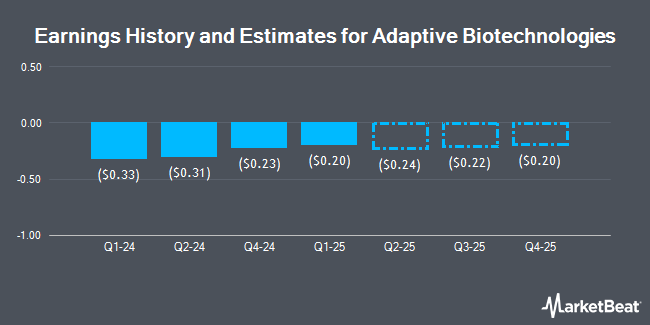

Adaptive Biotechnologies Corporation (NASDAQ:ADPT - Free Report) - Research analysts at William Blair lifted their Q3 2025 earnings estimates for Adaptive Biotechnologies in a report released on Monday, August 18th. William Blair analyst A. Brackmann now forecasts that the company will post earnings per share of ($0.09) for the quarter, up from their previous estimate of ($0.20). The consensus estimate for Adaptive Biotechnologies' current full-year earnings is ($0.92) per share. William Blair also issued estimates for Adaptive Biotechnologies' Q4 2025 earnings at ($0.10) EPS, FY2025 earnings at ($0.56) EPS, Q1 2026 earnings at ($0.19) EPS, Q2 2026 earnings at ($0.17) EPS, Q4 2026 earnings at ($0.15) EPS and FY2026 earnings at ($0.66) EPS.

A number of other brokerages have also recently weighed in on ADPT. JPMorgan Chase & Co. lifted their price target on shares of Adaptive Biotechnologies from $10.00 to $14.00 and gave the company an "overweight" rating in a research report on Wednesday, August 6th. TD Cowen lifted their price target on shares of Adaptive Biotechnologies from $13.00 to $15.00 and gave the company a "buy" rating in a research report on Wednesday, August 6th. Craig Hallum initiated coverage on shares of Adaptive Biotechnologies in a research report on Wednesday, June 18th. They set a "buy" rating and a $15.00 price target on the stock. Piper Sandler boosted their target price on shares of Adaptive Biotechnologies from $13.00 to $15.00 and gave the stock an "overweight" rating in a research report on Wednesday, August 6th. Finally, The Goldman Sachs Group boosted their target price on shares of Adaptive Biotechnologies from $9.00 to $10.00 and gave the stock a "buy" rating in a research report on Friday, May 2nd. Seven equities research analysts have rated the stock with a Buy rating and one has given a Hold rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $12.38.

Get Our Latest Stock Report on ADPT

Adaptive Biotechnologies Price Performance

ADPT stock traded up $0.12 during midday trading on Thursday, reaching $12.79. 272,668 shares of the company's stock traded hands, compared to its average volume of 2,022,900. The company has a market capitalization of $1.95 billion, a P/E ratio of -15.60 and a beta of 1.92. Adaptive Biotechnologies has a fifty-two week low of $3.98 and a fifty-two week high of $13.40. The business has a 50-day moving average price of $11.47 and a two-hundred day moving average price of $9.48.

Adaptive Biotechnologies (NASDAQ:ADPT - Get Free Report) last announced its quarterly earnings results on Tuesday, August 5th. The company reported ($0.17) earnings per share for the quarter, beating analysts' consensus estimates of ($0.24) by $0.07. The firm had revenue of $49.94 million for the quarter, compared to analysts' expectations of $49.40 million. Adaptive Biotechnologies had a negative net margin of 59.07% and a negative return on equity of 60.93%. Adaptive Biotechnologies's revenue was up 36.3% compared to the same quarter last year. During the same period in the previous year, the company posted ($0.31) earnings per share.

Institutional Inflows and Outflows

Institutional investors have recently made changes to their positions in the company. Bridgefront Capital LLC acquired a new stake in Adaptive Biotechnologies in the fourth quarter valued at $80,000. Personal CFO Solutions LLC acquired a new stake in Adaptive Biotechnologies in the first quarter valued at $84,000. Blair William & Co. IL acquired a new stake in Adaptive Biotechnologies in the first quarter valued at $84,000. Wealth Enhancement Advisory Services LLC acquired a new stake in Adaptive Biotechnologies in the first quarter valued at $87,000. Finally, Candriam S.C.A. acquired a new stake in Adaptive Biotechnologies in the first quarter valued at $90,000. 99.17% of the stock is owned by institutional investors and hedge funds.

Adaptive Biotechnologies Company Profile

(

Get Free Report)

Adaptive Biotechnologies Corporation, a commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases. The company offers immunosequencing platform which combines a suite of proprietary chemistry, computational biology, and machine learning to generate clinical immunomics data to decode the adaptive immune system.

Read More

Before you consider Adaptive Biotechnologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adaptive Biotechnologies wasn't on the list.

While Adaptive Biotechnologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.