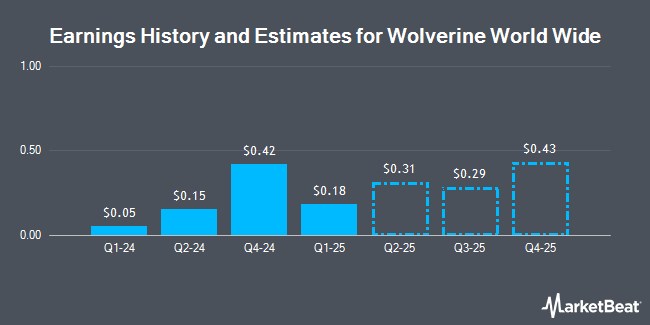

Wolverine World Wide (NYSE:WWW - Get Free Report) issued an update on its third quarter 2025 earnings guidance on Thursday morning. The company provided EPS guidance of 0.280-0.32 for the period, compared to the consensus EPS estimate of 0.254. The company issued revenue guidance of $450.0 million-$460.0 million, compared to the consensus revenue estimate of $453.9 million.

Wolverine World Wide Stock Down 1.0%

Wolverine World Wide stock traded down $0.27 during midday trading on Friday, hitting $27.48. The stock had a trading volume of 3,338,141 shares, compared to its average volume of 1,994,826. The company has a current ratio of 1.24, a quick ratio of 0.77 and a debt-to-equity ratio of 1.58. The stock has a market cap of $2.23 billion, a P/E ratio of 26.94 and a beta of 1.74. Wolverine World Wide has a 12 month low of $9.58 and a 12 month high of $28.57. The business has a fifty day moving average price of $20.05 and a 200 day moving average price of $17.12.

Wolverine World Wide (NYSE:WWW - Get Free Report) last issued its earnings results on Wednesday, August 6th. The textile maker reported $0.35 EPS for the quarter, beating analysts' consensus estimates of $0.23 by $0.12. Wolverine World Wide had a return on equity of 31.99% and a net margin of 4.73%. The company had revenue of $474.20 million during the quarter, compared to the consensus estimate of $447.82 million. During the same period in the previous year, the firm posted $0.15 earnings per share. Wolverine World Wide's quarterly revenue was up 11.5% compared to the same quarter last year. Research analysts predict that Wolverine World Wide will post 1.23 EPS for the current year.

Wolverine World Wide Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, November 3rd. Shareholders of record on Wednesday, October 1st will be paid a $0.10 dividend. This represents a $0.40 dividend on an annualized basis and a yield of 1.5%. The ex-dividend date is Wednesday, October 1st. Wolverine World Wide's payout ratio is presently 39.22%.

Analyst Ratings Changes

A number of equities analysts have commented on WWW shares. Telsey Advisory Group restated a "market perform" rating and issued a $29.00 target price (up from $17.00) on shares of Wolverine World Wide in a research note on Wednesday. KeyCorp reissued an "overweight" rating and set a $32.00 target price (up previously from $25.00) on shares of Wolverine World Wide in a report on Thursday. Piper Sandler reaffirmed an "overweight" rating and issued a $25.00 price target (up previously from $20.00) on shares of Wolverine World Wide in a report on Tuesday. Stifel Nicolaus dropped their price target on Wolverine World Wide from $27.00 to $19.00 and set a "buy" rating on the stock in a report on Thursday, April 10th. Finally, Robert W. Baird boosted their target price on shares of Wolverine World Wide from $15.00 to $20.00 and gave the company an "outperform" rating in a research note on Tuesday, May 6th. Two analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, Wolverine World Wide presently has an average rating of "Moderate Buy" and an average price target of $25.38.

Check Out Our Latest Report on WWW

Hedge Funds Weigh In On Wolverine World Wide

Several institutional investors and hedge funds have recently modified their holdings of the stock. Goldman Sachs Group Inc. boosted its holdings in Wolverine World Wide by 55.6% in the first quarter. Goldman Sachs Group Inc. now owns 1,504,571 shares of the textile maker's stock worth $20,929,000 after purchasing an additional 537,854 shares in the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC raised its position in shares of Wolverine World Wide by 13.4% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 227,688 shares of the textile maker's stock valued at $3,167,000 after buying an additional 26,870 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in shares of Wolverine World Wide by 5.1% during the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 47,480 shares of the textile maker's stock valued at $660,000 after buying an additional 2,321 shares during the last quarter. Finally, Royal Bank of Canada raised its position in shares of Wolverine World Wide by 295.7% during the first quarter. Royal Bank of Canada now owns 33,055 shares of the textile maker's stock valued at $460,000 after buying an additional 24,701 shares during the last quarter. 90.25% of the stock is currently owned by hedge funds and other institutional investors.

About Wolverine World Wide

(

Get Free Report)

Wolverine World Wide, Inc designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America. It operates through Active Group and Work Group segments. The company offers casual footwear and apparel; performance outdoor and athletic footwear and apparel; kids' footwear; industrial work boots and apparel; and uniform shoes and boots.

Featured Articles

Before you consider Wolverine World Wide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wolverine World Wide wasn't on the list.

While Wolverine World Wide currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.