ZoomInfo Technologies (NASDAQ:GTM - Free Report) had its price target hoisted by Piper Sandler from $11.00 to $12.00 in a research report report published on Tuesday,Benzinga reports. They currently have a neutral rating on the stock.

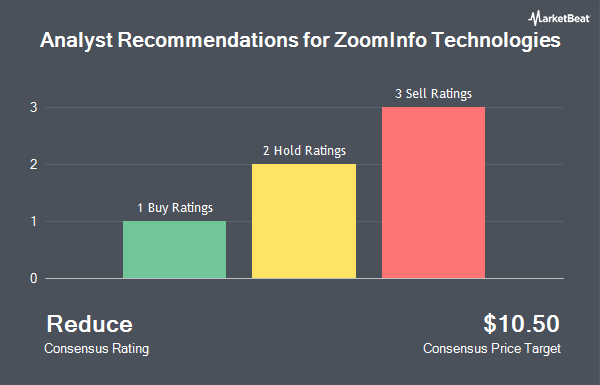

Several other brokerages have also recently issued reports on GTM. Wells Fargo & Company cut shares of ZoomInfo Technologies from a "hold" rating to a "strong sell" rating and lowered their target price for the company from $10.00 to $9.00 in a report on Friday, June 13th. Wall Street Zen upgraded shares of ZoomInfo Technologies from a "hold" rating to a "buy" rating in a research note on Saturday, July 5th. Finally, Needham & Company LLC restated a "buy" rating and issued a $15.00 target price on shares of ZoomInfo Technologies in a research note on Thursday, May 22nd. Three research analysts have rated the stock with a sell rating, two have issued a hold rating and two have issued a buy rating to the company. According to data from MarketBeat, ZoomInfo Technologies currently has an average rating of "Hold" and a consensus target price of $10.50.

Check Out Our Latest Stock Report on GTM

ZoomInfo Technologies Stock Performance

Shares of ZoomInfo Technologies stock traded up $0.20 on Tuesday, reaching $10.39. The company had a trading volume of 8,743,255 shares, compared to its average volume of 4,621,329. The business has a 50 day simple moving average of $10.23. The stock has a market cap of $3.42 billion, a price-to-earnings ratio of 39.96, a PEG ratio of 2.22 and a beta of 1.14. ZoomInfo Technologies has a 52-week low of $7.01 and a 52-week high of $13.39. The company has a current ratio of 0.71, a quick ratio of 0.66 and a debt-to-equity ratio of 0.85.

Insider Buying and Selling at ZoomInfo Technologies

In related news, CRO James M. Roth sold 18,408 shares of the business's stock in a transaction that occurred on Thursday, June 5th. The shares were sold at an average price of $10.02, for a total value of $184,448.16. Following the completion of the sale, the executive directly owned 26,103 shares in the company, valued at approximately $261,552.06. The trade was a 41.36% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders have sold a total of 35,819 shares of company stock valued at $359,478 over the last ninety days. Insiders own 9.00% of the company's stock.

ZoomInfo Technologies Company Profile

(

Get Free Report)

ZoomInfo Technologies Inc, through its subsidiaries, provides go-to-market intelligence and engagement platform for sales and marketing teams in the United States and internationally. The company's cloud-based platform provides information on organizations and professionals to help users identify target customers and decision makers, obtain continually updated predictive lead and company scoring, monitor buying signals and other attributes of target companies, craft messages, engage through automated sales tools, and track progress through the deal cycle.

Featured Stories

Before you consider ZoomInfo Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ZoomInfo Technologies wasn't on the list.

While ZoomInfo Technologies currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.