UnitedHealth Group (NYSE:UNH - Get Free Report) had its price target reduced by equities researchers at Wells Fargo & Company from $351.00 to $306.00 in a research report issued to clients and investors on Friday,Benzinga reports. The brokerage presently has an "overweight" rating on the healthcare conglomerate's stock. Wells Fargo & Company's price objective indicates a potential upside of 9.02% from the stock's current price.

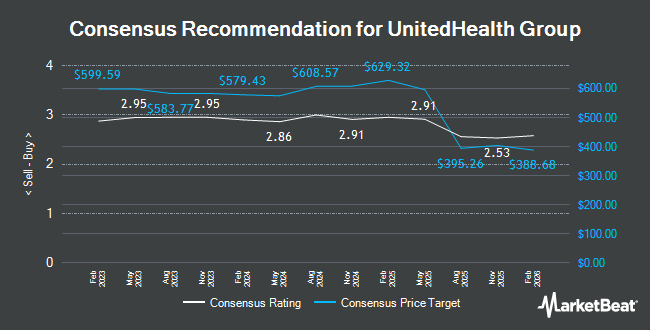

A number of other brokerages also recently weighed in on UNH. Truist Financial reduced their target price on UnitedHealth Group from $360.00 to $345.00 and set a "buy" rating on the stock in a report on Wednesday, July 16th. Raymond James Financial lowered UnitedHealth Group from a "strong-buy" rating to a "market perform" rating in a research report on Wednesday, May 14th. Wall Street Zen lowered UnitedHealth Group from a "buy" rating to a "hold" rating in a research report on Saturday, May 24th. Oppenheimer decreased their target price on UnitedHealth Group from $600.00 to $400.00 and set an "outperform" rating for the company in a research report on Wednesday, May 14th. Finally, Deutsche Bank Aktiengesellschaft cut their price target on UnitedHealth Group from $521.00 to $362.00 and set a "buy" rating for the company in a research note on Wednesday, May 14th. One analyst has rated the stock with a sell rating, nine have given a hold rating and fifteen have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $392.29.

Get Our Latest Stock Report on UNH

UnitedHealth Group Stock Performance

Shares of UNH traded up $2.11 during mid-day trading on Friday, reaching $280.69. The company's stock had a trading volume of 16,445,593 shares, compared to its average volume of 12,350,532. UnitedHealth Group has a 1-year low of $248.88 and a 1-year high of $630.73. The stock has a market cap of $254.62 billion, a P/E ratio of 11.75, a PEG ratio of 1.38 and a beta of 0.45. The business has a 50-day simple moving average of $301.58 and a two-hundred day simple moving average of $425.60. The company has a current ratio of 0.85, a quick ratio of 0.85 and a debt-to-equity ratio of 0.71.

Insiders Place Their Bets

In other news, CEO Stephen J. Hemsley bought 86,700 shares of the company's stock in a transaction dated Friday, May 16th. The stock was bought at an average cost of $288.57 per share, for a total transaction of $25,019,019.00. Following the completion of the acquisition, the chief executive officer owned 679,493 shares in the company, valued at approximately $196,081,295.01. This trade represents a 14.63% increase in their position. The acquisition was disclosed in a filing with the SEC, which is available at this hyperlink. Also, CFO John F. Rex bought 17,175 shares of the company's stock in a transaction dated Friday, May 16th. The shares were purchased at an average price of $291.12 per share, with a total value of $4,999,986.00. Following the completion of the acquisition, the chief financial officer owned 203,796 shares of the company's stock, valued at $59,329,091.52. This trade represents a 9.20% increase in their position. The disclosure for this purchase can be found here. Insiders have purchased 109,408 shares of company stock valued at $31,607,768 over the last quarter. Insiders own 0.28% of the company's stock.

Institutional Trading of UnitedHealth Group

Institutional investors have recently modified their holdings of the company. Financial Management Professionals Inc. lifted its stake in shares of UnitedHealth Group by 0.8% in the 1st quarter. Financial Management Professionals Inc. now owns 2,224 shares of the healthcare conglomerate's stock valued at $1,165,000 after purchasing an additional 17 shares during the period. Global Wealth Strategies & Associates increased its position in shares of UnitedHealth Group by 28.6% during the first quarter. Global Wealth Strategies & Associates now owns 90 shares of the healthcare conglomerate's stock valued at $47,000 after acquiring an additional 20 shares in the last quarter. Kolinsky Wealth Management LLC increased its position in shares of UnitedHealth Group by 1.0% during the fourth quarter. Kolinsky Wealth Management LLC now owns 2,135 shares of the healthcare conglomerate's stock valued at $1,080,000 after acquiring an additional 21 shares in the last quarter. Retirement Planning Group LLC grew its position in UnitedHealth Group by 5.1% in the 1st quarter. Retirement Planning Group LLC now owns 430 shares of the healthcare conglomerate's stock worth $225,000 after purchasing an additional 21 shares during the period. Finally, Net Worth Advisory Group grew its position in UnitedHealth Group by 0.6% in the 1st quarter. Net Worth Advisory Group now owns 3,642 shares of the healthcare conglomerate's stock worth $1,907,000 after purchasing an additional 21 shares during the period. 87.86% of the stock is currently owned by hedge funds and other institutional investors.

UnitedHealth Group Company Profile

(

Get Free Report)

UnitedHealth Group Incorporated operates as a diversified health care company in the United States. The company operates through four segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. The UnitedHealthcare segment offers consumer-oriented health benefit plans and services for national employers, public sector employers, mid-sized employers, small businesses, and individuals; health care coverage, and health and well-being services to individuals age 50 and older addressing their needs; Medicaid plans, children's health insurance and health care programs; and health and dental benefits, and hospital and clinical services, as well as health care benefits products and services to state programs caring for the economically disadvantaged, medically underserved, and those without the benefit of employer-funded health care coverage.

Featured Articles

Before you consider UnitedHealth Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UnitedHealth Group wasn't on the list.

While UnitedHealth Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.