Ryan Specialty (NYSE:RYAN - Get Free Report)'s stock had its "hold (c-)" rating reaffirmed by Weiss Ratings in a research note issued to investors on Wednesday,Weiss Ratings reports.

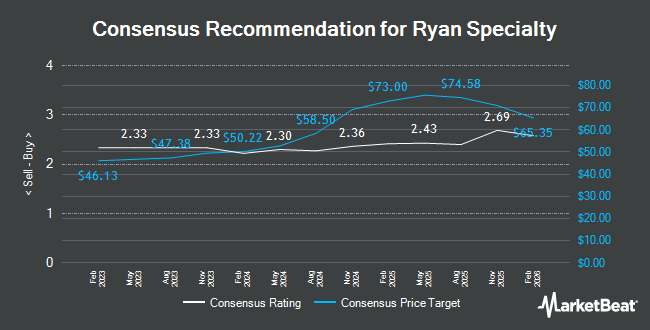

A number of other research analysts have also issued reports on the company. Morgan Stanley decreased their target price on Ryan Specialty from $68.00 to $65.00 and set an "overweight" rating on the stock in a research report on Tuesday. Citigroup assumed coverage on Ryan Specialty in a research report on Wednesday, August 13th. They set a "buy" rating and a $74.00 target price on the stock. UBS Group decreased their price objective on Ryan Specialty from $80.00 to $75.00 and set a "buy" rating on the stock in a report on Wednesday. Wall Street Zen upgraded Ryan Specialty from a "sell" rating to a "hold" rating in a report on Sunday, August 3rd. Finally, Wolfe Research upgraded Ryan Specialty to a "strong-buy" rating in a report on Tuesday, September 16th. One investment analyst has rated the stock with a Strong Buy rating, nine have issued a Buy rating and three have given a Hold rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $72.83.

Get Our Latest Stock Report on RYAN

Ryan Specialty Trading Up 0.1%

Shares of NYSE:RYAN opened at $58.26 on Wednesday. Ryan Specialty has a 1 year low of $50.08 and a 1 year high of $77.16. The firm has a market capitalization of $15.36 billion, a price-to-earnings ratio of 166.46, a price-to-earnings-growth ratio of 1.62 and a beta of 0.63. The company has a debt-to-equity ratio of 2.88, a current ratio of 1.01 and a quick ratio of 1.01. The business's 50 day moving average price is $56.44 and its 200-day moving average price is $64.25.

Ryan Specialty (NYSE:RYAN - Get Free Report) last announced its earnings results on Thursday, July 31st. The company reported $0.66 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.66. Ryan Specialty had a return on equity of 48.70% and a net margin of 6.81%.The firm had revenue of $855.17 million for the quarter, compared to analyst estimates of $837.52 million. During the same quarter last year, the firm posted $0.58 EPS. The business's revenue was up 23.0% on a year-over-year basis. On average, equities research analysts forecast that Ryan Specialty will post 2.29 earnings per share for the current fiscal year.

Insider Activity at Ryan Specialty

In related news, Chairman Patrick G. Ryan purchased 276,634 shares of Ryan Specialty stock in a transaction dated Friday, September 12th. The shares were acquired at an average price of $51.84 per share, for a total transaction of $14,340,706.56. Following the acquisition, the chairman directly owned 13,699,959 shares in the company, valued at approximately $710,205,874.56. The trade was a 2.06% increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. 52.21% of the stock is currently owned by corporate insiders.

Institutional Trading of Ryan Specialty

Institutional investors and hedge funds have recently bought and sold shares of the stock. Whittier Trust Co. of Nevada Inc. raised its holdings in Ryan Specialty by 281.6% in the 1st quarter. Whittier Trust Co. of Nevada Inc. now owns 332 shares of the company's stock valued at $25,000 after buying an additional 245 shares during the period. SVB Wealth LLC purchased a new stake in Ryan Specialty in the 1st quarter valued at about $26,000. WPG Advisers LLC purchased a new stake in Ryan Specialty in the 1st quarter valued at about $32,000. Golden State Wealth Management LLC raised its holdings in Ryan Specialty by 10,975.0% in the 2nd quarter. Golden State Wealth Management LLC now owns 443 shares of the company's stock valued at $30,000 after buying an additional 439 shares during the period. Finally, Central Pacific Bank Trust Division purchased a new stake in Ryan Specialty in the 2nd quarter valued at about $31,000. 84.82% of the stock is currently owned by hedge funds and other institutional investors.

About Ryan Specialty

(

Get Free Report)

Ryan Specialty Holdings, Inc operates as a service provider of specialty products and solutions for insurance brokers, agents, and carriers in the United States, Canada, the United Kingdom, Europe, and Singapore. It offers distribution, underwriting, product development, administration, and risk management services by acting as a wholesale broker and a managing underwriter.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ryan Specialty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryan Specialty wasn't on the list.

While Ryan Specialty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.