Zalando (OTCMKTS:ZLNDY - Get Free Report) was downgraded by equities researchers at Cfra Research from a "moderate buy" rating to a "hold" rating in a report issued on Monday, August 11th,Zacks.com reports.

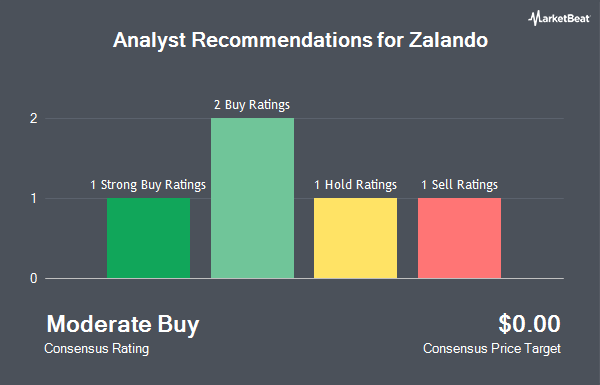

ZLNDY has been the topic of a number of other research reports. Morgan Stanley reissued an "underweight" rating on shares of Zalando in a report on Monday, July 14th. Citigroup reaffirmed a "buy" rating on shares of Zalando in a report on Tuesday, May 13th. One equities research analyst has rated the stock with a Strong Buy rating, two have given a Buy rating, one has assigned a Hold rating and one has issued a Sell rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy".

Check Out Our Latest Analysis on Zalando

Zalando Price Performance

ZLNDY traded up $0.32 during trading on Monday, reaching $14.03. 37,956 shares of the company were exchanged, compared to its average volume of 13,366. The company's 50-day moving average is $15.56 and its two-hundred day moving average is $17.23. The company has a market cap of $7.41 billion, a price-to-earnings ratio of 24.61 and a beta of 1.54. The company has a quick ratio of 0.89, a current ratio of 1.36 and a debt-to-equity ratio of 0.18. Zalando has a 12-month low of $11.55 and a 12-month high of $20.64.

Zalando (OTCMKTS:ZLNDY - Get Free Report) last issued its quarterly earnings data on Wednesday, August 6th. The company reported $0.21 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.21. The business had revenue of $3.28 billion for the quarter, compared to analysts' expectations of $2.52 billion. Zalando had a return on equity of 10.50% and a net margin of 2.49%. Research analysts forecast that Zalando will post 0.5 earnings per share for the current fiscal year.

About Zalando

(

Get Free Report)

Zalando SE operates an online platform for fashion and lifestyle products. The company operates through Fashion Store and Offprice segments. It provides shoes, apparel, accessories, and beauty products with free delivery and returns, as well as various payment options. The company also sells its products through Lounge by Zalando; and brick-and-mortar outlet stores.

Further Reading

Before you consider Zalando, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zalando wasn't on the list.

While Zalando currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.