O-I Glass (NYSE:OI - Get Free Report)'s stock had its "sell (d-)" rating restated by investment analysts at Weiss Ratings in a note issued to investors on Saturday,Weiss Ratings reports.

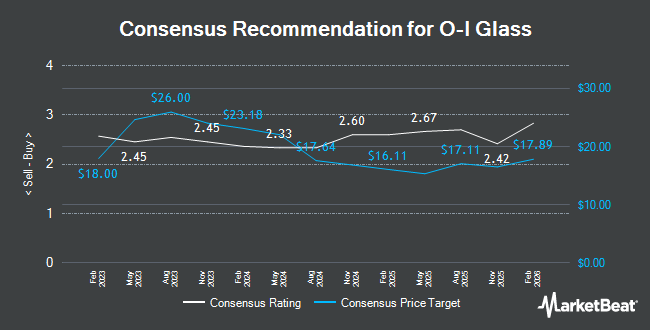

OI has been the subject of several other research reports. UBS Group restated a "buy" rating and set a $19.00 target price (up previously from $17.00) on shares of O-I Glass in a research note on Wednesday, July 9th. Truist Financial decreased their target price on O-I Glass from $21.00 to $17.00 and set a "buy" rating for the company in a research note on Monday, October 13th. Zacks Research downgraded O-I Glass from a "strong-buy" rating to a "hold" rating in a research note on Thursday, September 25th. Wall Street Zen downgraded O-I Glass from a "buy" rating to a "hold" rating in a research note on Friday, October 3rd. Finally, Wells Fargo & Company restated a "mixed" rating on shares of O-I Glass in a research note on Monday, August 4th. One investment analyst has rated the stock with a Strong Buy rating, four have given a Buy rating, four have given a Hold rating and one has issued a Sell rating to the company's stock. According to MarketBeat.com, O-I Glass currently has a consensus rating of "Moderate Buy" and an average target price of $16.56.

Read Our Latest Stock Analysis on OI

O-I Glass Stock Performance

Shares of OI stock opened at $12.61 on Friday. The company has a debt-to-equity ratio of 3.58, a current ratio of 1.24 and a quick ratio of 0.77. O-I Glass has a fifty-two week low of $9.23 and a fifty-two week high of $16.04. The stock's 50-day moving average is $12.70 and its two-hundred day moving average is $13.18. The firm has a market cap of $1.94 billion, a P/E ratio of -7.64, a PEG ratio of 0.24 and a beta of 0.93.

O-I Glass (NYSE:OI - Get Free Report) last issued its earnings results on Wednesday, March 1st. The industrial products company reported $0.36 earnings per share for the quarter. O-I Glass had a positive return on equity of 13.70% and a negative net margin of 3.95%.The company had revenue of $1.59 billion for the quarter. Analysts predict that O-I Glass will post 1.33 earnings per share for the current fiscal year.

Insider Buying and Selling

In other news, SVP Darrow A. Abrahams acquired 3,828 shares of O-I Glass stock in a transaction on Tuesday, August 5th. The stock was bought at an average price of $13.05 per share, for a total transaction of $49,955.40. Following the transaction, the senior vice president owned 184,447 shares of the company's stock, valued at $2,407,033.35. The trade was a 2.12% increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CEO Gordon Hardie acquired 8,000 shares of O-I Glass stock in a transaction on Tuesday, August 5th. The stock was purchased at an average price of $13.10 per share, with a total value of $104,800.00. Following the transaction, the chief executive officer directly owned 515,817 shares in the company, valued at approximately $6,757,202.70. This trade represents a 1.58% increase in their position. The disclosure for this purchase can be found here. 0.93% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On O-I Glass

A number of hedge funds have recently modified their holdings of OI. Headlands Technologies LLC acquired a new position in shares of O-I Glass in the 2nd quarter worth approximately $29,000. GAMMA Investing LLC raised its holdings in shares of O-I Glass by 79.3% in the 1st quarter. GAMMA Investing LLC now owns 2,583 shares of the industrial products company's stock worth $30,000 after buying an additional 1,142 shares in the last quarter. Caitong International Asset Management Co. Ltd acquired a new position in shares of O-I Glass in the 1st quarter worth approximately $30,000. Smartleaf Asset Management LLC raised its holdings in shares of O-I Glass by 64.1% in the 2nd quarter. Smartleaf Asset Management LLC now owns 2,350 shares of the industrial products company's stock worth $35,000 after buying an additional 918 shares in the last quarter. Finally, State of Wyoming acquired a new position in shares of O-I Glass in the 2nd quarter worth approximately $35,000. 97.24% of the stock is owned by institutional investors and hedge funds.

About O-I Glass

(

Get Free Report)

O-I Glass, Inc, through its subsidiaries, engages in the manufacture and sale of glass containers to food and beverage manufacturers primarily in the Americas, Europe, and internationally. The company produces glass containers for alcoholic beverages, including beer, flavored malt beverages, spirits, and wine.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider O-I Glass, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and O-I Glass wasn't on the list.

While O-I Glass currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.