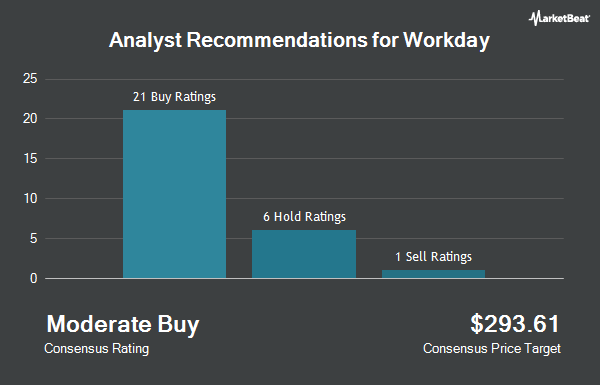

Workday, Inc. (NASDAQ:WDAY - Get Free Report) has received a consensus recommendation of "Moderate Buy" from the thirty-two brokerages that are presently covering the stock, MarketBeat.com reports. Nine investment analysts have rated the stock with a hold recommendation, twenty-one have issued a buy recommendation and two have issued a strong buy recommendation on the company. The average 1-year target price among brokerages that have issued ratings on the stock in the last year is $293.62.

A number of research analysts have recently commented on WDAY shares. Citigroup dropped their target price on shares of Workday from $287.00 to $270.00 and set a "neutral" rating for the company in a report on Thursday, January 16th. KeyCorp increased their target price on shares of Workday from $305.00 to $335.00 and gave the stock an "overweight" rating in a report on Wednesday, February 26th. Scotiabank dropped their target price on shares of Workday from $355.00 to $305.00 and set a "sector outperform" rating for the company in a report on Monday, March 17th. Stifel Nicolaus increased their target price on shares of Workday from $270.00 to $310.00 and gave the stock a "hold" rating in a report on Wednesday, February 26th. Finally, Oppenheimer increased their target price on shares of Workday from $300.00 to $320.00 and gave the stock an "outperform" rating in a report on Wednesday, February 26th.

Read Our Latest Analysis on WDAY

Insider Transactions at Workday

In related news, insider Sayan Chakraborty sold 6,056 shares of Workday stock in a transaction on Thursday, February 27th. The shares were sold at an average price of $265.50, for a total value of $1,607,868.00. Following the completion of the sale, the insider now owns 111,324 shares of the company's stock, valued at approximately $29,556,522. This trade represents a 5.16% decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CAO Mark S. Garfield sold 497 shares of Workday stock in a transaction on Thursday, April 10th. The shares were sold at an average price of $226.55, for a total transaction of $112,595.35. Following the completion of the sale, the chief accounting officer now directly owns 34,385 shares of the company's stock, valued at approximately $7,789,921.75. The trade was a 1.42% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 321,724 shares of company stock valued at $77,976,126 in the last quarter. 19.31% of the stock is currently owned by company insiders.

Institutional Trading of Workday

Hedge funds have recently bought and sold shares of the business. Roxbury Financial LLC acquired a new stake in Workday in the 4th quarter valued at $25,000. Crews Bank & Trust bought a new position in Workday during the 4th quarter valued at $26,000. Avion Wealth lifted its stake in Workday by 452.6% during the 4th quarter. Avion Wealth now owns 105 shares of the software maker's stock valued at $27,000 after acquiring an additional 86 shares in the last quarter. Cornerstone Planning Group LLC lifted its stake in Workday by 76.1% during the 1st quarter. Cornerstone Planning Group LLC now owns 125 shares of the software maker's stock valued at $28,000 after acquiring an additional 54 shares in the last quarter. Finally, Dagco Inc. bought a new position in Workday during the 1st quarter valued at $31,000. Institutional investors and hedge funds own 89.81% of the company's stock.

Workday Stock Up 1.3%

WDAY stock opened at $270.02 on Wednesday. The company has a market cap of $71.83 billion, a PE ratio of 44.78, a price-to-earnings-growth ratio of 3.55 and a beta of 1.30. The business has a 50-day simple moving average of $238.96 and a 200 day simple moving average of $252.65. Workday has a 52 week low of $199.81 and a 52 week high of $294.00. The company has a quick ratio of 2.05, a current ratio of 2.05 and a debt-to-equity ratio of 0.35.

Workday (NASDAQ:WDAY - Get Free Report) last posted its quarterly earnings results on Tuesday, February 25th. The software maker reported $0.48 EPS for the quarter, missing analysts' consensus estimates of $1.75 by ($1.27). The company had revenue of $2.21 billion during the quarter, compared to analyst estimates of $2.18 billion. Workday had a net margin of 19.86% and a return on equity of 6.13%. Sell-side analysts anticipate that Workday will post 2.63 EPS for the current fiscal year.

Workday Company Profile

(

Get Free ReportWorkday, Inc provides enterprise cloud applications in the United States and internationally. Its applications help its customers to plan, execute, analyze, and extend to other applications and environments to manage their business and operations. The company offers a suite of financial management applications to maintain accounting information in the general ledger; manage financial processes, such as payables and receivables; identify real-time financial, operational, and management insights; enhance financial consolidation; reduce time-to-close; promote internal control and auditability; and achieve consistency across finance operations.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Workday, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Workday wasn't on the list.

While Workday currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.