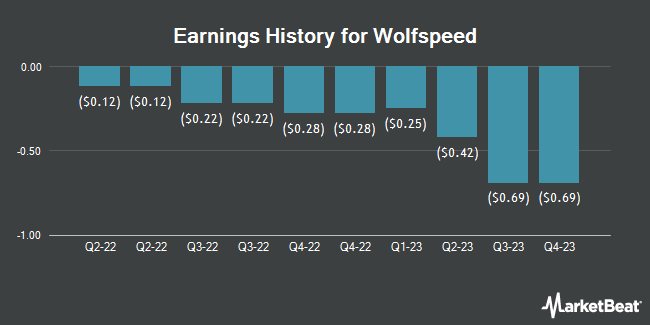

Wolfspeed (NYSE:WOLF - Get Free Report) issued its earnings results on Monday. The company reported ($0.85) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.72) by ($0.13), Zacks reports. Wolfspeed had a negative return on equity of 103.97% and a negative net margin of 146.43%.

Wolfspeed Price Performance

WOLF stock traded down $0.0450 during mid-day trading on Monday, reaching $1.3250. The company's stock had a trading volume of 4,217,724 shares, compared to its average volume of 38,209,836. The stock has a market cap of $206.21 million, a PE ratio of -0.16 and a beta of 1.23. The company has a current ratio of 4.64, a quick ratio of 3.90 and a debt-to-equity ratio of 30.65. Wolfspeed has a fifty-two week low of $0.3876 and a fifty-two week high of $17.4475. The company's 50 day moving average is $1.33 and its two-hundred day moving average is $2.92.

Analysts Set New Price Targets

A number of brokerages recently issued reports on WOLF. Piper Sandler lowered their price target on Wolfspeed from $10.00 to $6.00 and set an "overweight" rating for the company in a report on Friday, May 9th. Citigroup reaffirmed a "sell" rating and set a $3.00 price target (down from $7.00) on shares of Wolfspeed in a research report on Friday, May 9th. Finally, JPMorgan Chase & Co. reaffirmed an "underweight" rating on shares of Wolfspeed in a research report on Friday, May 9th. Four equities research analysts have rated the stock with a Buy rating, two have assigned a Hold rating and four have issued a Sell rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and an average target price of $9.80.

Get Our Latest Research Report on Wolfspeed

Institutional Trading of Wolfspeed

Institutional investors have recently added to or reduced their stakes in the stock. Canada Pension Plan Investment Board acquired a new stake in Wolfspeed in the 2nd quarter valued at approximately $34,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. purchased a new stake in Wolfspeed in the second quarter valued at $34,000. Marex Group plc purchased a new stake in shares of Wolfspeed in the second quarter valued at about $44,000. WINTON GROUP Ltd purchased a new stake in shares of Wolfspeed in the second quarter valued at about $47,000. Finally, Engineers Gate Manager LP acquired a new position in Wolfspeed during the second quarter worth about $108,000.

About Wolfspeed

(

Get Free Report)

Wolfspeed, Inc operates as a powerhouse semiconductor company focuses on silicon carbide and gallium nitride (GaN) technologies in Europe, Hong Kong, China, rest of Asia-Pacific, the United States, and internationally. It offers silicon carbide and GaN materials, including silicon carbide bare wafers, epitaxial wafers, and GaN epitaxial layers on silicon carbide wafers to manufacture products for RF, power, and other applications.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Wolfspeed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wolfspeed wasn't on the list.

While Wolfspeed currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.