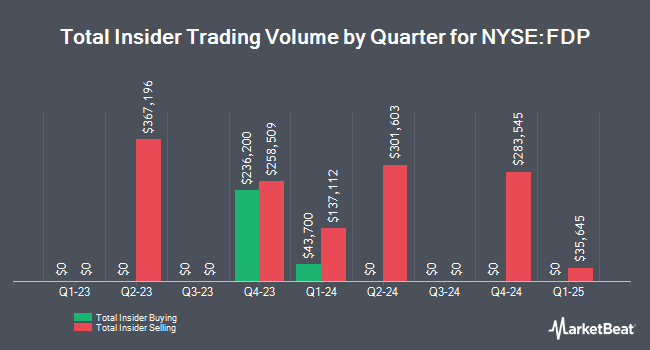

Fresh Del Monte Produce, Inc. (NYSE:FDP - Get Free Report) SVP Ziad Nabulsi sold 1,000 shares of Fresh Del Monte Produce stock in a transaction dated Tuesday, August 5th. The stock was sold at an average price of $35.95, for a total value of $35,950.00. Following the transaction, the senior vice president owned 10,498 shares of the company's stock, valued at $377,403.10. The trade was a 8.70% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this link.

Fresh Del Monte Produce Trading Up 1.1%

FDP stock traded up $0.41 during midday trading on Monday, hitting $36.91. The stock had a trading volume of 23,065 shares, compared to its average volume of 378,493. The firm has a market cap of $1.77 billion, a P/E ratio of 11.81 and a beta of 0.42. The company has a current ratio of 2.08, a quick ratio of 1.11 and a debt-to-equity ratio of 0.10. Fresh Del Monte Produce, Inc. has a 1-year low of $26.50 and a 1-year high of $40.75. The business has a fifty day moving average price of $34.05 and a two-hundred day moving average price of $32.46.

Fresh Del Monte Produce (NYSE:FDP - Get Free Report) last announced its quarterly earnings data on Wednesday, July 30th. The company reported $1.23 earnings per share for the quarter, beating the consensus estimate of $0.95 by $0.28. The firm had revenue of $1.18 billion for the quarter, compared to analyst estimates of $1.16 billion. Fresh Del Monte Produce had a net margin of 3.49% and a return on equity of 6.84%. The business's quarterly revenue was up 3.8% compared to the same quarter last year. During the same quarter in the prior year, the business earned $1.06 earnings per share.

Fresh Del Monte Produce Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, September 5th. Stockholders of record on Wednesday, August 13th will be given a dividend of $0.30 per share. This represents a $1.20 dividend on an annualized basis and a dividend yield of 3.3%. The ex-dividend date of this dividend is Wednesday, August 13th. Fresh Del Monte Produce's dividend payout ratio is currently 38.46%.

Analyst Ratings Changes

Separately, Wall Street Zen raised shares of Fresh Del Monte Produce from a "buy" rating to a "strong-buy" rating in a research note on Saturday.

Check Out Our Latest Research Report on Fresh Del Monte Produce

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently modified their holdings of FDP. Millennium Management LLC boosted its position in Fresh Del Monte Produce by 1,647.2% during the first quarter. Millennium Management LLC now owns 596,496 shares of the company's stock valued at $18,390,000 after buying an additional 562,356 shares during the period. Allianz Asset Management GmbH boosted its holdings in Fresh Del Monte Produce by 88.9% in the second quarter. Allianz Asset Management GmbH now owns 712,931 shares of the company's stock worth $23,113,000 after purchasing an additional 335,619 shares during the last quarter. Hennessy Advisors Inc. purchased a new position in shares of Fresh Del Monte Produce during the 2nd quarter worth $9,254,000. LSV Asset Management boosted its stake in shares of Fresh Del Monte Produce by 68.8% during the 1st quarter. LSV Asset Management now owns 580,018 shares of the company's stock worth $17,882,000 after acquiring an additional 236,476 shares during the last quarter. Finally, Cubist Systematic Strategies LLC bought a new stake in shares of Fresh Del Monte Produce during the 1st quarter valued at $6,523,000. 64.83% of the stock is owned by institutional investors.

About Fresh Del Monte Produce

(

Get Free Report)

Fresh Del Monte Produce Inc, through its subsidiaries, produces, markets, and distributes fresh and fresh-cut fruits and vegetables in North America, Central America, South America, Europe, the Middle East, Africa, Asia, and internationally. It operates through three segments: Fresh and Value-Added Products, Banana, and Other Products and Services.

Recommended Stories

Before you consider Fresh Del Monte Produce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fresh Del Monte Produce wasn't on the list.

While Fresh Del Monte Produce currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.