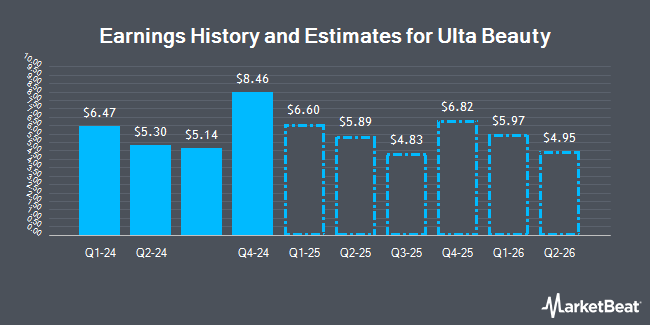

Ulta Beauty Inc. (NASDAQ:ULTA - Free Report) - Equities research analysts at DA Davidson boosted their Q2 2026 earnings per share estimates for Ulta Beauty in a research report issued to clients and investors on Friday, August 1st. DA Davidson analyst M. Baker now expects that the specialty retailer will post earnings of $5.03 per share for the quarter, up from their prior forecast of $4.69. DA Davidson currently has a "Buy" rating and a $585.00 price target on the stock. The consensus estimate for Ulta Beauty's current full-year earnings is $23.96 per share. DA Davidson also issued estimates for Ulta Beauty's FY2026 earnings at $23.49 EPS and FY2027 earnings at $26.67 EPS.

Other analysts have also issued reports about the company. Canaccord Genuity Group boosted their target price on Ulta Beauty from $542.00 to $600.00 and gave the company a "buy" rating in a research report on Friday, August 1st. Telsey Advisory Group restated an "outperform" rating and set a $520.00 price target on shares of Ulta Beauty in a report on Friday, July 11th. Truist Financial upped their target price on Ulta Beauty from $364.00 to $386.00 and gave the company a "neutral" rating in a research report on Thursday, May 15th. Oppenheimer boosted their target price on shares of Ulta Beauty from $465.00 to $510.00 and gave the company an "outperform" rating in a report on Friday, May 30th. Finally, Robert W. Baird lifted their price objective on Ulta Beauty from $440.00 to $525.00 and gave the company an "outperform" rating in a report on Friday, May 30th. One research analyst has rated the stock with a sell rating, thirteen have given a hold rating and twelve have issued a buy rating to the company. According to MarketBeat, the company presently has an average rating of "Hold" and an average target price of $469.09.

Check Out Our Latest Stock Report on Ulta Beauty

Ulta Beauty Price Performance

ULTA traded down $16.57 during trading on Monday, hitting $499.62. 380,376 shares of the stock traded hands, compared to its average volume of 887,482. The company has a market cap of $22.46 billion, a price-to-earnings ratio of 19.52, a PEG ratio of 3.08 and a beta of 1.12. Ulta Beauty has a twelve month low of $309.01 and a twelve month high of $523.68. The business has a 50 day moving average price of $481.11 and a 200 day moving average price of $413.66.

Ulta Beauty (NASDAQ:ULTA - Get Free Report) last issued its quarterly earnings results on Thursday, May 29th. The specialty retailer reported $6.70 earnings per share (EPS) for the quarter, beating the consensus estimate of $5.73 by $0.97. The firm had revenue of $2.85 billion for the quarter, compared to analyst estimates of $2.79 billion. Ulta Beauty had a net margin of 10.45% and a return on equity of 49.73%. The company's revenue was up 4.5% compared to the same quarter last year. During the same period in the previous year, the business earned $6.47 EPS.

Hedge Funds Weigh In On Ulta Beauty

A number of hedge funds have recently bought and sold shares of the business. Capital World Investors acquired a new position in Ulta Beauty in the 4th quarter valued at about $430,674,000. Price T Rowe Associates Inc. MD raised its position in Ulta Beauty by 128.2% in the first quarter. Price T Rowe Associates Inc. MD now owns 1,225,023 shares of the specialty retailer's stock valued at $449,021,000 after purchasing an additional 688,267 shares during the period. Marshall Wace LLP lifted its stake in Ulta Beauty by 10,336.7% during the fourth quarter. Marshall Wace LLP now owns 459,110 shares of the specialty retailer's stock worth $199,681,000 after purchasing an additional 454,711 shares in the last quarter. GAMMA Investing LLC grew its stake in shares of Ulta Beauty by 38,770.6% in the first quarter. GAMMA Investing LLC now owns 443,513 shares of the specialty retailer's stock valued at $162,565,000 after buying an additional 442,372 shares in the last quarter. Finally, JPMorgan Chase & Co. raised its holdings in shares of Ulta Beauty by 81.7% in the 1st quarter. JPMorgan Chase & Co. now owns 913,600 shares of the specialty retailer's stock valued at $334,871,000 after buying an additional 410,900 shares during the period. Hedge funds and other institutional investors own 90.39% of the company's stock.

Ulta Beauty Company Profile

(

Get Free Report)

Ulta Beauty, Inc operates as a specialty beauty retailer in the United States. The company offers branded and private label beauty products, including cosmetics, fragrance, haircare, skincare, bath and body products, professional hair products, and salon styling tools through its Ulta Beauty stores, shop-in-shops, Ulta.com website, and its mobile applications.

Featured Articles

Before you consider Ulta Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ulta Beauty wasn't on the list.

While Ulta Beauty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.