to a "hold" rating in a research report on Thursday, May 8th. Finally, Citizens Jmp cut shares of Vor Biopharma from a "strong-buy" rating to a "hold" rating in a research note on Friday, May 9th. Five research analysts have rated the stock with a Buy rating and four have given a Hold rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $6.07.

View Our Latest Report on VOR

Vor Biopharma Price Performance

Shares of VOR stock traded up $0.1550 on Friday, hitting $2.2050. 5,087,781 shares of the company's stock were exchanged, compared to its average volume of 7,945,833. The company has a 50 day moving average of $1.66 and a 200 day moving average of $1.05. The stock has a market cap of $279.34 million, a P/E ratio of -1.34 and a beta of 2.06. Vor Biopharma has a 12 month low of $0.13 and a 12 month high of $3.29.

Institutional Trading of Vor Biopharma

Several large investors have recently modified their holdings of the stock. XTX Topco Ltd acquired a new position in shares of Vor Biopharma during the 4th quarter valued at $80,000. Lynx1 Capital Management LP acquired a new position in shares of Vor Biopharma during the fourth quarter valued at about $707,000. Northern Trust Corp boosted its position in shares of Vor Biopharma by 39.0% during the 4th quarter. Northern Trust Corp now owns 157,617 shares of the company's stock worth $175,000 after purchasing an additional 44,252 shares in the last quarter. RA Capital Management L.P. boosted its position in shares of Vor Biopharma by 74.3% during the 4th quarter. RA Capital Management L.P. now owns 39,646,039 shares of the company's stock worth $44,007,000 after purchasing an additional 16,897,159 shares in the last quarter. Finally, Trustees of Columbia University in the City of New York acquired a new stake in shares of Vor Biopharma in the 4th quarter valued at about $102,000. Institutional investors and hedge funds own 97.29% of the company's stock.

Vor Biopharma Company Profile

(

Get Free Report)

Vor Biopharma Inc operates as a clinical-stage cell and genome engineering company. Its lead product is tremtelectogene empogeditemcel (trem-cel), an engineered hematopoietic stem cell (eHSC) product candidate that is in phase 1/2 trial to treat acute myeloid leukemia (AML) and other hematological malignancies.

Featured Articles

Before you consider Vor Biopharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vor Biopharma wasn't on the list.

While Vor Biopharma currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.