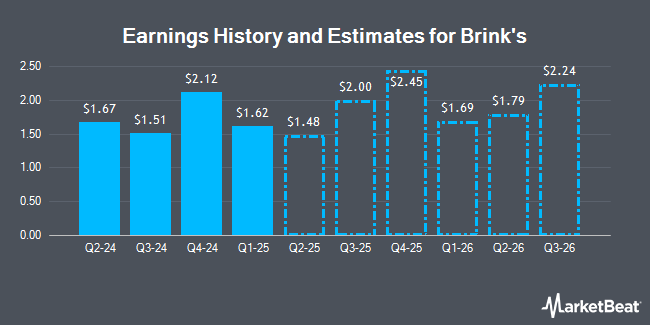

Brink's Company (The) (NYSE:BCO - Free Report) - Equities researchers at William Blair increased their Q3 2025 EPS estimates for Brink's in a research note issued on Wednesday, August 6th. William Blair analyst T. Mulrooney now anticipates that the business services provider will earn $2.05 per share for the quarter, up from their previous forecast of $2.00. The consensus estimate for Brink's' current full-year earnings is $6.49 per share. William Blair also issued estimates for Brink's' Q4 2025 earnings at $2.54 EPS, FY2025 earnings at $7.97 EPS, Q1 2026 earnings at $1.82 EPS, Q2 2026 earnings at $2.02 EPS, Q3 2026 earnings at $2.41 EPS, Q4 2026 earnings at $2.93 EPS and FY2026 earnings at $9.15 EPS.

Separately, Wall Street Zen upgraded shares of Brink's from a "hold" rating to a "strong-buy" rating in a report on Sunday.

Read Our Latest Analysis on Brink's

Brink's Stock Performance

NYSE BCO traded up $2.59 during trading hours on Friday, reaching $109.21. 278,658 shares of the company were exchanged, compared to its average volume of 313,870. Brink's has a 1 year low of $80.10 and a 1 year high of $115.91. The business's 50 day simple moving average is $90.64 and its 200-day simple moving average is $89.44. The company has a quick ratio of 1.51, a current ratio of 1.51 and a debt-to-equity ratio of 9.84. The stock has a market capitalization of $4.55 billion, a P/E ratio of 29.51 and a beta of 1.46.

Brink's (NYSE:BCO - Get Free Report) last announced its earnings results on Wednesday, August 6th. The business services provider reported $1.79 EPS for the quarter, beating the consensus estimate of $1.43 by $0.36. The company had revenue of $1.30 billion during the quarter, compared to the consensus estimate of $1.27 billion. Brink's had a net margin of 3.21% and a return on equity of 86.86%. The firm's revenue for the quarter was up 3.8% on a year-over-year basis. During the same quarter in the prior year, the company posted $1.67 earnings per share.

Brink's Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, September 2nd. Shareholders of record on Monday, July 28th will be given a dividend of $0.255 per share. This represents a $1.02 dividend on an annualized basis and a yield of 0.9%. The ex-dividend date is Monday, July 28th. Brink's's dividend payout ratio (DPR) is currently 27.57%.

Insiders Place Their Bets

In other Brink's news, insider Michael E. Sweeney sold 1,314 shares of the stock in a transaction dated Wednesday, August 6th. The shares were sold at an average price of $99.05, for a total transaction of $130,151.70. Following the completion of the transaction, the insider owned 10,326 shares in the company, valued at $1,022,790.30. This trade represents a 11.29% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Insiders have sold a total of 2,802 shares of company stock worth $280,262 in the last three months. 0.72% of the stock is owned by company insiders.

Hedge Funds Weigh In On Brink's

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. Xponance Inc. boosted its position in shares of Brink's by 2.0% in the first quarter. Xponance Inc. now owns 6,372 shares of the business services provider's stock valued at $549,000 after acquiring an additional 128 shares during the period. Hexagon Capital Partners LLC boosted its position in shares of Brink's by 32.0% in the first quarter. Hexagon Capital Partners LLC now owns 536 shares of the business services provider's stock valued at $46,000 after acquiring an additional 130 shares during the period. State of Alaska Department of Revenue boosted its position in shares of Brink's by 2.7% in the first quarter. State of Alaska Department of Revenue now owns 5,112 shares of the business services provider's stock valued at $440,000 after acquiring an additional 135 shares during the period. CANADA LIFE ASSURANCE Co boosted its position in shares of Brink's by 0.4% in the fourth quarter. CANADA LIFE ASSURANCE Co now owns 39,207 shares of the business services provider's stock valued at $3,632,000 after acquiring an additional 142 shares during the period. Finally, GAMMA Investing LLC boosted its position in shares of Brink's by 16.2% in the first quarter. GAMMA Investing LLC now owns 1,081 shares of the business services provider's stock valued at $93,000 after acquiring an additional 151 shares during the period. Institutional investors own 94.96% of the company's stock.

About Brink's

(

Get Free Report)

The Brink's Co engages in providing cash management services, digital retail solutions, and ATM managed services. It operates through the following geographical segments: North America, Latin America, Europe, and Rest of World. The North America segment operates in the U.S. and Canada. The Latin America segment refers to the operations in Latin American countries.

Featured Articles

Before you consider Brink's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brink's wasn't on the list.

While Brink's currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.