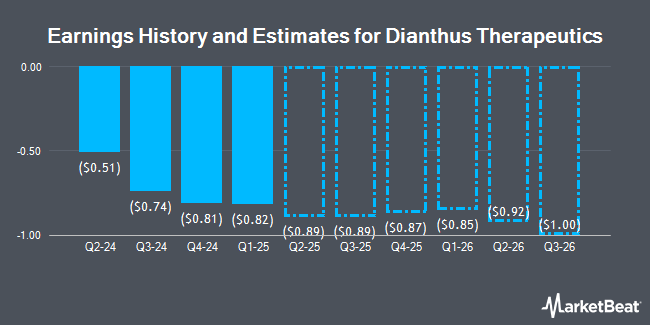

Dianthus Therapeutics, Inc. (NASDAQ:DNTH - Free Report) - Equities researchers at William Blair issued their Q1 2026 earnings per share estimates for shares of Dianthus Therapeutics in a note issued to investors on Thursday, August 7th. William Blair analyst M. Minter expects that the company will post earnings of ($0.75) per share for the quarter. William Blair has a "Outperform" rating on the stock. The consensus estimate for Dianthus Therapeutics' current full-year earnings is ($2.61) per share. William Blair also issued estimates for Dianthus Therapeutics' Q2 2026 earnings at ($0.78) EPS and Q3 2026 earnings at ($0.80) EPS.

Dianthus Therapeutics (NASDAQ:DNTH - Get Free Report) last announced its earnings results on Thursday, August 7th. The company reported ($0.88) earnings per share for the quarter, missing the consensus estimate of ($0.86) by ($0.02). Dianthus Therapeutics had a negative return on equity of 34.72% and a negative net margin of 2,364.56%. The business had revenue of $0.19 million for the quarter, compared to analysts' expectations of $0.87 million.

A number of other analysts have also recently commented on the company. HC Wainwright reaffirmed a "buy" rating and set a $40.00 price target on shares of Dianthus Therapeutics in a research report on Tuesday, May 13th. Robert W. Baird lowered their price target on Dianthus Therapeutics from $58.00 to $50.00 and set an "outperform" rating for the company in a research report on Tuesday, May 13th. Seven analysts have rated the stock with a buy rating, Based on data from MarketBeat, Dianthus Therapeutics currently has an average rating of "Buy" and an average target price of $53.00.

Check Out Our Latest Report on DNTH

Dianthus Therapeutics Price Performance

DNTH traded down $0.04 on Monday, reaching $20.21. 59,636 shares of the stock were exchanged, compared to its average volume of 316,865. The company's 50-day moving average price is $19.46 and its 200 day moving average price is $20.00. Dianthus Therapeutics has a fifty-two week low of $13.36 and a fifty-two week high of $32.27. The firm has a market capitalization of $650.56 million, a PE ratio of -6.22 and a beta of 1.43.

Hedge Funds Weigh In On Dianthus Therapeutics

Several institutional investors and hedge funds have recently modified their holdings of DNTH. KLP Kapitalforvaltning AS acquired a new position in shares of Dianthus Therapeutics in the 4th quarter valued at about $33,000. JPMorgan Chase & Co. lifted its holdings in shares of Dianthus Therapeutics by 14.0% in the 4th quarter. JPMorgan Chase & Co. now owns 12,129 shares of the company's stock valued at $264,000 after buying an additional 1,490 shares during the period. Wellington Management Group LLP lifted its holdings in shares of Dianthus Therapeutics by 12.2% in the 4th quarter. Wellington Management Group LLP now owns 60,337 shares of the company's stock valued at $1,315,000 after buying an additional 6,552 shares during the period. FMR LLC lifted its holdings in shares of Dianthus Therapeutics by 0.8% in the 4th quarter. FMR LLC now owns 4,439,281 shares of the company's stock valued at $96,776,000 after buying an additional 36,133 shares during the period. Finally, Invesco Ltd. lifted its holdings in shares of Dianthus Therapeutics by 7.4% in the 4th quarter. Invesco Ltd. now owns 11,521 shares of the company's stock valued at $251,000 after buying an additional 790 shares during the period. Institutional investors and hedge funds own 47.53% of the company's stock.

About Dianthus Therapeutics

(

Get Free Report)

Dianthus Therapeutics, Inc, a clinical-stage biotechnology company, develops complement therapeutics for patients with severe autoimmune and inflammatory diseases. It is developing DNTH103, a monoclonal antibody, which is in Phase 2 clinical trial, for the treatment of generalized myasthenia gravis, multifocal motor neuropathy, and chronic inflammatory demyelinating polyneuropathy.

See Also

Before you consider Dianthus Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dianthus Therapeutics wasn't on the list.

While Dianthus Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.