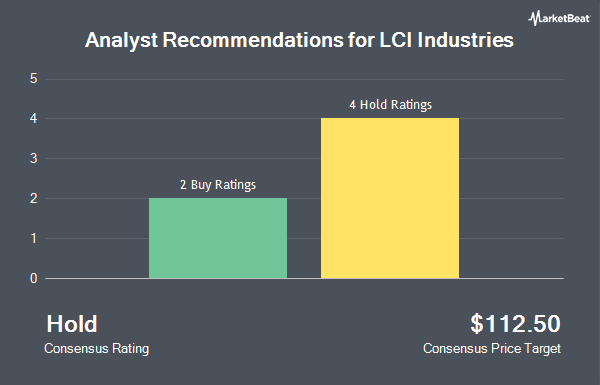

LCI Industries (NYSE:LCII - Get Free Report)'s stock had its "hold (c)" rating reissued by stock analysts at Weiss Ratings in a research note issued to investors on Wednesday,Weiss Ratings reports.

A number of other analysts have also recently weighed in on the company. Wall Street Zen raised LCI Industries from a "hold" rating to a "buy" rating in a research report on Friday, October 3rd. BMO Capital Markets boosted their price objective on LCI Industries from $80.00 to $85.00 and gave the stock an "underperform" rating in a research report on Wednesday, August 6th. One investment analyst has rated the stock with a Buy rating, four have assigned a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus price target of $103.25.

Check Out Our Latest Analysis on LCI Industries

LCI Industries Price Performance

Shares of NYSE:LCII opened at $88.77 on Wednesday. LCI Industries has a fifty-two week low of $72.31 and a fifty-two week high of $129.38. The business has a 50-day moving average of $99.54 and a two-hundred day moving average of $92.24. The stock has a market capitalization of $2.15 billion, a P/E ratio of 14.82 and a beta of 1.31. The company has a debt-to-equity ratio of 0.68, a current ratio of 2.80 and a quick ratio of 1.34.

LCI Industries (NYSE:LCII - Get Free Report) last announced its quarterly earnings results on Tuesday, August 5th. The company reported $2.39 earnings per share for the quarter, topping analysts' consensus estimates of $2.22 by $0.17. LCI Industries had a return on equity of 11.57% and a net margin of 3.93%.The company had revenue of $1.11 billion during the quarter, compared to analysts' expectations of $1.07 billion. During the same quarter in the previous year, the firm earned $2.40 earnings per share. The business's quarterly revenue was up 5.1% compared to the same quarter last year. On average, equities research analysts predict that LCI Industries will post 6.76 EPS for the current fiscal year.

Hedge Funds Weigh In On LCI Industries

Several large investors have recently added to or reduced their stakes in LCII. Millennium Management LLC raised its holdings in LCI Industries by 482.2% in the 1st quarter. Millennium Management LLC now owns 635,540 shares of the company's stock valued at $55,565,000 after acquiring an additional 526,378 shares in the last quarter. ARGA Investment Management LP raised its holdings in LCI Industries by 1,386.8% in the 2nd quarter. ARGA Investment Management LP now owns 424,374 shares of the company's stock valued at $38,699,000 after acquiring an additional 395,831 shares in the last quarter. Boston Partners acquired a new position in shares of LCI Industries in the 1st quarter worth approximately $20,721,000. Jane Street Group LLC raised its holdings in shares of LCI Industries by 651.1% in the 1st quarter. Jane Street Group LLC now owns 234,864 shares of the company's stock worth $20,534,000 after buying an additional 203,594 shares in the last quarter. Finally, Bank of Montreal Can raised its holdings in shares of LCI Industries by 70.4% in the 2nd quarter. Bank of Montreal Can now owns 435,844 shares of the company's stock worth $39,745,000 after buying an additional 180,060 shares in the last quarter. Institutional investors and hedge funds own 99.71% of the company's stock.

LCI Industries Company Profile

(

Get Free Report)

LCI Industries, together with its subsidiaries, manufactures and supplies engineered components for the manufacturers of recreational vehicles (RVs) and adjacent industries in the United States and internationally. It operates through two segments: Original Equipment Manufacturers (OEM) and Aftermarket.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider LCI Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LCI Industries wasn't on the list.

While LCI Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.