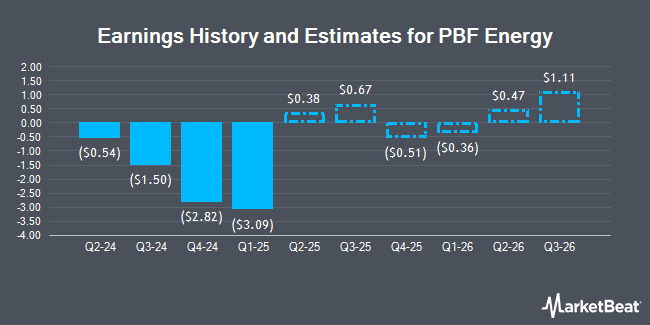

PBF Energy Inc. (NYSE:PBF - Free Report) - Investment analysts at Zacks Research decreased their Q4 2026 earnings per share (EPS) estimates for PBF Energy in a research report issued on Thursday, September 11th. Zacks Research analyst Team now anticipates that the oil and gas company will post earnings per share of $0.11 for the quarter, down from their prior forecast of $0.13. The consensus estimate for PBF Energy's current full-year earnings is ($1.12) per share. Zacks Research also issued estimates for PBF Energy's Q1 2027 earnings at $0.17 EPS.

Other analysts have also issued research reports about the company. Scotiabank reaffirmed a "sector perform" rating and set a $25.00 price objective (up previously from $16.00) on shares of PBF Energy in a research note on Friday, July 11th. Citigroup increased their target price on PBF Energy from $16.00 to $29.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 16th. Bank of America increased their target price on PBF Energy from $16.00 to $21.00 and gave the stock an "underperform" rating in a research report on Wednesday, September 3rd. Wells Fargo & Company increased their target price on PBF Energy from $21.00 to $24.00 and gave the stock an "equal weight" rating in a research report on Tuesday, July 15th. Finally, Morgan Stanley increased their target price on PBF Energy from $20.00 to $24.00 and gave the stock an "equal weight" rating in a research report on Wednesday, July 16th. One research analyst has rated the stock with a Buy rating, seven have issued a Hold rating and six have given a Sell rating to the company's stock. According to MarketBeat.com, PBF Energy currently has a consensus rating of "Reduce" and a consensus price target of $25.54.

Check Out Our Latest Analysis on PBF

PBF Energy Price Performance

Shares of PBF traded down $0.54 during trading hours on Monday, reaching $30.12. 7,985,642 shares of the company traded hands, compared to its average volume of 3,802,793. The company has a quick ratio of 0.55, a current ratio of 1.31 and a debt-to-equity ratio of 0.46. The stock has a market capitalization of $3.48 billion, a PE ratio of -3.51 and a beta of 0.98. PBF Energy has a fifty-two week low of $13.61 and a fifty-two week high of $34.22. The stock has a fifty day simple moving average of $25.53 and a 200 day simple moving average of $21.78.

PBF Energy (NYSE:PBF - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The oil and gas company reported ($1.03) EPS for the quarter, beating analysts' consensus estimates of ($1.19) by $0.16. The business had revenue of $7.48 billion for the quarter, compared to analyst estimates of $6.65 billion. PBF Energy had a negative return on equity of 17.46% and a negative net margin of 3.24%.The business's revenue for the quarter was down 14.4% compared to the same quarter last year. During the same quarter last year, the company earned ($0.54) earnings per share.

Hedge Funds Weigh In On PBF Energy

A number of large investors have recently modified their holdings of PBF. Cetera Investment Advisers raised its holdings in shares of PBF Energy by 60.8% in the 4th quarter. Cetera Investment Advisers now owns 37,281 shares of the oil and gas company's stock worth $990,000 after purchasing an additional 14,098 shares during the period. Nuveen Asset Management LLC raised its holdings in shares of PBF Energy by 94.7% in the 4th quarter. Nuveen Asset Management LLC now owns 568,901 shares of the oil and gas company's stock worth $15,104,000 after purchasing an additional 276,672 shares during the period. Nomura Holdings Inc. purchased a new position in shares of PBF Energy in the 4th quarter worth about $344,000. ProShare Advisors LLC raised its holdings in shares of PBF Energy by 37.0% during the 4th quarter. ProShare Advisors LLC now owns 32,839 shares of the oil and gas company's stock valued at $872,000 after buying an additional 8,870 shares during the period. Finally, Rafferty Asset Management LLC raised its holdings in shares of PBF Energy by 0.4% during the 4th quarter. Rafferty Asset Management LLC now owns 177,474 shares of the oil and gas company's stock valued at $4,712,000 after buying an additional 795 shares during the period. 96.29% of the stock is currently owned by hedge funds and other institutional investors.

PBF Energy Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, August 28th. Stockholders of record on Thursday, August 14th were issued a $0.275 dividend. This represents a $1.10 dividend on an annualized basis and a dividend yield of 3.7%. The ex-dividend date was Thursday, August 14th. PBF Energy's dividend payout ratio (DPR) is -12.81%.

About PBF Energy

(

Get Free Report)

PBF Energy Inc, through its subsidiaries, engages in refining and supplying petroleum products. The company operates in two segments, Refining and Logistics. It produces gasoline, ultra-low-sulfur diesel, heating oil, diesel fuel, jet fuel, lubricants, petrochemicals, and asphalt, as well as unbranded transportation fuels, petrochemical feedstocks, blending components, and other petroleum products from crude oil.

Recommended Stories

Before you consider PBF Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PBF Energy wasn't on the list.

While PBF Energy currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.