ZoomInfo Technologies (NASDAQ:GTM - Free Report) had its price objective lifted by KeyCorp from $7.00 to $9.00 in a research note published on Tuesday morning,Benzinga reports. The firm currently has an underweight rating on the stock.

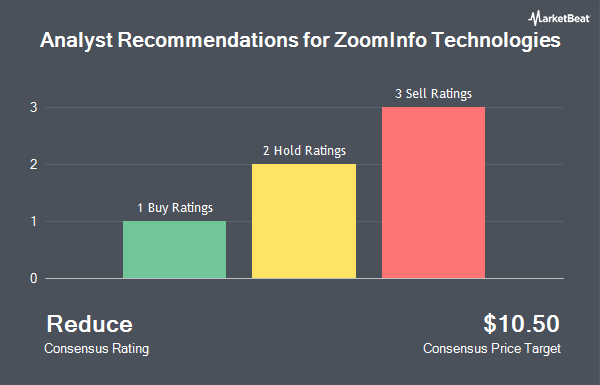

Other research analysts have also issued reports about the stock. Needham & Company LLC reaffirmed a "buy" rating and set a $15.00 price objective on shares of ZoomInfo Technologies in a research note on Thursday, May 22nd. Wall Street Zen raised shares of ZoomInfo Technologies from a "hold" rating to a "buy" rating in a research note on Saturday, July 5th. Wells Fargo & Company downgraded shares of ZoomInfo Technologies from a "hold" rating to a "strong sell" rating and cut their price target for the company from $10.00 to $9.00 in a report on Friday, June 13th. Piper Sandler raised their price objective on shares of ZoomInfo Technologies from $11.00 to $12.00 and gave the stock a "neutral" rating in a research note on Tuesday. Finally, DA Davidson started coverage on ZoomInfo Technologies in a research report on Tuesday. They set a "neutral" rating and a $11.00 target price for the company. Three investment analysts have rated the stock with a sell rating, two have issued a hold rating and two have issued a buy rating to the stock. Based on data from MarketBeat, ZoomInfo Technologies has an average rating of "Hold" and an average target price of $10.50.

Get Our Latest Stock Report on ZoomInfo Technologies

ZoomInfo Technologies Price Performance

Shares of ZoomInfo Technologies stock traded up $0.20 on Tuesday, reaching $10.39. The company had a trading volume of 8,743,255 shares, compared to its average volume of 4,621,329. The firm has a market capitalization of $3.42 billion, a price-to-earnings ratio of 39.96, a price-to-earnings-growth ratio of 2.22 and a beta of 1.14. The company has a current ratio of 0.71, a quick ratio of 0.66 and a debt-to-equity ratio of 0.85. The firm's 50-day simple moving average is $10.23. ZoomInfo Technologies has a 1 year low of $7.01 and a 1 year high of $13.39.

Insider Transactions at ZoomInfo Technologies

In other ZoomInfo Technologies news, CRO James M. Roth sold 14,773 shares of the company's stock in a transaction dated Wednesday, July 2nd. The shares were sold at an average price of $10.05, for a total value of $148,468.65. Following the transaction, the executive directly owned 40,877 shares in the company, valued at $410,813.85. This represents a 26.55% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Over the last three months, insiders have sold 35,819 shares of company stock valued at $359,478. 9.00% of the stock is owned by insiders.

ZoomInfo Technologies Company Profile

(

Get Free Report)

ZoomInfo Technologies Inc, through its subsidiaries, provides go-to-market intelligence and engagement platform for sales and marketing teams in the United States and internationally. The company's cloud-based platform provides information on organizations and professionals to help users identify target customers and decision makers, obtain continually updated predictive lead and company scoring, monitor buying signals and other attributes of target companies, craft messages, engage through automated sales tools, and track progress through the deal cycle.

Featured Articles

Before you consider ZoomInfo Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ZoomInfo Technologies wasn't on the list.

While ZoomInfo Technologies currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.