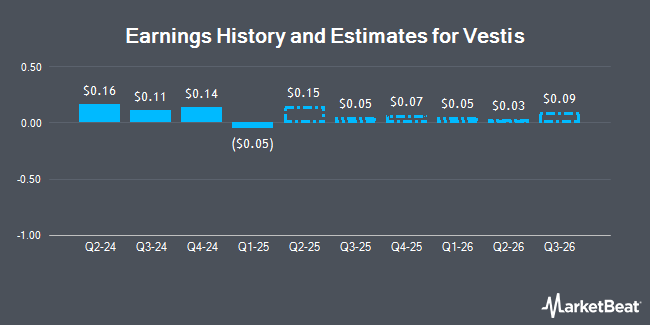

Vestis Corporation (NYSE:VSTS - Free Report) - William Blair dropped their FY2025 earnings per share (EPS) estimates for shares of Vestis in a research report issued to clients and investors on Wednesday, August 6th. William Blair analyst T. Mulrooney now anticipates that the company will post earnings of $0.16 per share for the year, down from their previous forecast of $0.22. The consensus estimate for Vestis' current full-year earnings is $0.70 per share.

A number of other equities analysts also recently commented on VSTS. Wall Street Zen raised shares of Vestis from a "sell" rating to a "hold" rating in a report on Saturday. JPMorgan Chase & Co. reduced their price target on shares of Vestis from $6.00 to $5.50 and set an "underweight" rating on the stock in a research report on Thursday, August 7th. Finally, Barclays lowered their price objective on shares of Vestis from $10.00 to $5.00 and set an "underweight" rating for the company in a research report on Friday, May 9th. Two research analysts have rated the stock with a sell rating and three have issued a hold rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $9.13.

Get Our Latest Research Report on VSTS

Vestis Stock Down 1.4%

VSTS stock traded down $0.06 during mid-day trading on Friday, hitting $4.38. 1,466,762 shares of the company were exchanged, compared to its average volume of 2,373,257. The firm has a fifty day simple moving average of $6.01 and a 200 day simple moving average of $8.52. The company has a market capitalization of $576.93 million, a PE ratio of -19.04 and a beta of 0.96. Vestis has a twelve month low of $4.32 and a twelve month high of $17.83. The company has a current ratio of 1.84, a quick ratio of 1.42 and a debt-to-equity ratio of 1.45.

Vestis (NYSE:VSTS - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The company reported $0.05 earnings per share for the quarter, meeting analysts' consensus estimates of $0.05. The business had revenue of $673.80 million during the quarter, compared to analyst estimates of $673.65 million. Vestis had a negative net margin of 1.11% and a positive return on equity of 3.76%. The business's revenue was down 3.5% on a year-over-year basis. During the same period last year, the business earned $0.16 EPS.

Institutional Inflows and Outflows

Several hedge funds have recently modified their holdings of the business. Private Management Group Inc. boosted its position in Vestis by 37.5% during the second quarter. Private Management Group Inc. now owns 2,439,718 shares of the company's stock worth $13,980,000 after purchasing an additional 665,376 shares during the period. Rhumbline Advisers boosted its holdings in shares of Vestis by 29.7% during the 2nd quarter. Rhumbline Advisers now owns 354,023 shares of the company's stock worth $2,029,000 after buying an additional 81,138 shares during the period. Legal & General Group Plc grew its stake in Vestis by 4.4% in the 2nd quarter. Legal & General Group Plc now owns 320,210 shares of the company's stock valued at $1,835,000 after buying an additional 13,380 shares during the last quarter. JPMorgan Chase & Co. raised its holdings in Vestis by 739.5% in the 2nd quarter. JPMorgan Chase & Co. now owns 675,770 shares of the company's stock worth $3,872,000 after acquiring an additional 595,276 shares during the period. Finally, Wealthspire Advisors LLC bought a new position in Vestis in the 2nd quarter worth $107,000. Institutional investors and hedge funds own 97.40% of the company's stock.

Insiders Place Their Bets

In other Vestis news, Director Keith A. Meister acquired 377,277 shares of Vestis stock in a transaction that occurred on Friday, May 23rd. The stock was purchased at an average cost of $5.89 per share, with a total value of $2,222,161.53. Following the purchase, the director owned 18,380,501 shares in the company, valued at approximately $108,261,150.89. The trade was a 2.10% increase in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. In the last 90 days, insiders have purchased 800,675 shares of company stock worth $4,777,432. Insiders own 13.60% of the company's stock.

About Vestis

(

Get Free Report)

Vestis Corporation provides uniform rentals and workplace supplies in the United States and Canada. Its products include uniform options, such as shirts, pants, outerwear, gowns, scrubs, high visibility garments, particulate-free garments, and flame-resistant garments, as well as shoes and accessories; and workplace supplies, including managed restroom supply services, first-aid supplies and safety products, floor mats, towels, and linens.

See Also

Before you consider Vestis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vestis wasn't on the list.

While Vestis currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.