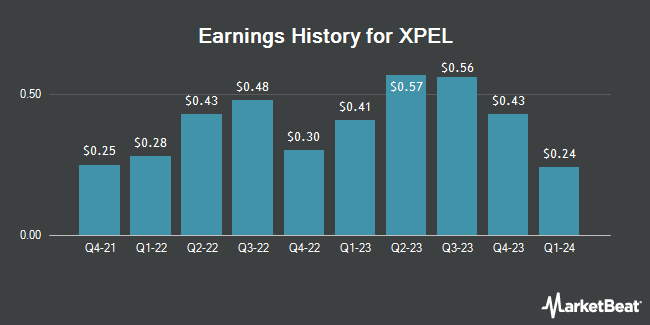

XPEL (NASDAQ:XPEL - Get Free Report) announced its earnings results on Tuesday. The company reported $0.31 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.25 by $0.06, Zacks reports. The company had revenue of $103.81 million for the quarter, compared to analyst estimates of $97.40 million. XPEL had a net margin of 11.61% and a return on equity of 24.68%. XPEL's quarterly revenue was up 15.2% on a year-over-year basis. During the same period in the prior year, the business earned $0.24 earnings per share. XPEL updated its Q2 2025 guidance to EPS.

XPEL Price Performance

Shares of NASDAQ XPEL traded down $0.91 during mid-day trading on Friday, hitting $36.71. The company's stock had a trading volume of 250,715 shares, compared to its average volume of 206,588. The company's fifty day simple moving average is $29.51 and its 200-day simple moving average is $37.40. XPEL has a one year low of $24.25 and a one year high of $48.58. The stock has a market cap of $1.02 billion, a price-to-earnings ratio of 20.98 and a beta of 1.83.

XPEL declared that its board has initiated a share repurchase plan on Tuesday, May 6th that allows the company to buyback $50.00 million in outstanding shares. This buyback authorization allows the company to repurchase up to 5.4% of its stock through open market purchases. Stock buyback plans are generally an indication that the company's management believes its stock is undervalued.

XPEL Company Profile

(

Get Free Report)

XPEL, Inc sells, distributes, and installs protective films and coatings worldwide. The company offers automotive surface and paint protection film, headlight protection, and automotive and architectural window films, as well as proprietary DAP software. It also provides pre-cut film products, merchandise and apparel, ceramic coatings, and tools and accessories.

Recommended Stories

Before you consider XPEL, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and XPEL wasn't on the list.

While XPEL currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.