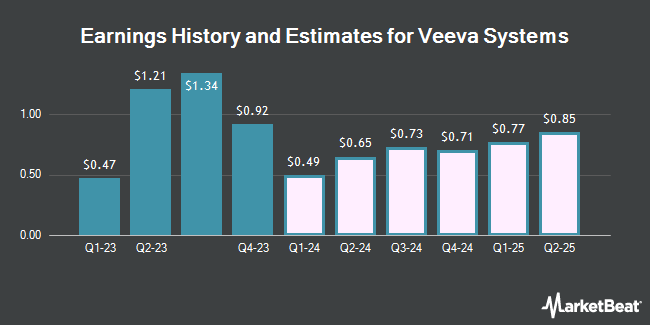

Veeva Systems Inc. (NYSE:VEEV - Free Report) - Stock analysts at Zacks Research increased their Q3 2026 earnings per share estimates for Veeva Systems in a research note issued on Wednesday, September 17th. Zacks Research analyst Team now expects that the technology company will post earnings of $1.38 per share for the quarter, up from their prior estimate of $1.31. The consensus estimate for Veeva Systems' current full-year earnings is $4.35 per share. Zacks Research also issued estimates for Veeva Systems' Q4 2026 earnings at $1.31 EPS, FY2026 earnings at $5.55 EPS, Q1 2027 earnings at $1.38 EPS, Q2 2027 earnings at $1.43 EPS, FY2027 earnings at $5.71 EPS, Q1 2028 earnings at $1.63 EPS, Q2 2028 earnings at $1.71 EPS and FY2028 earnings at $6.91 EPS.

A number of other brokerages have also recently commented on VEEV. Mizuho increased their target price on Veeva Systems from $295.00 to $325.00 and gave the company an "outperform" rating in a report on Friday, August 29th. Citigroup increased their price objective on Veeva Systems from $329.00 to $349.00 and gave the company a "buy" rating in a research note on Thursday, August 28th. JPMorgan Chase & Co. upgraded Veeva Systems from a "neutral" rating to an "overweight" rating and raised their price objective for the company from $290.00 to $330.00 in a report on Monday, September 8th. Piper Sandler upped their target price on shares of Veeva Systems from $325.00 to $355.00 and gave the stock an "overweight" rating in a report on Thursday, August 28th. Finally, Wall Street Zen raised shares of Veeva Systems from a "hold" rating to a "buy" rating in a research note on Friday, May 30th. Seventeen analysts have rated the stock with a Buy rating, six have given a Hold rating and two have assigned a Sell rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $301.48.

Read Our Latest Analysis on Veeva Systems

Veeva Systems Stock Performance

Shares of VEEV traded up $3.46 during mid-day trading on Monday, hitting $281.25. 1,406,523 shares of the company were exchanged, compared to its average volume of 1,546,638. The stock has a market cap of $46.10 billion, a price-to-earnings ratio of 55.56, a price-to-earnings-growth ratio of 2.15 and a beta of 0.95. Veeva Systems has a 1-year low of $200.30 and a 1-year high of $296.72. The company has a 50 day moving average of $280.65 and a 200-day moving average of $259.41.

Insider Buying and Selling at Veeva Systems

In other news, SVP Jonathan Faddis sold 720 shares of the stock in a transaction on Thursday, July 10th. The stock was sold at an average price of $285.62, for a total transaction of $205,646.40. Following the completion of the transaction, the senior vice president directly owned 7,902 shares in the company, valued at approximately $2,256,969.24. This represents a 8.35% decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Priscilla Hung sold 171 shares of the business's stock in a transaction dated Monday, July 7th. The shares were sold at an average price of $284.40, for a total transaction of $48,632.40. Following the completion of the sale, the director owned 3,966 shares in the company, valued at approximately $1,127,930.40. This trade represents a 4.13% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 1,063 shares of company stock valued at $302,955. 10.30% of the stock is owned by insiders.

Institutional Investors Weigh In On Veeva Systems

A number of institutional investors have recently made changes to their positions in the stock. Abound Financial LLC acquired a new position in shares of Veeva Systems in the 1st quarter worth approximately $25,000. ORG Partners LLC purchased a new stake in Veeva Systems in the first quarter valued at approximately $26,000. Trust Co. of Toledo NA OH acquired a new position in Veeva Systems during the second quarter worth $29,000. Golden State Wealth Management LLC lifted its stake in Veeva Systems by 152.9% during the first quarter. Golden State Wealth Management LLC now owns 129 shares of the technology company's stock worth $30,000 after purchasing an additional 78 shares in the last quarter. Finally, Wayfinding Financial LLC purchased a new position in shares of Veeva Systems during the first quarter worth $32,000. 88.20% of the stock is currently owned by institutional investors and hedge funds.

About Veeva Systems

(

Get Free Report)

Veeva Systems Inc provides cloud-based software for the life sciences industry. It offers Veeva Commercial Cloud, a suite of software and analytics solutions, such as Veeva customer relationship management (CRM) that enable customer-facing employees at pharmaceutical and biotechnology companies; Veeva Vault PromoMats, an end-to-end content and digital asset management solution; Veeva Vault Medical that provides source of medical content across multiple channels and geographies; Veeva Crossix, an analytics platform for pharmaceutical brands; Veeva OpenData, a customer reference data solution; Veeva Link, a data application that allows link to generate real-time intelligence; and Veeva Compass includes de-identified and longitudinal patient data for the United States.

See Also

Before you consider Veeva Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veeva Systems wasn't on the list.

While Veeva Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.