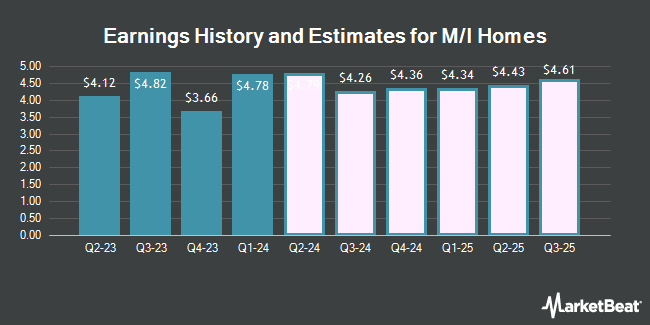

M/I Homes, Inc. (NYSE:MHO - Free Report) - Research analysts at Wedbush dropped their Q3 2025 earnings per share (EPS) estimates for M/I Homes in a research report issued on Thursday, July 24th. Wedbush analyst J. Mccanless now expects that the construction company will post earnings per share of $4.56 for the quarter, down from their prior forecast of $4.95. The consensus estimate for M/I Homes' current full-year earnings is $18.44 per share. Wedbush also issued estimates for M/I Homes' Q4 2025 earnings at $4.79 EPS, FY2025 earnings at $17.75 EPS, Q1 2026 earnings at $3.58 EPS, Q2 2026 earnings at $4.89 EPS, Q3 2026 earnings at $5.06 EPS, Q4 2026 earnings at $5.42 EPS and FY2026 earnings at $18.94 EPS.

Several other brokerages have also recently weighed in on MHO. Raymond James Financial reduced their price target on M/I Homes from $168.00 to $140.00 and set a "strong-buy" rating for the company in a research report on Tuesday, April 29th. Wall Street Zen cut M/I Homes from a "buy" rating to a "hold" rating in a research report on Friday, April 25th.

Check Out Our Latest Report on M/I Homes

M/I Homes Stock Performance

Shares of NYSE:MHO traded down $1.22 during trading on Monday, hitting $119.60. The stock had a trading volume of 25,417 shares, compared to its average volume of 280,134. M/I Homes has a 12-month low of $100.22 and a 12-month high of $176.18. The stock has a market capitalization of $3.20 billion, a price-to-earnings ratio of 6.57 and a beta of 1.64. The company has a quick ratio of 1.72, a current ratio of 7.21 and a debt-to-equity ratio of 0.32. The stock has a 50-day simple moving average of $112.68 and a two-hundred day simple moving average of $115.31.

M/I Homes (NYSE:MHO - Get Free Report) last issued its quarterly earnings results on Wednesday, July 23rd. The construction company reported $4.42 earnings per share for the quarter, missing the consensus estimate of $4.43 by ($0.01). The business had revenue of $1.16 billion during the quarter, compared to analyst estimates of $1.12 billion. M/I Homes had a return on equity of 17.23% and a net margin of 11.40%. M/I Homes's revenue was up 4.8% compared to the same quarter last year.

Institutional Investors Weigh In On M/I Homes

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. Principal Financial Group Inc. increased its holdings in M/I Homes by 2.6% during the 1st quarter. Principal Financial Group Inc. now owns 144,678 shares of the construction company's stock worth $16,519,000 after purchasing an additional 3,698 shares during the period. GAMMA Investing LLC increased its holdings in M/I Homes by 57.6% during the 1st quarter. GAMMA Investing LLC now owns 919 shares of the construction company's stock worth $105,000 after purchasing an additional 336 shares during the period. Wealth Enhancement Advisory Services LLC increased its holdings in M/I Homes by 17.2% during the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 5,205 shares of the construction company's stock worth $594,000 after purchasing an additional 763 shares during the period. Allspring Global Investments Holdings LLC increased its holdings in M/I Homes by 44.2% during the 1st quarter. Allspring Global Investments Holdings LLC now owns 7,707 shares of the construction company's stock worth $880,000 after purchasing an additional 2,363 shares during the period. Finally, Fifth Third Bancorp increased its holdings in M/I Homes by 38.3% during the 1st quarter. Fifth Third Bancorp now owns 379 shares of the construction company's stock worth $43,000 after purchasing an additional 105 shares during the period. Hedge funds and other institutional investors own 95.14% of the company's stock.

M/I Homes Company Profile

(

Get Free Report)

M/I Homes, Inc, together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments.

Featured Articles

Before you consider M/I Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M/I Homes wasn't on the list.

While M/I Homes currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.