WPP (NYSE:WPP - Get Free Report)'s stock had its "sell (d+)" rating reiterated by Weiss Ratings in a report released on Wednesday,Weiss Ratings reports.

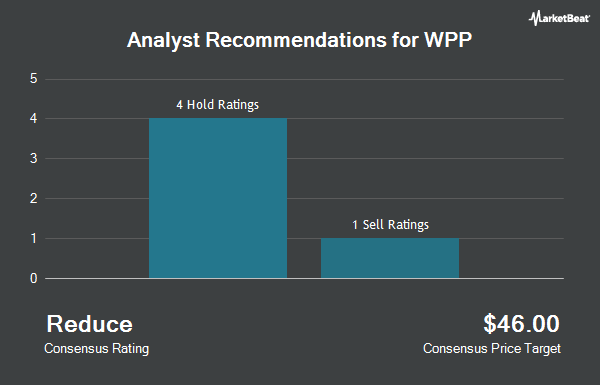

Several other analysts have also commented on WPP. Deutsche Bank Aktiengesellschaft reissued a "buy" rating on shares of WPP in a report on Thursday, July 10th. Barclays restated an "underweight" rating on shares of WPP in a report on Friday, August 8th. Kepler Capital Markets downgraded WPP from a "strong-buy" rating to a "hold" rating in a research report on Thursday, July 31st. Wall Street Zen downgraded WPP from a "hold" rating to a "sell" rating in a research report on Sunday, September 21st. Finally, Zacks Research upgraded WPP from a "strong sell" rating to a "hold" rating in a research report on Monday. One analyst has rated the stock with a Buy rating, three have given a Hold rating and two have issued a Sell rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Reduce".

View Our Latest Report on WPP

WPP Stock Performance

WPP stock traded up $0.23 during midday trading on Wednesday, hitting $24.67. 145,894 shares of the company were exchanged, compared to its average volume of 377,999. The firm has a market capitalization of $5.32 billion, a PE ratio of 4.13 and a beta of 0.95. WPP has a fifty-two week low of $23.43 and a fifty-two week high of $57.37. The business has a fifty day simple moving average of $25.84 and a two-hundred day simple moving average of $32.43.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the stock. Hotchkis & Wiley Capital Management LLC grew its stake in WPP by 27.2% during the 1st quarter. Hotchkis & Wiley Capital Management LLC now owns 6,720,858 shares of the business services provider's stock worth $255,124,000 after purchasing an additional 1,436,668 shares in the last quarter. Invesco Ltd. raised its stake in WPP by 50.8% during the 1st quarter. Invesco Ltd. now owns 2,448,296 shares of the business services provider's stock valued at $92,937,000 after acquiring an additional 824,336 shares during the last quarter. Brandes Investment Partners LP raised its stake in WPP by 12.2% during the 2nd quarter. Brandes Investment Partners LP now owns 626,371 shares of the business services provider's stock valued at $21,930,000 after acquiring an additional 68,271 shares during the last quarter. Bank of America Corp DE raised its stake in WPP by 10.8% during the 2nd quarter. Bank of America Corp DE now owns 470,900 shares of the business services provider's stock valued at $16,486,000 after acquiring an additional 45,866 shares during the last quarter. Finally, Northern Trust Corp raised its stake in shares of WPP by 11.6% during the 1st quarter. Northern Trust Corp now owns 283,028 shares of the business services provider's stock worth $10,744,000 after buying an additional 29,388 shares in the last quarter. 4.34% of the stock is owned by institutional investors and hedge funds.

About WPP

(

Get Free Report)

WPP plc, a creative transformation company, provides communications, experience, commerce, and technology services in North America, the United Kingdom, Western Continental Europe, the Asia Pacific, Latin America, Africa, the Middle East, and Central and Eastern Europe. The company operates through three segments: Global Integrated Agencies, Public Relations, and Specialist Agencies.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider WPP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WPP wasn't on the list.

While WPP currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.