Pharvaris (NASDAQ:PHVS - Get Free Report)'s stock had its "sell (d-)" rating reaffirmed by equities researchers at Weiss Ratings in a research note issued on Wednesday,Weiss Ratings reports.

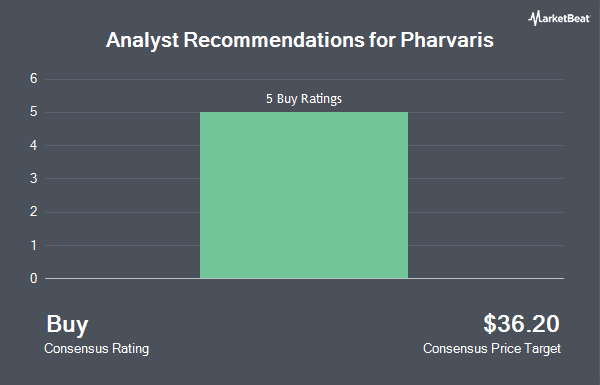

Other equities analysts have also recently issued reports about the stock. Guggenheim began coverage on shares of Pharvaris in a research note on Wednesday, June 11th. They issued a "buy" rating and a $32.00 target price for the company. JMP Securities decreased their target price on shares of Pharvaris from $55.00 to $52.00 and set a "market outperform" rating for the company in a research note on Wednesday, August 13th. Finally, Zacks Research raised shares of Pharvaris from a "strong sell" rating to a "hold" rating in a research note on Monday, August 18th. Four analysts have rated the stock with a Buy rating, one has issued a Hold rating and one has assigned a Sell rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $34.00.

Check Out Our Latest Research Report on Pharvaris

Pharvaris Stock Up 2.4%

NASDAQ PHVS opened at $22.98 on Wednesday. Pharvaris has a 12-month low of $11.51 and a 12-month high of $26.33. The company has a market capitalization of $1.20 billion, a PE ratio of -6.84 and a beta of -2.77. The firm's 50 day moving average is $22.86 and its 200-day moving average is $19.05.

Pharvaris (NASDAQ:PHVS - Get Free Report) last released its earnings results on Tuesday, August 12th. The company reported ($0.94) earnings per share for the quarter, missing the consensus estimate of ($0.87) by ($0.07). As a group, sell-side analysts expect that Pharvaris will post -2.71 EPS for the current year.

Hedge Funds Weigh In On Pharvaris

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in PHVS. TFG Asset Management GP Ltd boosted its position in Pharvaris by 48.1% during the second quarter. TFG Asset Management GP Ltd now owns 188,100 shares of the company's stock worth $3,311,000 after purchasing an additional 61,105 shares during the period. Amundi boosted its position in shares of Pharvaris by 2,741,600.0% in the second quarter. Amundi now owns 27,417 shares of the company's stock valued at $489,000 after acquiring an additional 27,416 shares during the period. TD Asset Management Inc boosted its position in shares of Pharvaris by 41.5% in the first quarter. TD Asset Management Inc now owns 78,122 shares of the company's stock valued at $1,227,000 after acquiring an additional 22,906 shares during the period. Boothbay Fund Management LLC bought a new stake in shares of Pharvaris in the second quarter valued at about $285,000. Finally, Geode Capital Management LLC boosted its position in shares of Pharvaris by 41.1% in the second quarter. Geode Capital Management LLC now owns 54,102 shares of the company's stock valued at $952,000 after acquiring an additional 15,769 shares during the period.

Pharvaris Company Profile

(

Get Free Report)

Pharvaris N.V., a clinical-stage biopharmaceutical company, focuses on the development and commercialization of therapies for rare diseases. The company develops PHA121, a small molecule bradykinin B2-receptor antagonist for the treatment of hereditary angioedema (HAE). It also develops PHVS416, an on-demand, rapid exposure soft capsule for patients suffering from acute HAE attacks which is under Phase 2 clinical trial; and PHVS719, a prophylactic extended-release tablet for HAE patients which is under Phase 1 clinical trial.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pharvaris, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pharvaris wasn't on the list.

While Pharvaris currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.