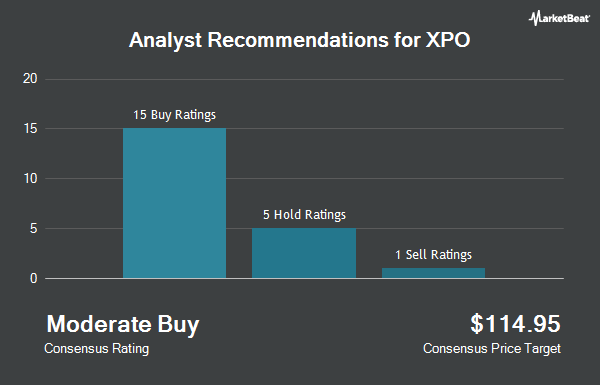

Shares of XPO, Inc. (NYSE:XPO - Get Free Report) have been assigned an average rating of "Buy" from the nineteen ratings firms that are covering the company, Marketbeat.com reports. Nineteen equities research analysts have rated the stock with a buy rating. The average twelve-month price objective among brokerages that have issued ratings on the stock in the last year is $134.89.

XPO has been the subject of several research analyst reports. Deutsche Bank Aktiengesellschaft initiated coverage on XPO in a report on Friday, March 7th. They set a "buy" rating and a $156.00 price target for the company. Citigroup reduced their price target on shares of XPO from $148.00 to $113.00 and set a "buy" rating on the stock in a research report on Tuesday, April 8th. Stephens reiterated an "overweight" rating and set a $131.00 price objective on shares of XPO in a research report on Thursday, June 5th. Wells Fargo & Company dropped their price objective on shares of XPO from $130.00 to $116.00 and set an "overweight" rating for the company in a research note on Thursday, May 1st. Finally, JPMorgan Chase & Co. lowered their price target on shares of XPO from $132.00 to $121.00 and set an "overweight" rating for the company in a report on Thursday, May 1st.

Get Our Latest Research Report on XPO

XPO Price Performance

XPO traded up $2.75 during trading on Friday, reaching $132.21. 434,560 shares of the company traded hands, compared to its average volume of 1,622,573. The company has a market cap of $15.58 billion, a P/E ratio of 40.68, a PEG ratio of 2.40 and a beta of 1.93. The company has a debt-to-equity ratio of 2.03, a quick ratio of 1.02 and a current ratio of 1.02. XPO has a 12-month low of $85.06 and a 12-month high of $161.00. The firm has a fifty day simple moving average of $117.24 and a 200 day simple moving average of $121.32.

XPO (NYSE:XPO - Get Free Report) last posted its earnings results on Wednesday, April 30th. The transportation company reported $0.73 earnings per share for the quarter, beating the consensus estimate of $0.65 by $0.08. XPO had a net margin of 4.87% and a return on equity of 28.27%. The company had revenue of $1.95 billion during the quarter, compared to analysts' expectations of $1.98 billion. During the same period last year, the company posted $0.81 earnings per share. XPO's quarterly revenue was down 3.2% on a year-over-year basis. On average, equities analysts forecast that XPO will post 4.15 EPS for the current year.

XPO announced that its board has authorized a share buyback program on Thursday, March 27th that allows the company to repurchase $750.00 million in shares. This repurchase authorization allows the transportation company to repurchase up to 5.7% of its shares through open market purchases. Shares repurchase programs are typically an indication that the company's board of directors believes its shares are undervalued.

Institutional Investors Weigh In On XPO

Large investors have recently modified their holdings of the business. Proficio Capital Partners LLC purchased a new stake in XPO during the fourth quarter worth $8,772,000. US Bancorp DE lifted its stake in shares of XPO by 30.6% during the 4th quarter. US Bancorp DE now owns 22,382 shares of the transportation company's stock worth $2,935,000 after purchasing an additional 5,240 shares during the last quarter. Halbert Hargrove Global Advisors LLC bought a new stake in XPO during the fourth quarter valued at about $42,000. Jones Financial Companies Lllp raised its holdings in XPO by 29.8% in the fourth quarter. Jones Financial Companies Lllp now owns 6,476 shares of the transportation company's stock worth $849,000 after purchasing an additional 1,486 shares in the last quarter. Finally, Steward Partners Investment Advisory LLC raised its holdings in XPO by 16.4% in the fourth quarter. Steward Partners Investment Advisory LLC now owns 839 shares of the transportation company's stock worth $110,000 after purchasing an additional 118 shares in the last quarter. Institutional investors own 97.73% of the company's stock.

About XPO

(

Get Free ReportXPO, Inc provides freight transportation services in the United States, rest of North America, France, the United Kingdom, rest of Europe, and internationally. The company operates in two segments, North American LTL and European Transportation. The North American LTL segment provides customers with less-than-truckload (LTL) services, such as geographic density and day-definite domestic services.

Read More

Before you consider XPO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and XPO wasn't on the list.

While XPO currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.