BeOne Medicines (NASDAQ:ONC - Get Free Report)'s stock had its "sell (d-)" rating reissued by research analysts at Weiss Ratings in a report issued on Friday,Weiss Ratings reports.

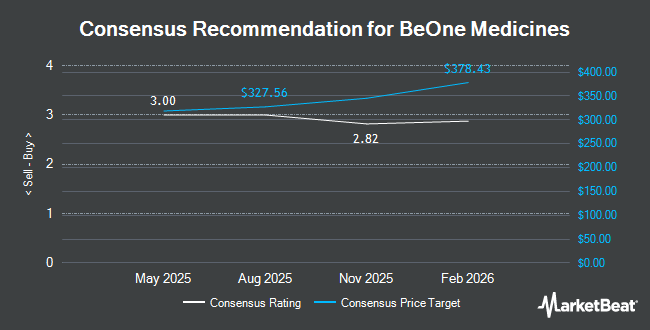

ONC has been the topic of a number of other research reports. Wall Street Zen raised BeOne Medicines from a "buy" rating to a "strong-buy" rating in a research note on Friday, October 3rd. Guggenheim increased their target price on BeOne Medicines from $350.00 to $365.00 and gave the company a "buy" rating in a research note on Thursday, August 7th. Royal Bank Of Canada increased their target price on BeOne Medicines from $349.00 to $364.00 and gave the company an "outperform" rating in a research note on Thursday, August 7th. Zacks Research raised BeOne Medicines from a "hold" rating to a "strong-buy" rating in a research note on Thursday, September 18th. Finally, JPMorgan Chase & Co. raised their price objective on BeOne Medicines from $345.00 to $385.00 and gave the company an "overweight" rating in a research note on Wednesday, October 8th. One investment analyst has rated the stock with a Strong Buy rating, eight have assigned a Buy rating and one has issued a Sell rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $345.60.

Get Our Latest Report on ONC

BeOne Medicines Price Performance

ONC traded up $0.78 during trading on Friday, reaching $310.81. The stock had a trading volume of 112,628 shares, compared to its average volume of 398,857. The stock has a market cap of $34.06 billion, a PE ratio of -179.66 and a beta of 0.31. The company has a debt-to-equity ratio of 0.04, a quick ratio of 1.72 and a current ratio of 1.95. BeOne Medicines has a one year low of $170.99 and a one year high of $355.30. The business has a 50-day moving average of $325.72 and a 200-day moving average of $280.26.

BeOne Medicines (NASDAQ:ONC - Get Free Report) last released its earnings results on Wednesday, August 6th. The company reported $0.84 EPS for the quarter, beating analysts' consensus estimates of $0.48 by $0.36. The business had revenue of $1.32 billion for the quarter, compared to analysts' expectations of $1.24 billion. BeOne Medicines had a negative return on equity of 1.22% and a negative net margin of 3.89%. As a group, equities research analysts anticipate that BeOne Medicines will post -5.82 EPS for the current fiscal year.

Insider Activity

In other news, insider Lai Wang sold 5,000 shares of the firm's stock in a transaction dated Tuesday, September 9th. The stock was sold at an average price of $350.06, for a total transaction of $1,750,300.00. The sale was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, SVP Chan Henry Lee sold 11,013 shares of the firm's stock in a transaction dated Wednesday, August 13th. The stock was sold at an average price of $300.45, for a total value of $3,308,855.85. The disclosure for this sale can be found here. In the last ninety days, insiders sold 163,484 shares of company stock valued at $51,324,146. Company insiders own 6.62% of the company's stock.

Institutional Trading of BeOne Medicines

Large investors have recently modified their holdings of the business. Anchor Investment Management LLC bought a new stake in shares of BeOne Medicines in the second quarter worth about $26,000. Caitong International Asset Management Co. Ltd bought a new stake in shares of BeOne Medicines in the second quarter worth about $28,000. Daiwa Securities Group Inc. bought a new stake in shares of BeOne Medicines in the second quarter worth about $35,000. Farther Finance Advisors LLC bought a new stake in shares of BeOne Medicines in the second quarter worth about $39,000. Finally, Signaturefd LLC bought a new stake in shares of BeOne Medicines in the second quarter worth about $49,000. 48.55% of the stock is owned by institutional investors.

About BeOne Medicines

(

Get Free Report)

BeOne Medicines Ltd. is a global oncology company domiciled in Switzerland that is discovering and developing innovative treatments that are more affordable and accessible to cancer patients worldwide. The firm portfolio spanning hematology and solid tumors, BeOne is expediting development of its diverse pipeline of novel therapeutics through its internal capabilities and collaborations.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BeOne Medicines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BeOne Medicines wasn't on the list.

While BeOne Medicines currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.