Yara International ASA (OTCMKTS:YARIY - Get Free Report) will likely be announcing its results before the market opens on Friday, October 17th. Analysts expect the company to announce earnings of $0.70 per share for the quarter.

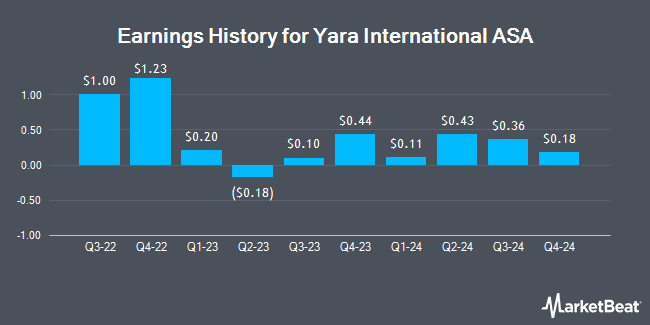

Yara International ASA (OTCMKTS:YARIY - Get Free Report) last released its quarterly earnings results on Friday, July 18th. The basic materials company reported $1.82 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.53 by $1.29. Yara International ASA had a return on equity of 19.27% and a net margin of 4.78%.The business had revenue of $3.95 billion during the quarter, compared to analyst estimates of $41.02 billion. On average, analysts expect Yara International ASA to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Yara International ASA Stock Performance

OTCMKTS:YARIY opened at $18.86 on Friday. The stock has a 50-day simple moving average of $18.45 and a two-hundred day simple moving average of $17.71. Yara International ASA has a 52-week low of $12.98 and a 52-week high of $20.31. The company has a debt-to-equity ratio of 0.37, a quick ratio of 0.83 and a current ratio of 1.60. The firm has a market capitalization of $9.61 billion, a PE ratio of 13.67 and a beta of 0.88.

Wall Street Analyst Weigh In

Several analysts have issued reports on YARIY shares. Zacks Research lowered Yara International ASA from a "strong-buy" rating to a "hold" rating in a report on Friday, September 26th. Pareto Securities raised Yara International ASA to a "hold" rating in a research note on Friday, October 3rd. Two equities research analysts have rated the stock with a Strong Buy rating, two have given a Hold rating and one has issued a Sell rating to the company's stock. According to MarketBeat, Yara International ASA has a consensus rating of "Moderate Buy".

Check Out Our Latest Stock Analysis on YARIY

About Yara International ASA

(

Get Free Report)

Yara International ASA provides crop nutrition and industrial solutions in Norway, European Union, Europe, Africa, Asia, North and Latin America, Australia, and New Zealand. The company offers ammonium- and urea-based fertilizers; compound fertilizers that contain nutrients, such as nitrogen, phosphorus, and potassium; coatings; biostimulants; organic-based fertilizers; green fertilizers are nitrate-based mineral fertilizers, as well as foliar and fertigation solutions; and nitrate, calcium nitrate, micronutrient, and fertigation and urea fertilizers.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Yara International ASA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yara International ASA wasn't on the list.

While Yara International ASA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.