Brighthouse Financial (NASDAQ:BHF - Get Free Report) had its target price hoisted by analysts at Wells Fargo & Company from $52.00 to $53.00 in a report released on Wednesday,Benzinga reports. The brokerage presently has an "equal weight" rating on the stock. Wells Fargo & Company's price objective would suggest a potential upside of 8.56% from the stock's previous close.

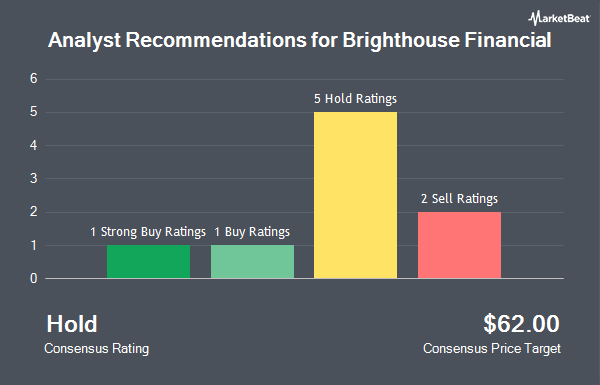

Other equities analysts have also recently issued reports about the company. JPMorgan Chase & Co. raised their price objective on Brighthouse Financial from $56.00 to $63.00 and gave the stock an "underweight" rating in a research note on Tuesday, July 8th. Morgan Stanley raised their price objective on Brighthouse Financial from $42.00 to $46.00 and gave the stock an "underweight" rating in a research note on Tuesday. Wall Street Zen cut Brighthouse Financial from a "buy" rating to a "hold" rating in a research note on Saturday, June 21st. Barclays reduced their price objective on Brighthouse Financial from $70.00 to $65.00 and set an "overweight" rating on the stock in a research note on Friday, August 8th. Finally, Weiss Ratings restated a "hold (c)" rating on shares of Brighthouse Financial in a research note on Saturday, September 27th. One investment analyst has rated the stock with a Strong Buy rating, one has issued a Buy rating, five have given a Hold rating and two have assigned a Sell rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $59.78.

Check Out Our Latest Stock Report on Brighthouse Financial

Brighthouse Financial Price Performance

BHF stock traded up $0.21 during trading on Wednesday, hitting $48.82. The stock had a trading volume of 53,471 shares, compared to its average volume of 935,945. The company's 50 day moving average price is $48.33 and its two-hundred day moving average price is $52.69. Brighthouse Financial has a 1-year low of $42.07 and a 1-year high of $64.12. The stock has a market cap of $2.79 billion, a price-to-earnings ratio of 5.30 and a beta of 0.86. The company has a debt-to-equity ratio of 0.55, a quick ratio of 0.93 and a current ratio of 0.93.

Brighthouse Financial (NASDAQ:BHF - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The company reported $3.43 EPS for the quarter, missing the consensus estimate of $4.70 by ($1.27). Brighthouse Financial had a net margin of 10.24% and a return on equity of 21.06%. The business had revenue of $2.15 billion during the quarter, compared to analysts' expectations of $2.21 billion. During the same quarter in the previous year, the business posted $5.57 EPS. The company's quarterly revenue was down 2.8% on a year-over-year basis. On average, sell-side analysts forecast that Brighthouse Financial will post 20.32 EPS for the current fiscal year.

Institutional Investors Weigh In On Brighthouse Financial

Several institutional investors have recently made changes to their positions in BHF. Smartleaf Asset Management LLC lifted its holdings in shares of Brighthouse Financial by 66.5% during the 2nd quarter. Smartleaf Asset Management LLC now owns 566 shares of the company's stock valued at $31,000 after buying an additional 226 shares during the last quarter. IFP Advisors Inc lifted its holdings in shares of Brighthouse Financial by 1,900.0% during the 2nd quarter. IFP Advisors Inc now owns 740 shares of the company's stock valued at $40,000 after buying an additional 703 shares during the last quarter. Brooklyn Investment Group lifted its holdings in shares of Brighthouse Financial by 42.0% during the 1st quarter. Brooklyn Investment Group now owns 764 shares of the company's stock valued at $44,000 after buying an additional 226 shares during the last quarter. Ameriflex Group Inc. lifted its holdings in Brighthouse Financial by 12,371.4% in the 2nd quarter. Ameriflex Group Inc. now owns 873 shares of the company's stock worth $47,000 after purchasing an additional 866 shares during the last quarter. Finally, Jones Financial Companies Lllp lifted its holdings in Brighthouse Financial by 835.2% in the 1st quarter. Jones Financial Companies Lllp now owns 823 shares of the company's stock worth $48,000 after purchasing an additional 735 shares during the last quarter. 81.24% of the stock is currently owned by institutional investors and hedge funds.

About Brighthouse Financial

(

Get Free Report)

Brighthouse Financial, Inc provides annuity and life insurance products in the United States. It operates through three segments: Annuities, Life, and Run-off. The Annuities segment consists of variable, fixed, index-linked, and income annuities for contract holders' needs for protected wealth accumulation on a tax-deferred basis, wealth transfer, and income security.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Brighthouse Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brighthouse Financial wasn't on the list.

While Brighthouse Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.