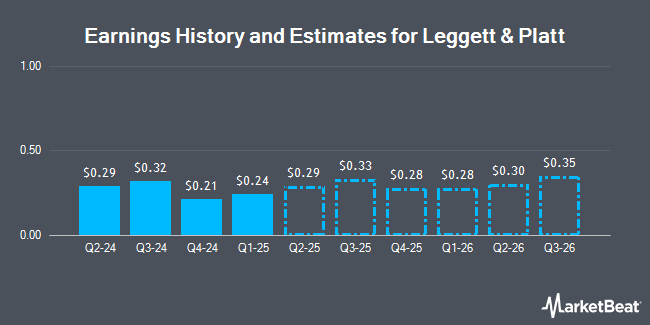

Leggett & Platt, Incorporated (NYSE:LEG - Free Report) - Analysts at Zacks Research cut their Q2 2026 EPS estimates for Leggett & Platt in a research report issued on Thursday, September 18th. Zacks Research analyst Team now anticipates that the company will post earnings of $0.29 per share for the quarter, down from their prior estimate of $0.31. Zacks Research has a "Strong Sell" rating on the stock. The consensus estimate for Leggett & Platt's current full-year earnings is $1.14 per share.

Other equities analysts have also recently issued research reports about the company. Piper Sandler reiterated a "neutral" rating and set a $9.00 target price (down previously from $10.00) on shares of Leggett & Platt in a report on Monday, August 4th. Wall Street Zen downgraded shares of Leggett & Platt from a "buy" rating to a "hold" rating in a research note on Saturday, August 2nd. Three equities research analysts have rated the stock with a Hold rating and one has assigned a Sell rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Reduce" and an average target price of $9.67.

View Our Latest Stock Analysis on Leggett & Platt

Leggett & Platt Stock Down 2.1%

LEG stock traded down $0.20 during trading hours on Monday, reaching $9.19. 1,595,369 shares of the stock were exchanged, compared to its average volume of 1,810,994. The firm's 50-day moving average is $9.53 and its 200-day moving average is $8.94. The company has a market cap of $1.24 billion, a price-to-earnings ratio of 8.77 and a beta of 0.70. The company has a debt-to-equity ratio of 2.09, a current ratio of 2.17 and a quick ratio of 1.36. Leggett & Platt has a 12 month low of $6.47 and a 12 month high of $14.23.

Leggett & Platt (NYSE:LEG - Get Free Report) last released its quarterly earnings results on Thursday, July 31st. The company reported $0.30 earnings per share for the quarter, beating the consensus estimate of $0.29 by $0.01. The company had revenue of $1.06 billion during the quarter, compared to analysts' expectations of $1.06 billion. Leggett & Platt had a net margin of 3.36% and a return on equity of 19.42%. The business's quarterly revenue was down 6.3% compared to the same quarter last year. During the same quarter in the prior year, the company earned $0.29 earnings per share. Leggett & Platt has set its FY 2025 guidance at 1.000-1.200 EPS.

Leggett & Platt Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, October 15th. Investors of record on Monday, September 15th will be paid a $0.05 dividend. This represents a $0.20 annualized dividend and a yield of 2.2%. The ex-dividend date is Monday, September 15th. Leggett & Platt's dividend payout ratio (DPR) is 19.42%.

Institutional Investors Weigh In On Leggett & Platt

Several hedge funds have recently bought and sold shares of LEG. Deutsche Bank AG lifted its position in Leggett & Platt by 3.2% during the fourth quarter. Deutsche Bank AG now owns 67,319 shares of the company's stock worth $646,000 after acquiring an additional 2,109 shares during the last quarter. Nuveen Asset Management LLC boosted its stake in Leggett & Platt by 20.4% in the 4th quarter. Nuveen Asset Management LLC now owns 305,875 shares of the company's stock valued at $2,936,000 after purchasing an additional 51,733 shares during the period. Two Sigma Investments LP increased its position in Leggett & Platt by 45.1% during the 4th quarter. Two Sigma Investments LP now owns 874,668 shares of the company's stock worth $8,397,000 after buying an additional 271,917 shares during the period. Two Sigma Advisers LP increased its position in Leggett & Platt by 82.1% during the 4th quarter. Two Sigma Advisers LP now owns 630,100 shares of the company's stock worth $6,049,000 after buying an additional 284,100 shares during the period. Finally, Squarepoint Ops LLC boosted its position in shares of Leggett & Platt by 49.6% in the fourth quarter. Squarepoint Ops LLC now owns 345,589 shares of the company's stock valued at $3,318,000 after acquiring an additional 114,536 shares during the period. 64.23% of the stock is currently owned by institutional investors and hedge funds.

About Leggett & Platt

(

Get Free Report)

Leggett & Platt, Inc engages in the manufacture and distribution of furniture and engineered components and products among homes, offices, automobiles, and commercial aircraft. It operates through the following segments: Bedding Products, Specialized Products, and Furniture, Flooring & Textile Products.

See Also

Before you consider Leggett & Platt, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Leggett & Platt wasn't on the list.

While Leggett & Platt currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.