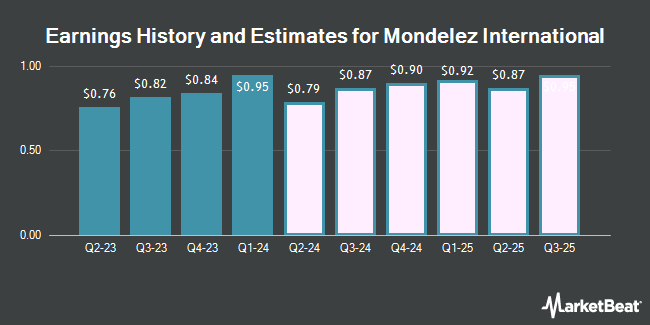

Mondelez International, Inc. (NASDAQ:MDLZ - Free Report) - Stock analysts at DA Davidson lowered their FY2025 EPS estimates for shares of Mondelez International in a report issued on Monday, October 20th. DA Davidson analyst B. Holland now anticipates that the company will post earnings per share of $3.01 for the year, down from their previous estimate of $3.04. The consensus estimate for Mondelez International's current full-year earnings is $2.90 per share.

Mondelez International (NASDAQ:MDLZ - Get Free Report) last posted its earnings results on Tuesday, April 11th. The company reported $0.66 earnings per share for the quarter. Mondelez International had a net margin of 9.84% and a return on equity of 15.35%. The firm had revenue of $7.30 billion during the quarter.

Several other research firms have also recently issued reports on MDLZ. UBS Group decreased their price target on shares of Mondelez International from $69.00 to $65.00 and set a "neutral" rating on the stock in a research note on Wednesday, October 8th. Sanford C. Bernstein raised their price target on shares of Mondelez International from $79.00 to $88.00 and gave the stock an "outperform" rating in a research note on Wednesday, July 30th. Evercore ISI decreased their price target on shares of Mondelez International from $73.00 to $72.00 and set an "outperform" rating on the stock in a research note on Friday, September 26th. Wells Fargo & Company decreased their target price on shares of Mondelez International from $78.00 to $74.00 and set an "overweight" rating on the stock in a research report on Thursday, September 25th. Finally, Berenberg Bank cut shares of Mondelez International from a "buy" rating to a "hold" rating and set a $70.00 target price on the stock. in a research report on Thursday, October 2nd. Twelve analysts have rated the stock with a Buy rating, seven have given a Hold rating and one has issued a Sell rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $70.22.

View Our Latest Stock Analysis on MDLZ

Mondelez International Price Performance

Mondelez International stock opened at $61.75 on Wednesday. Mondelez International has a 12-month low of $53.95 and a 12-month high of $71.39. The stock has a market capitalization of $79.90 billion, a P/E ratio of 22.62, a P/E/G ratio of 5.62 and a beta of 0.45. The firm's 50-day moving average is $62.25 and its two-hundred day moving average is $65.19. The company has a debt-to-equity ratio of 0.69, a current ratio of 0.64 and a quick ratio of 0.39.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of the business. State Street Corp lifted its position in Mondelez International by 1.1% during the second quarter. State Street Corp now owns 59,446,397 shares of the company's stock valued at $4,036,594,000 after buying an additional 670,634 shares in the last quarter. Price T Rowe Associates Inc. MD lifted its position in Mondelez International by 90.1% during the first quarter. Price T Rowe Associates Inc. MD now owns 29,017,101 shares of the company's stock valued at $1,968,811,000 after buying an additional 13,755,181 shares in the last quarter. Geode Capital Management LLC lifted its position in Mondelez International by 0.8% during the second quarter. Geode Capital Management LLC now owns 28,951,049 shares of the company's stock valued at $1,943,170,000 after buying an additional 242,695 shares in the last quarter. Norges Bank acquired a new position in Mondelez International during the second quarter valued at approximately $1,239,834,000. Finally, Invesco Ltd. lifted its position in Mondelez International by 10.7% during the second quarter. Invesco Ltd. now owns 13,892,264 shares of the company's stock valued at $936,894,000 after buying an additional 1,345,078 shares in the last quarter. 78.32% of the stock is owned by institutional investors and hedge funds.

Mondelez International Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, October 14th. Investors of record on Tuesday, September 30th were given a $0.50 dividend. This is a boost from Mondelez International's previous quarterly dividend of $0.47. This represents a $2.00 annualized dividend and a dividend yield of 3.2%. The ex-dividend date of this dividend was Tuesday, September 30th. Mondelez International's dividend payout ratio is 73.26%.

Mondelez International Company Profile

(

Get Free Report)

Mondelez International, Inc, through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe. It provides biscuits and baked snacks, including cookies, crackers, salted snacks, snack bars, and cakes and pastries; chocolates; and gums and candies, as well as various cheese and grocery, and powdered beverage products.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Mondelez International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mondelez International wasn't on the list.

While Mondelez International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.