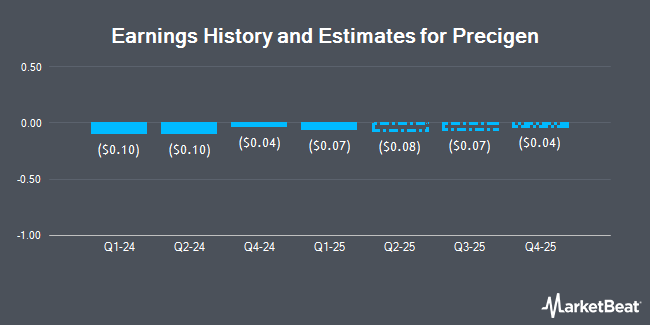

Precigen, Inc. (NASDAQ:PGEN - Free Report) - Stock analysts at HC Wainwright issued their Q3 2026 EPS estimates for shares of Precigen in a research report issued to clients and investors on Wednesday, August 13th. HC Wainwright analyst S. Ramakanth expects that the biotechnology company will post earnings per share of ($0.01) for the quarter. HC Wainwright has a "Buy" rating and a $6.00 price objective on the stock. The consensus estimate for Precigen's current full-year earnings is ($0.32) per share. HC Wainwright also issued estimates for Precigen's Q4 2026 earnings at $0.00 EPS, FY2027 earnings at $0.11 EPS, FY2028 earnings at $0.30 EPS and FY2029 earnings at $0.53 EPS.

PGEN has been the topic of several other reports. Cantor Fitzgerald reaffirmed an "overweight" rating on shares of Precigen in a research report on Thursday, May 15th. JMP Securities reissued a "market outperform" rating and issued a $6.00 price objective on shares of Precigen in a report on Thursday, June 12th. Wall Street Zen raised Precigen from a "sell" rating to a "hold" rating in a research note on Saturday, July 12th. Finally, JPMorgan Chase & Co. raised shares of Precigen from an "underweight" rating to a "neutral" rating in a research note on Friday. Two equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. According to data from MarketBeat, Precigen has a consensus rating of "Moderate Buy" and a consensus target price of $6.00.

View Our Latest Stock Analysis on PGEN

Precigen Stock Performance

PGEN stock traded up $1.09 during trading on Thursday, hitting $2.94. 173,120,762 shares of the company traded hands, compared to its average volume of 11,864,537. The company has a 50-day moving average of $1.68 and a 200-day moving average of $1.60. The firm has a market capitalization of $876.03 million, a PE ratio of -7.00 and a beta of 1.87. Precigen has a 1 year low of $0.65 and a 1 year high of $3.49.

Precigen (NASDAQ:PGEN - Get Free Report) last posted its quarterly earnings data on Tuesday, August 12th. The biotechnology company reported ($0.11) earnings per share for the quarter, beating the consensus estimate of ($0.14) by $0.03. The firm had revenue of $0.86 million for the quarter, compared to analysts' expectations of $0.67 million. Precigen had a negative net margin of 2,868.66% and a negative return on equity of 842.83%.

Hedge Funds Weigh In On Precigen

A number of large investors have recently bought and sold shares of the business. Adage Capital Partners GP L.L.C. increased its stake in Precigen by 3.8% during the 1st quarter. Adage Capital Partners GP L.L.C. now owns 11,276,000 shares of the biotechnology company's stock valued at $16,801,000 after purchasing an additional 410,595 shares in the last quarter. Geode Capital Management LLC increased its stake in shares of Precigen by 7.7% in the 2nd quarter. Geode Capital Management LLC now owns 3,749,182 shares of the biotechnology company's stock valued at $5,325,000 after purchasing an additional 269,580 shares in the last quarter. Parkman Healthcare Partners LLC purchased a new position in shares of Precigen during the 1st quarter valued at approximately $4,755,000. Northern Trust Corp increased its stake in shares of Precigen by 11.6% during the fourth quarter. Northern Trust Corp now owns 1,168,689 shares of the biotechnology company's stock worth $1,309,000 after purchasing an additional 121,700 shares in the last quarter. Finally, Bank of America Corp DE boosted its stake in shares of Precigen by 258.2% in the second quarter. Bank of America Corp DE now owns 832,261 shares of the biotechnology company's stock worth $1,182,000 after acquiring an additional 599,914 shares during the last quarter. Institutional investors own 33.51% of the company's stock.

Precigen Company Profile

(

Get Free Report)

Precigen, Inc operates as a discovery and clinical-stage biopharmaceutical company that develops gene and cell therapies using precision technology to target diseases in therapeutic areas of immuno-oncology, autoimmune disorders, and infectious diseases. It operates through two segments, Biopharmaceuticals and Exemplar.

Featured Stories

Before you consider Precigen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Precigen wasn't on the list.

While Precigen currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.