Huntsman (NYSE:HUN - Get Free Report) had its price target decreased by analysts at Wells Fargo & Company from $13.00 to $9.00 in a research note issued on Tuesday,Benzinga reports. The brokerage presently has an "equal weight" rating on the basic materials company's stock. Wells Fargo & Company's price target suggests a potential downside of 4.76% from the stock's previous close.

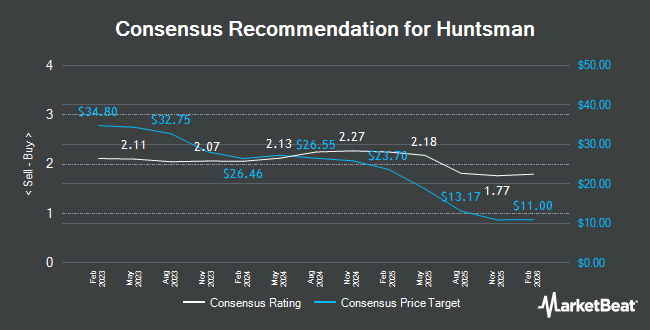

Several other analysts also recently commented on HUN. UBS Group decreased their target price on shares of Huntsman from $13.00 to $11.00 and set a "neutral" rating for the company in a research report on Wednesday, July 9th. Bank of America downgraded shares of Huntsman from a "buy" rating to a "neutral" rating and decreased their target price for the stock from $22.00 to $15.00 in a research report on Tuesday, April 15th. The Goldman Sachs Group decreased their target price on shares of Huntsman from $13.50 to $12.00 and set a "sell" rating for the company in a research report on Tuesday, July 8th. JPMorgan Chase & Co. decreased their target price on shares of Huntsman from $22.00 to $20.00 and set an "overweight" rating for the company in a research report on Monday, May 5th. Finally, Wall Street Zen downgraded shares of Huntsman from a "hold" rating to a "sell" rating in a research report on Wednesday, May 21st. Two equities research analysts have rated the stock with a sell rating, eight have issued a hold rating and one has given a buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Hold" and an average price target of $12.06.

Read Our Latest Report on HUN

Huntsman Stock Down 0.5%

HUN traded down $0.05 on Tuesday, reaching $9.45. 4,384,940 shares of the company traded hands, compared to its average volume of 5,402,444. The stock's 50 day moving average price is $10.86 and its 200-day moving average price is $13.50. Huntsman has a 52-week low of $9.02 and a 52-week high of $25.12. The company has a market cap of $1.64 billion, a price-to-earnings ratio of -4.85 and a beta of 0.70. The company has a debt-to-equity ratio of 0.54, a current ratio of 1.43 and a quick ratio of 0.82.

Huntsman (NYSE:HUN - Get Free Report) last posted its earnings results on Thursday, July 31st. The basic materials company reported ($0.20) EPS for the quarter, missing the consensus estimate of ($0.15) by ($0.05). The business had revenue of $1.46 billion during the quarter, compared to the consensus estimate of $1.51 billion. Huntsman had a negative return on equity of 2.48% and a negative net margin of 5.75%. The business's revenue was down 7.4% on a year-over-year basis. During the same period in the prior year, the firm earned $0.14 earnings per share. On average, sell-side analysts expect that Huntsman will post 0.32 EPS for the current fiscal year.

Hedge Funds Weigh In On Huntsman

Several large investors have recently bought and sold shares of HUN. Hexagon Capital Partners LLC raised its stake in Huntsman by 177.9% during the 1st quarter. Hexagon Capital Partners LLC now owns 2,179 shares of the basic materials company's stock valued at $34,000 after purchasing an additional 1,395 shares during the last quarter. IFP Advisors Inc raised its stake in Huntsman by 197.6% during the 2nd quarter. IFP Advisors Inc now owns 3,661 shares of the basic materials company's stock valued at $38,000 after purchasing an additional 2,431 shares during the last quarter. Quadrant Capital Group LLC raised its stake in Huntsman by 74.9% during the 4th quarter. Quadrant Capital Group LLC now owns 2,232 shares of the basic materials company's stock valued at $40,000 after purchasing an additional 956 shares during the last quarter. Byrne Asset Management LLC acquired a new position in Huntsman during the 2nd quarter valued at $44,000. Finally, Caitong International Asset Management Co. Ltd raised its stake in Huntsman by 1,717.9% during the 1st quarter. Caitong International Asset Management Co. Ltd now owns 3,254 shares of the basic materials company's stock valued at $51,000 after purchasing an additional 3,075 shares during the last quarter. 84.81% of the stock is currently owned by institutional investors and hedge funds.

About Huntsman

(

Get Free Report)

Huntsman Corporation manufactures and sells diversified organic chemical products worldwide. The company operates in three segments: Polyurethanes, Performance Products, and Advanced Materials. The Polyurethanes segment offers polyurethane chemicals, including methyl diphenyl diisocyanate, polyether and polyester polyols, and thermoplastic polyurethane; and aniline, benzene, nitrobenzene and other co-products.

Featured Articles

Before you consider Huntsman, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntsman wasn't on the list.

While Huntsman currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.