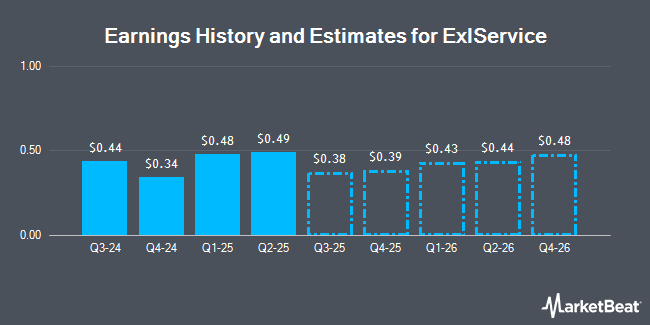

ExlService Holdings, Inc. (NASDAQ:EXLS - Free Report) - Equities researchers at William Blair upped their Q3 2025 earnings estimates for shares of ExlService in a research note issued on Wednesday, July 30th. William Blair analyst M. Nolan now expects that the business services provider will post earnings of $0.39 per share for the quarter, up from their previous estimate of $0.38. The consensus estimate for ExlService's current full-year earnings is $1.27 per share. William Blair also issued estimates for ExlService's FY2025 earnings at $1.57 EPS, Q4 2026 earnings at $0.48 EPS and FY2026 earnings at $1.81 EPS.

Several other brokerages have also recently commented on EXLS. Wall Street Zen upgraded shares of ExlService from a "hold" rating to a "buy" rating in a research note on Friday, May 9th. JPMorgan Chase & Co. lifted their price objective on shares of ExlService from $52.00 to $53.00 and gave the company an "overweight" rating in a research note on Thursday, May 1st. Finally, Needham & Company LLC restated a "buy" rating and set a $55.00 price objective on shares of ExlService in a research note on Tuesday, June 3rd. One research analyst has rated the stock with a hold rating and six have given a buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $51.50.

Check Out Our Latest Stock Report on EXLS

ExlService Stock Performance

Shares of NASDAQ EXLS opened at $42.16 on Monday. The company has a current ratio of 3.15, a quick ratio of 3.15 and a debt-to-equity ratio of 0.24. ExlService has a 12 month low of $31.87 and a 12 month high of $52.43. The company has a 50 day simple moving average of $44.76 and a two-hundred day simple moving average of $46.35. The stock has a market cap of $6.81 billion, a price-to-earnings ratio of 29.28, a PEG ratio of 1.88 and a beta of 0.81.

ExlService (NASDAQ:EXLS - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The business services provider reported $0.49 EPS for the quarter, beating the consensus estimate of $0.45 by $0.04. ExlService had a net margin of 12.00% and a return on equity of 25.38%. The business had revenue of $514.46 million during the quarter, compared to analysts' expectations of $504.87 million. During the same period in the previous year, the business posted $0.40 EPS. The business's quarterly revenue was up 14.7% compared to the same quarter last year.

Hedge Funds Weigh In On ExlService

Institutional investors have recently made changes to their positions in the company. Whittier Trust Co. purchased a new stake in ExlService in the 1st quarter worth $45,000. Morse Asset Management Inc purchased a new stake in ExlService in the 4th quarter worth $49,000. Strategic Investment Solutions Inc. IL purchased a new stake in ExlService in the 1st quarter worth $77,000. Caitong International Asset Management Co. Ltd increased its holdings in ExlService by 25.7% in the 1st quarter. Caitong International Asset Management Co. Ltd now owns 1,803 shares of the business services provider's stock worth $85,000 after acquiring an additional 369 shares in the last quarter. Finally, Johnson Financial Group Inc. purchased a new stake in ExlService in the 4th quarter worth $85,000. 92.92% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at ExlService

In other news, insider Vikas Bhalla sold 25,000 shares of ExlService stock in a transaction that occurred on Thursday, May 8th. The shares were sold at an average price of $46.11, for a total transaction of $1,152,750.00. Following the completion of the transaction, the insider directly owned 135,046 shares of the company's stock, valued at $6,226,971.06. The trade was a 15.62% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. 4.04% of the stock is currently owned by company insiders.

ExlService Company Profile

(

Get Free Report)

ExlService Holdings, Inc operates as a data analytics, and digital operations and solutions company in the United States and internationally. The company operates through Insurance, Healthcare, Analytics, and Emerging Business segments. It also provides digital operations and solutions and analytics-driven services, such as claims processing, premium and benefit administration, agency management, account reconciliation, policy research, underwriting support, new business acquisition, policy servicing, premium audit, surveys, billing and collection, commercial and residential survey, and customer service using digital technology, artificial intelligence, machine learning, and advanced automation; digital customer acquisition services using a software-as-a-service delivery model through LifePRO and LISS platforms; subrogation services; and Subrosource software platform, an end-to-end subrogation platform.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ExlService, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ExlService wasn't on the list.

While ExlService currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.