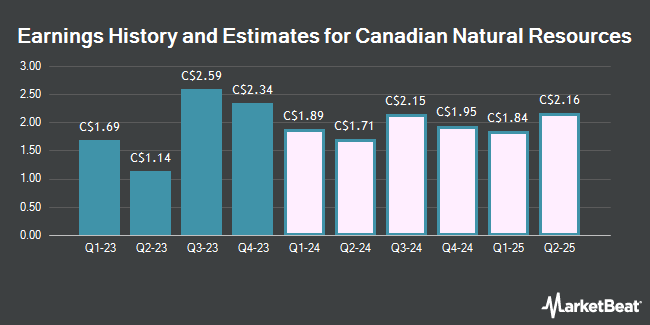

Canadian Natural Resources Limited (TSE:CNQ - Free Report) NYSE: CNQ - Analysts at Zacks Research cut their Q1 2026 earnings estimates for shares of Canadian Natural Resources in a research report issued on Friday, June 27th. Zacks Research analyst T. Saha now anticipates that the company will post earnings per share of $0.55 for the quarter, down from their prior estimate of $0.65. The consensus estimate for Canadian Natural Resources' current full-year earnings is $3.83 per share. Zacks Research also issued estimates for Canadian Natural Resources' Q2 2026 earnings at $0.49 EPS, Q4 2026 earnings at $0.56 EPS, FY2026 earnings at $2.28 EPS, Q1 2027 earnings at $0.83 EPS and FY2027 earnings at $3.45 EPS.

Several other equities research analysts have also commented on the company. CIBC boosted their price objective on Canadian Natural Resources from C$59.00 to C$62.00 in a research note on Thursday, April 10th. Wells Fargo & Company increased their price objective on Canadian Natural Resources from C$42.00 to C$46.00 and gave the company an "equal weight" rating in a research note on Thursday, June 26th. Evercore ISI raised shares of Canadian Natural Resources from a "hold" rating to a "strong-buy" rating in a report on Friday, March 7th. Raymond James Financial raised shares of Canadian Natural Resources from a "market perform" rating to an "outperform" rating and dropped their price objective for the company from C$52.00 to C$49.00 in a research note on Wednesday, April 9th. Finally, Scotiabank upgraded shares of Canadian Natural Resources from a "sector perform" rating to an "outperform" rating and set a C$56.00 price objective for the company in a report on Wednesday, March 19th. Five research analysts have rated the stock with a hold rating, eight have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, Canadian Natural Resources currently has an average rating of "Moderate Buy" and a consensus target price of C$54.58.

Get Our Latest Stock Analysis on Canadian Natural Resources

Canadian Natural Resources Price Performance

CNQ traded down C$0.27 during midday trading on Monday, hitting C$43.79. 4,279,936 shares of the company traded hands, compared to its average volume of 14,383,038. The business has a 50 day simple moving average of C$42.85 and a two-hundred day simple moving average of C$42.78. Canadian Natural Resources has a 52-week low of C$34.92 and a 52-week high of C$52.15. The company has a market capitalization of C$91.90 billion, a price-to-earnings ratio of 12.16, a PEG ratio of 0.53 and a beta of 1.89. The company has a current ratio of 0.84, a quick ratio of 0.54 and a debt-to-equity ratio of 25.79.

Insider Activity at Canadian Natural Resources

In related news, Senior Officer Robin Sean Zabek sold 20,000 shares of Canadian Natural Resources stock in a transaction that occurred on Wednesday, June 11th. The shares were sold at an average price of C$44.90, for a total value of C$898,000.00. Also, Senior Officer Mark Allen Stainthorpe sold 45,000 shares of the company's stock in a transaction on Tuesday, June 17th. The stock was sold at an average price of C$45.66, for a total value of C$2,054,700.00. Insiders have sold a total of 249,676 shares of company stock valued at $11,265,119 over the last quarter. 4.26% of the stock is owned by insiders.

About Canadian Natural Resources

(

Get Free Report)

Canadian Natural Resources is one of the largest oil and natural gas producers in western Canada, supplemented by operations in the North Sea and Offshore Africa. The company's portfolio includes light and medium oil, heavy oil, bitumen, synthetic oil, natural gas liquids, and natural gas. Production averaged 1.16 million barrels of oil equivalent per day in 2020, and the company estimates that it holds over 11.5 billion boe of proven and probable crude oil and natural gas reserves.

Featured Articles

Before you consider Canadian Natural Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Natural Resources wasn't on the list.

While Canadian Natural Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

We are about to experience the greatest A.I. boom in stock market history...

Thanks to a pivotal economic catalyst, specific tech stocks will skyrocket just like they did during the "dot com" boom in the 1990s.

That’s why, we’ve hand-selected 7 tiny tech disruptor stocks positioned to surge.

- The first pick is a tiny under-the-radar A.I. stock that's trading for just $3.00. This company already has 98 registered patents for cutting-edge voice and sound recognition technology... And has lined up major partnerships with some of the biggest names in the auto, tech, and music industry... plus many more.

- The second pick presents an affordable avenue to bolster EVs and AI development…. Analysts are calling this stock a “buy” right now and predict a high price target of $19.20, substantially more than its current $6 trading price.

- Our final and favorite pick is generating a brand-new kind of AI. It's believed this tech will be bigger than the current well-known leader in this industry… Analysts predict this innovative tech is gearing up to create a tidal wave of new wealth, fueling a $15.7 TRILLION market boom.

Right now, we’re staring down the barrel of a true once-in-a-lifetime moment. As an investment opportunity, this kind of breakthrough doesn't come along every day.

And the window to get in on the ground-floor — maximizing profit potential from this expected market surge — is closing quickly...

Simply enter your email below to get the names and tickers of the 7 small stocks with potential to make investors very, very happy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.