Y-mAbs Therapeutics (NASDAQ:YMAB - Get Free Report) was upgraded by analysts at Wall Street Zen to a "hold" rating in a research report issued to clients and investors on Saturday.

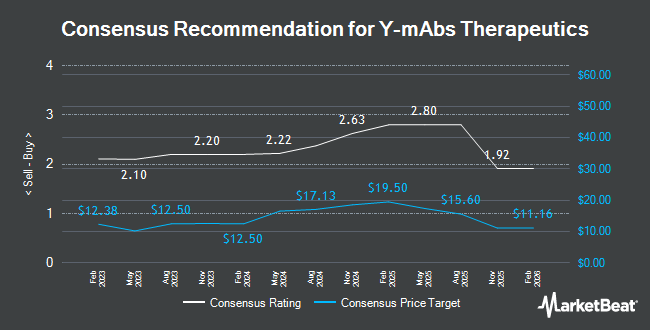

Several other research firms also recently issued reports on YMAB. Wedbush downgraded Y-mAbs Therapeutics from a "strong-buy" rating to a "hold" rating and set a $8.60 price objective on the stock. in a report on Tuesday, August 5th. HC Wainwright reissued a "neutral" rating and issued a $8.60 price target (down previously from $11.00) on shares of Y-mAbs Therapeutics in a research note on Wednesday, August 6th. Oppenheimer downgraded Y-mAbs Therapeutics from an "outperform" rating to a "market perform" rating in a research note on Tuesday, August 5th. Canaccord Genuity Group downgraded Y-mAbs Therapeutics from a "strong-buy" rating to a "hold" rating and cut their price target for the company from $26.00 to $8.60 in a research note on Tuesday, August 5th. Finally, Brookline Capital Management downgraded Y-mAbs Therapeutics from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, August 5th. Eight investment analysts have rated the stock with a Hold rating and two have assigned a Sell rating to the company's stock. According to data from MarketBeat, Y-mAbs Therapeutics has a consensus rating of "Reduce" and an average target price of $9.62.

Check Out Our Latest Stock Analysis on YMAB

Y-mAbs Therapeutics Price Performance

NASDAQ:YMAB remained flat at $8.61 during trading hours on Friday. The company has a fifty day simple moving average of $7.35 and a 200-day simple moving average of $5.52. Y-mAbs Therapeutics has a twelve month low of $3.55 and a twelve month high of $16.11. The firm has a market cap of $391.24 million, a P/E ratio of -17.22 and a beta of 0.54.

Y-mAbs Therapeutics (NASDAQ:YMAB - Get Free Report) last posted its quarterly earnings data on Friday, August 8th. The company reported ($0.07) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.27) by $0.20. Y-mAbs Therapeutics had a negative return on equity of 24.60% and a negative net margin of 26.03%.The firm had revenue of $19.52 million for the quarter, compared to the consensus estimate of $18.40 million. On average, analysts anticipate that Y-mAbs Therapeutics will post -0.65 EPS for the current year.

Hedge Funds Weigh In On Y-mAbs Therapeutics

Hedge funds have recently modified their holdings of the stock. Cubist Systematic Strategies LLC grew its holdings in shares of Y-mAbs Therapeutics by 223.9% in the 1st quarter. Cubist Systematic Strategies LLC now owns 155,522 shares of the company's stock valued at $689,000 after acquiring an additional 107,511 shares in the last quarter. Bank of America Corp DE grew its holdings in shares of Y-mAbs Therapeutics by 59.5% in the 4th quarter. Bank of America Corp DE now owns 127,159 shares of the company's stock valued at $996,000 after acquiring an additional 47,439 shares in the last quarter. Exchange Traded Concepts LLC grew its holdings in Y-mAbs Therapeutics by 107.9% during the first quarter. Exchange Traded Concepts LLC now owns 26,762 shares of the company's stock worth $119,000 after purchasing an additional 13,890 shares during the period. Nuveen LLC bought a new position in Y-mAbs Therapeutics during the first quarter worth about $498,000. Finally, Jacobs Levy Equity Management Inc. grew its holdings in Y-mAbs Therapeutics by 58.7% during the first quarter. Jacobs Levy Equity Management Inc. now owns 237,511 shares of the company's stock worth $1,052,000 after purchasing an additional 87,830 shares during the period. Institutional investors own 70.85% of the company's stock.

Y-mAbs Therapeutics Company Profile

(

Get Free Report)

Y-mAbs Therapeutics, Inc, a commercial-stage biopharmaceutical company, focuses on the development and commercialization of antibody based therapeutic products for the treatment of cancer in the United States and internationally. It offers DANYELZA, a monoclonal antibody in combination with granulocyte-macrophage colony-stimulating factor for the treatment of pediatric patients with relapsed or refractory high-risk neuroblastoma in the bone or bone marrow.

See Also

Before you consider Y-mAbs Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Y-mAbs Therapeutics wasn't on the list.

While Y-mAbs Therapeutics currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.